The Australian government has reversed an unfortunate change it made to the Tourist Refund Scheme (TRS) last year that would have made the scheme virtually useless to most Australians.

With the TRS, anyone departing Australia on an international flight can claim back the GST or Wine Equalisation Tax (WET) on products with a combined value of at least $300 that have been bought in Australia within the previous 60 days. The items must be carried out of the country.

Previously, any items for which a tax refund had been claimed could then be brought back into Australia as part of the standard duty-free allowance. They would count towards a passenger’s duty-free concession, which is $900 for adults or $450 for children and air crew, but the tax would not need to be repaid as long as the total value of items being imported was under the duty-free limit. (Personal items like clothing and shoes don’t count towards this.)

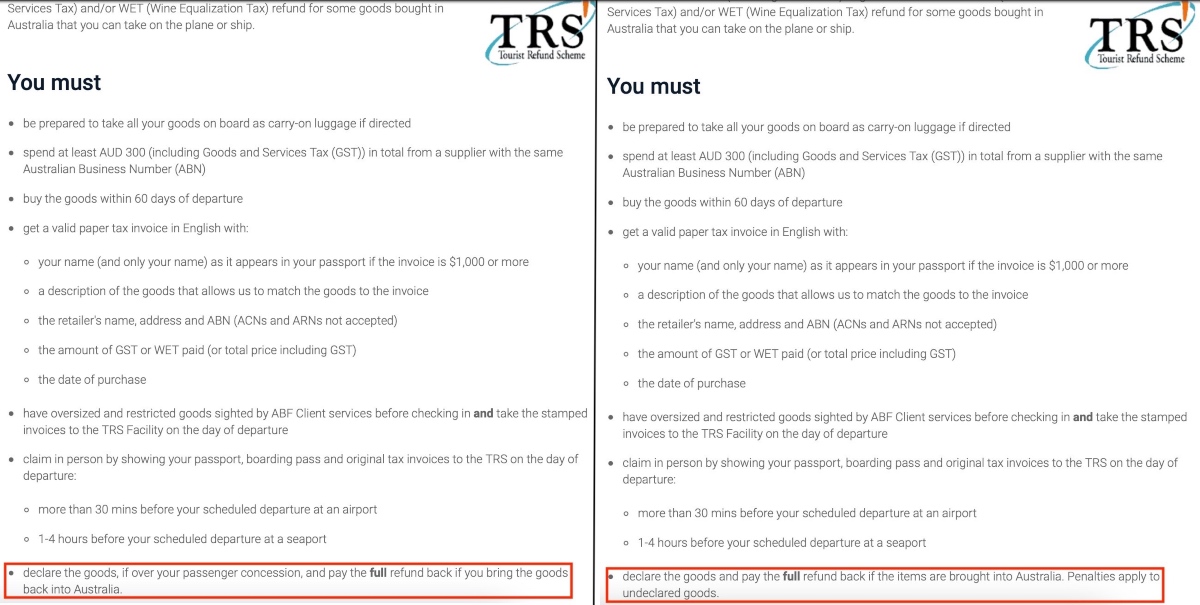

The 2021 rule change

In around September 2021, the Australian Border Force (ABF) quietly changed the rules so that the tax refund on any items brought back into Australia would need to be repaid in full – even if their value was under the duty-free concession.

Below are screenshots from the ABF website from August 2021 (left) and October 2021 (right):

Following this change, the following notice was also being printed on TRS receipts:

If TRS goods return to Australia they must be declared and the full refund paid back. TRS goods are not included in your passenger concession. Penalties apply to undeclared goods.

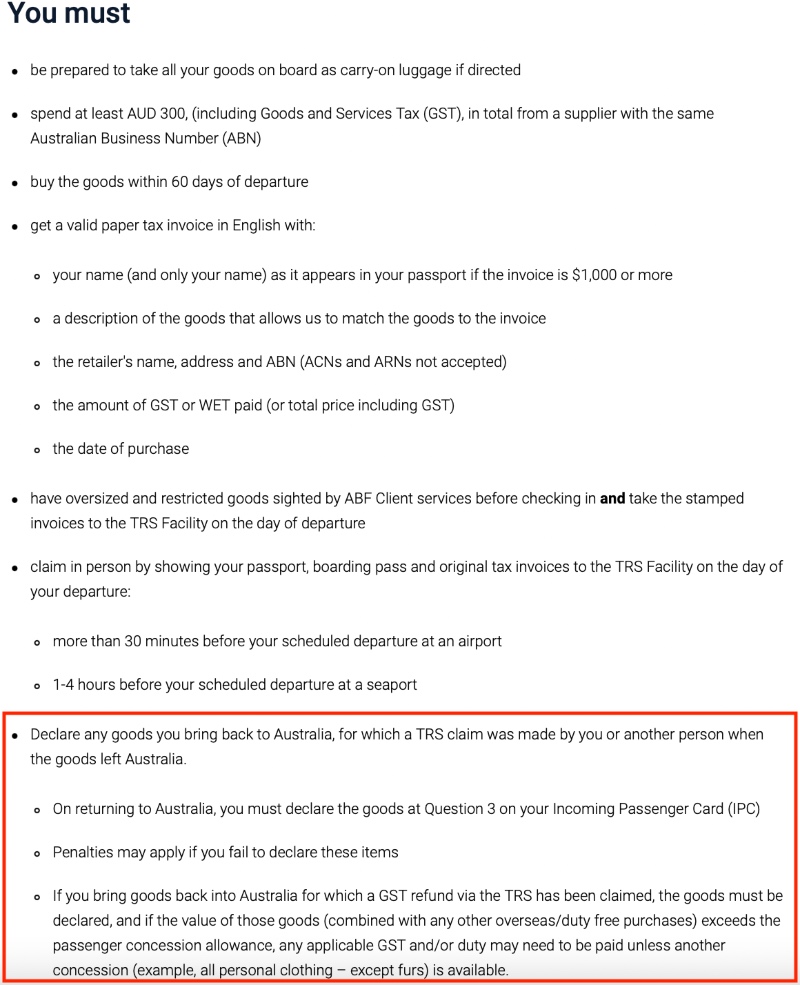

This change has been reversed

A lot of people were obviously unhappy about this change, with many travellers pointing out they would choose to shop overseas rather than supporting Australian businesses if this is how the TRS would now work.

The good news is that the rules have been revised again. This is the new wording on the Border Force website, as of 14 April 2022:

Goods for which TRS has been claimed can now be brought back into Australia, and the GST refund no longer needs to be repaid if the total value of all goods being imported is under the duty-free concession. However, you are now required to declare these goods by marking “yes” to Question 3 on the Incoming Passenger Card.

There was some confusion about this over recent days while various pages on the Australian Border Force website contained conflicting information. But all pages have now been updated with the new rules.

Join the discussion on the Australian Frequent Flyer forum: New TRS rules? Goods no longer included in cap?