Credit card sign-up bonuses are one of the easiest ways to earn lots of frequent flyer points for relatively minimal outlay. During promotions, many banks offer tens or even hundreds of thousands of bonus Qantas points, Velocity points or bank reward points to new customers who sign up for credit cards.

With so many points on offer, it’s easy to see why enthusiastic points collectors take credit card churning seriously! This is the art of applying for a card, collecting the bonus points and then cancelling it.

But there are a few catches.

Firstly, applying for too many credit cards within a short space of time could harm your credit rating. If you go too hard, this could limit your future access to credit, including for things like home loans.

Secondly, most banks only offer sign-up bonus points to new customers. This means that if you already have a credit card, you won’t earn another sign-up bonus by transferring to a new card or applying for a second one with the same bank.

In the past, most banks defined a “new customer” as someone who didn’t hold a card with that bank during the past year. But banks are increasingly now extending this period to two years. ANZ is the latest Australian bank to do so…

Contents

Credit card exclusion periods

It’s not just a bank’s current credit card holders who are ineligible to earn sign-on bonus points with a new card. Most banks also won’t award sign-up bonuses to customers who have recently cancelled their card/s with that bank.

If you recently cancelled a card with a particular bank, you may even be ineligible for bonus points when applying for a different card offered by that bank to the one you previously had.

This is fair enough, as banks design these offers to attract new customers. The banks don’t really want to encourage churning as this costs them money.

The amount of time that you need to wait after cancelling your card, before you’re eligible for another sign-up bonus with that same bank, is known as the exclusion period or blackout period.

When banks run promotions offering bonus points to new credit card applicants, the exclusion period for previous customers is usually stated in the offer terms & conditions. It’s typically 12-24 months, but this varies by bank.

Previous customers can still apply for a new credit card during their “exclusion period” – they just won’t earn the bonus points.

What are the sign-up bonus offer exclusion periods for each bank?

Here are the current credit card exclusion periods for the major Australian banks:

| Card issuer | Bonus points exclusion period for past customers |

|---|---|

| American Express | 18 months |

| ANZ | 24 months |

| Bankwest | 24 months |

| CommBank | 18 months |

| G&C Mutual Bank | 24 months |

| HSBC | 12 months (or 18 months for Star Alliance credit card) |

| NAB | 18 months |

| Qantas Money | 12 months |

| St.George/Bank of Melbourne/Bank SA | 24 months |

| Westpac | 24 months |

Recent changes to ANZ exclusion periods

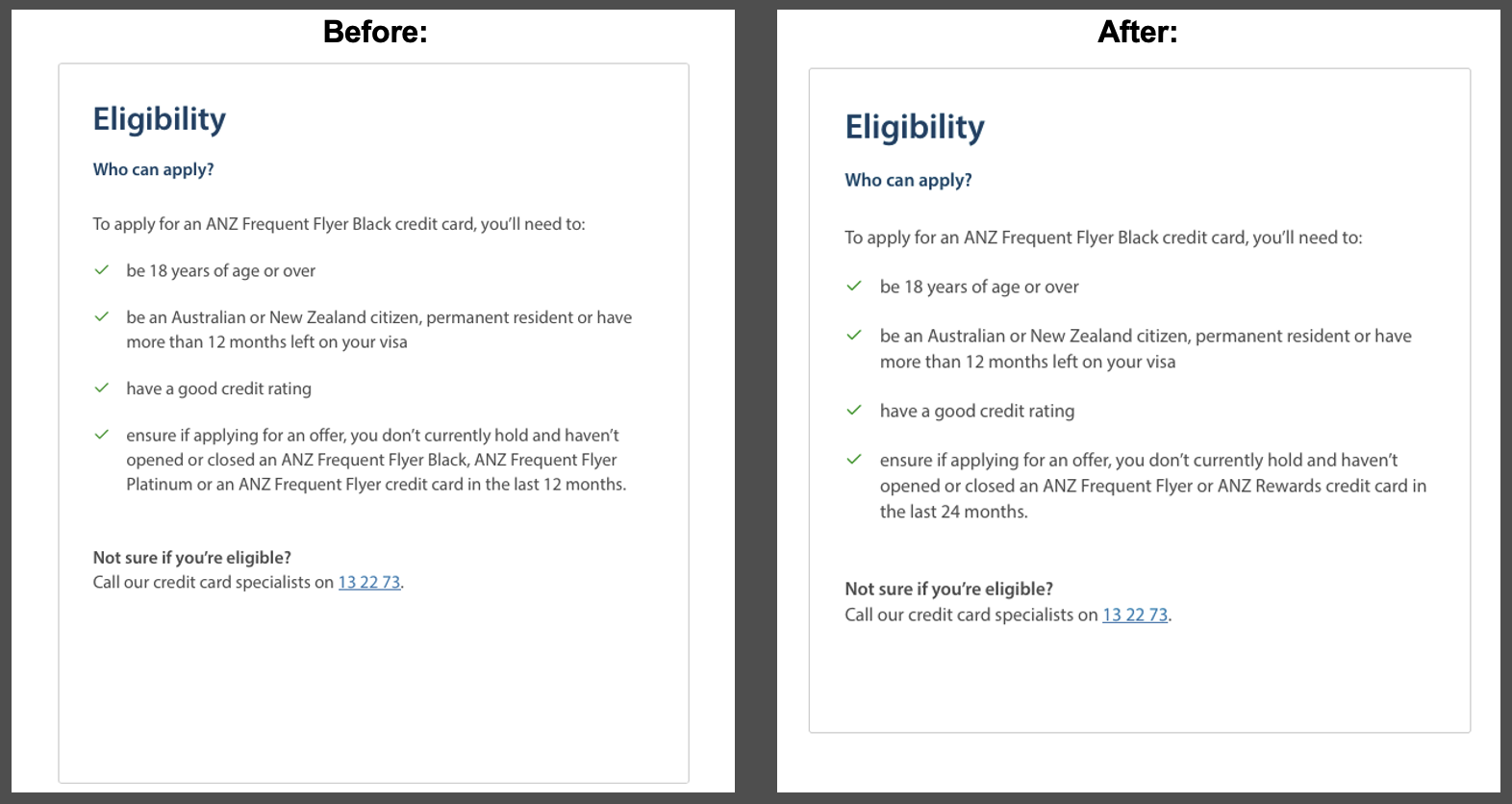

ANZ has just increased the amount of time previous cardholders need to wait before accessing a new sign-up bonus from 12 to 24 months. It has also broadened its definition of a previous customer.

Previously, ANZ also allowed existing or recent holders of an ANZ Frequent Flyer Black or Frequent Flyer Platinum card (which both earn Qantas Points) to apply for a new ANZ Rewards card, and still receive the sign-up bonus. The ANZ Rewards Black and ANZ Rewards Platinum cards both earn ANZ Rewards points, rather than Qantas Points, and were treated as separate products. (The same was also true in reverse.)

But this is no longer the case. Late last week, ANZ quietly changed the eligibility criteria listed on its website:

As you would expect, many AFF members aren’t thrilled about this change. One wrote on our forum:

Far out, this was my next one in line to churn. Extending the lockout to 24 months AND extending it to both QFF and ANZ rewards cards means I’ll go from opening an account this month to opening one in October 2026…

diamondhands on the AFF forum

Another person wrote:

Pretty much all the CCs are now 24 month lock out periods now? Awful news.

am0985 on the AFF forum

Changes to CommBank, Westpac and St.George exclusion periods

ANZ is not the first major bank to tighten the screws on sign-up bonuses in recent times. In late 2024, CommBank also changed its exclusion period from 12 to 18 months.

Westpac also recently extended its offer exclusion period from 12 to 24 months.

The same 24-month exclusion period applies to St.George, Bank of Melbourne and Bank SA customers. All three of those banks are owned by Westpac and offer the same credit card products as each other.

Other things to keep in mind

There are a few other things worth noting when it comes to eligibility for credit card sign-up offers…

Citibank credit cards

Citibank credit cards don’t typically have advertised exclusion periods. However, it’s still a good idea to read the terms & conditions of each individual offer.

In the past, some AFF members have reported that Citibank rejected their applications because they already had (or recently applied for) another credit card issued by Citibank. There is some discussion about Citibank applications and exclusion periods in this AFF thread.

Virgin Money credit cards

Virgin Money’s sign-up bonus offers typically include the wording in the fine print:

Offer is not available to existing Virgin Money Credit Card holders (including upgrades).

At the time of writing, there is no specific mention of points not being available to past customers.

HSBC credit cards

For the purpose of eligibility for sign-up bonuses, HSBC treats its Star Alliance credit card differently to other cards.

You can still be eligible for the Star Alliance Gold fast-track with the HSBC Star Alliance card, even if you’ve recently held a different HSBC card. You just can’t be transferring directly from another HSBC card, or have held this exact card within the past 18 months.

Get Star Alliance Gold status without flying…

- Card Name

- HSBC Star Alliance Credit Card

- Earn

- 1

- Signup Bonus

-

Fast Track to Star Alliance Gold Status

- Annual Fee

- $0 in the first year, $499 p.a. thereafter

- Read more

- View Offer

on everyday purchases

American Express referrals

If you already have an American Express card, you can still earn bonus points if a new cardholder signs up using your referral link.

In addition, there is nothing stopping your spouse or partner from applying for their own Amex card and earning their own bonus points, even if they’re listed as an additional cardholder on your own Amex card.

Our Favourite American Express Cards

- Card Name

- American Express Platinum Card

- Earn

- 2.25

- Signup Bonus

-

Receive 200,000 bonus Membership Rewards Points¹

Apply by 8th Jul 2025

- Annual Fee

- $1,450 p.a.

- Read more

- View Offer

on everyday purchases

- Card Name

- American Express Explorer Credit Card

- Earn

- 2

- Signup Bonus

-

100,000 bonus Membership Rewards Points¹

Apply by 2nd Dec 2025

- Annual Fee

- $395 p.a.

- Read more

- View Offer

on everyday purchases

- Card Name

- American Express Velocity Platinum

- Earn

- 1.25

- Signup Bonus

-

60,000 bonus Velocity Points*

Apply by 12th Aug 2025

- Annual Fee

- $440 p.a.

- Read more

- View Offer

on everyday purchases