Did you know that Aussies are slugged as much as $128.62 in Australian departure taxes and airport fees every time they fly overseas?

Whenever you purchase an international flight, your ticket will include a range of taxes that are paid directly to governments and airports. These are payable on both revenue and award bookings, and are charged on top of the airfare and any airline fuel surcharges. So, where does your money actually go when you book a plane ticket?

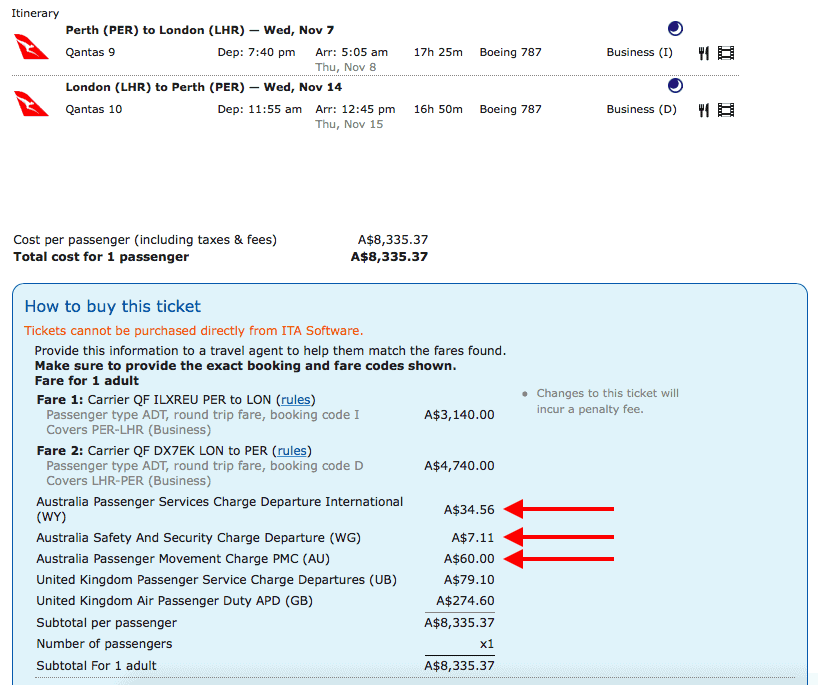

There are three different types of charges levied on international flights out of Australia. One is the government’s $60 “Passenger Movement Charge” or PMC. This Australian departure tax is paid directly to the Australian government. All passengers – both Australian residents and tourists – need to pay this when leaving the country. But there is no tax for arriving back in Australia. Children under 12 and international passengers in transit through Australia are exempt from paying the Passenger Movement Charge.

There are also two charges collected by airports. These are the “Australia Safety And Security Charge” and the “Australia Passenger Services Charge”. They are payable when both departing and arriving back in the country. The amounts payable do vary by airport. On a return international flight from Perth, for example, the passenger services charge is $34.56 and the security charge is only $7.11. This brings the total Australian taxes payable on this ticket to $101.67. But other Australian airports have higher charges.

Here’s what you’ll pay in Australian-imposed taxes and charges on a return international flight from the following airports:

- Perth: $101.67

- Melbourne: $106.15

- Adelaide: $109.28

- Darwin: $113.03

- Cairns: $116.66

- Canberra: $120.36 (or $180.22 if flying Singapore Airlines)

- Sydney: $122.56

- Brisbane: $128.62

So, how does this compare to other countries? Well, Australian departure taxes are among the highest in the world. You’ll pay just $33.50 in taxes when flying in and out of Singapore, and only $21.30 on a return flight to Bali in Indonesia. Hong Kong’s charges add to $54.50, although this does include a $26.80 Hong Kong Airport construction fee. New Zealand’s taxes are around $61.40 for a return ticket to Auckland, and return flights to Los Angeles in the USA attract $83.50 in fees.

The UK, however, is a serial offender. The Heathrow Airport “Passenger Service Charge” ranges from $34 for short-haul flights to $79.10 on long-haul tickets. This is in addition to the UK government’s Air Passenger Duty, which can add up to $274.60 to the cost of your ticket to London. The Air Passenger Duty is only charged on departing flights, not arrivals.

In this example, you can see the breakdown of taxes on a return Qantas Business class ticket from Perth to London. The total taxes are $455.37.

As it happens, you’d also be paying $1,080 in Qantas carrier charges if you happened to be booking these flights with Qantas Frequent Flyer points. So for this ticket you’d be paying $1,535.37 just in taxes & carrier charges on top of any points required.