Australia’s Tourist Refund Scheme (TRS) has long been a popular way for international travellers to claim a refund of the tax paid on expensive items being carried out of the country. But a recent change has rendered the scheme a lot less useful than before for Australians heading overseas on short holidays or business trips.

With the TRS, you can claim back the Goods & Services Tax (GST) or Wine Equalisation Tax (WET) on items bought in Australia within 60 days prior to leaving the country. The items need to be worth at least $300, and you need to show the physical items and original receipt/s at the TRS office at the airport. If the item is worth more than $1,000, the receipt also must have your full name on it.

This makes the TRS useful if you want to claim the tax back on purchases such as computers, phones, jewellery or anything else that meets the criteria.

Previously, it was also possible to bring these items back into Australia at the end of your trip, up to the duty-free concession of AU$900 per adult, or AU$450 per child or airline crew member. This concession can be pooled when multiple people are travelling together.

Goods up to this value (other than commercial goods) that have been purchased overseas, or at an inbound duty-free shop in Australia, can still be imported into Australia without being subject to GST. Goods previously exported from Australia, that had had the tax refunded, were also previously included in the duty-free concession if the items were brought back into the country.

But around September last year, the Australian government changed the rules. If you return to Australia with items you’ve previously claimed a GST refund on, you must now declare these and repay the tax in full. This includes items worth less than $900.

The Australian Border Force (ABF) website was quietly updated around September 2021, but the change was not well-publicised. The new rule has recently caught some travellers leaving the country by surprise.

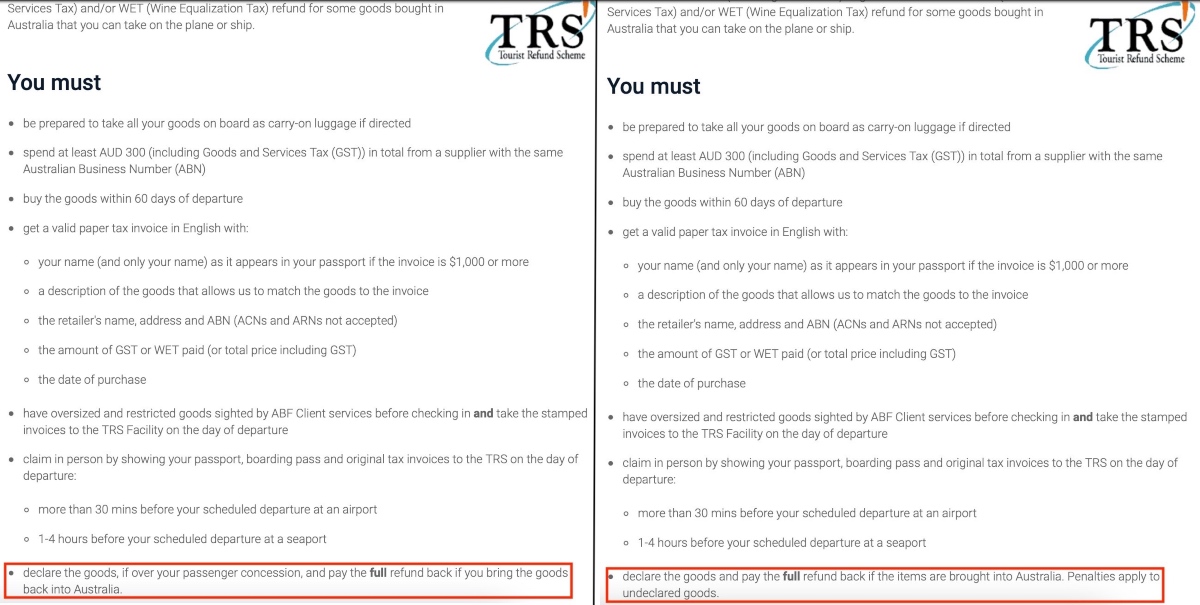

Below are screenshots from the ABF website. The screenshot on the left is from August 2021, and the image on the right is from October 2021:

As you can see, travellers are now required to declare any items for which a tax refund has been claimed if bringing them back into the country. This previously only applied to goods over the $900 passenger concession.

An AFF member who flew to Singapore last week also noticed that their TRS receipt said:

If TRS goods return to Australia they must be declared and the full refund paid back. TRS goods are not included in your passenger concession. Penalties apply to undeclared goods.

The ABF webpage about duty free concessions also now states:

If you return to Australia with goods for which you have claimed a GST refund under the TRS on departure, you must declare those goods at Question 3 on the Incoming Passenger Card (IPC).

GST refunds received on goods claimed under the TRS will have to be repaid if the items are brought into Australia.

This change won’t have much impact on international tourists, who can still use the TRS to buy products in Australia and get a tax refund when taking them back home with them. This is primarily what the scheme is designed for, anyway.

But this change closes a loophole that has been used by Australians for years to claim GST back on recent purchases when travelling overseas for a short holiday or business trip. The result may be that more Australians choose to make large purchases overseas instead of supporting local Australian businesses.

Join the discussion on the Australian Frequent Flyer forum: New TRS rules? Goods no longer included in cap?