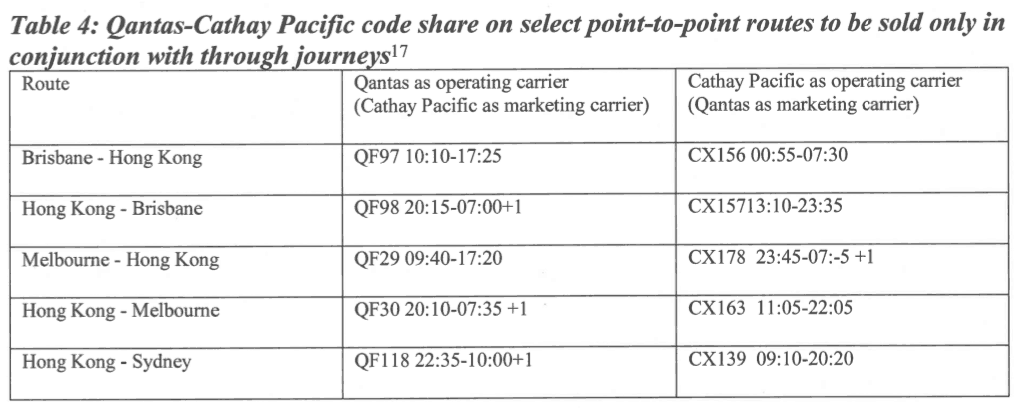

Back in January, Qantas applied for permission from Australia’s International Air Services Commission (IASC) to place its “QF” code on five Cathay Pacific services between Sydney, Melbourne, Brisbane and Hong Kong. Similarly, Cathay Pacific would codeshare on five Qantas services on the same routes. The codeshare agreement, if approved, was due to begin at the end of March 2019.

However, Virgin Australia objected strongly to the proposed codeshare agreement between Qantas and Cathay Pacific. The ACCC also expressed concerns. Ultimately, the IASC agreed that the codeshare agreement was not in the best interests of the travelling public and decided to block the proposal.

Qantas already inked a limited codeshare agreement with Cathay Pacific, which is also a member of the Oneworld alliance, in October 2018. Since then, Qantas has already codeshared with Cathay Pacific on various routes including from Perth and Cairns to Hong Kong. (Cathay Pacific’s Cairns-Hong Kong flights will end in October.) Qantas also places its “QF” code on a range of Cathay Pacific routes beyond Hong Kong, including to destinations in India. And Cathay Pacific already codeshares on a range of Qantas domestic routes within Australia. However, the two airlines do not currently offer codeshare services on overlapping routes where both airlines operate direct flights.

Qantas argued that an expanded codeshare agreement with Cathay Pacific would be in the public interest as it would offer improved connectivity via Hong Kong to many destinations. Qantas stated that, without the agreement, Qantas would be unable to offer its customers attractive connections from Australia to Delhi, Mumbai and Bangalore – particularly pertinent given the recent collapse of Jet Airways. Clearly, there would also have been benefits for Qantas and Cathay Pacific frequent flyers, as they would have been able to earn more frequent flyer points and status credits on some flights.

The new codeshare agreement would not have made codeshare flights available to passengers booking point-to-point tickets from Sydney, Melbourne or Brisbane to/from Hong Kong. Qantas chose to exclude these flights from the proposed agreement because they knew it was unlikely the IASC would approve that. As the codeshares would only be available to passengers with flights requiring connections, Qantas argued that the proposal would “preserve and extend the competitive tension” between it and Cathay Pacific.

Virgin Australia strongly objected to the proposal

In numerous submissions to the IASC, Virgin Australia objected to the proposed codeshare agreement as it would give Qantas and Cathay Pacific even more combined market power. Since Hong Kong Airlines stopped flying to Australia last October, Virgin Australia is the only other airline offering non-stop flights between Australia and Hong Kong. After entering the market in 2017, Virgin Australia has brought much-needed price competition to a route which had been dominated by just two major players in Cathay Pacific and Qantas.

But Virgin has been struggling to fill its planes. Last year, Virgin filled just two-thirds of available seats on its flights to and from Hong Kong. By comparison, both Qantas and Cathay Pacific had load factors of 83% – slightly above the industry average.

Virgin successfully argued that the proposed Qantas/Cathay Pacific codeshare agreement would give the two airlines even greater market power than they already have. This would make it difficult for Virgin to sustain its operations on the route and could cause it to eventually withdraw – which is obviously bad for competition and not in the public interest. Having two very dominant players in the market would also make it difficult for other potential market entrants. Qantas and Cathay Pacific already enjoy a combined 90% market share.

The ACCC also expressed concerns that the codeshare agreement “may soften competition in the Australia-Hong Kong air passengers services market by making it easier for Qantas and Cathay to coordinate their price and capacity decisions so as to raise price (or reduce service)”.

The IASC has blocked the proposal

The International Air Services Commission, chaired by Dr Ian Douglas, has tentatively ruled in Virgin’s favour and does not plan to approve Qantas’ request.

The IASC acknowledges that there may be “some consumer benefits in terms of improved connectivity and potentially some increase in route options”. But it concludes that increased cooperation between Qantas and Cathay would “likely to entrench and expand the market position of Qantas and Cathay Pacific, to the detriment of Virgin Australia’s competitive position and the position of any potential future entrants on the route. If this occurs, it is likely to weaken competition on the route, leading to an increase in prices and/or a reduction in other benefits to consumers.”

Qantas has until 7 June 2019 to appeal the decision.

Join the discussion on the Australian Frequent Flyer forum: CATHAY to Codeshare on QANTAS Hong Kong Flights