HSBC Star Alliance Credit Card

Fast track to Star Alliance Gold status with the HSBC Star Alliance credit card.

- Signup bonus

- Fast Track to Star Alliance Gold Status , when you spend $4,000 or more on eligible purchases in the first 90 days from account opening

- Points Earned

- Earn 1 Star Alliance Point per $1 on eligible purchases, up to $3,000 per statement period and 0.5 Star Alliance Points per $1 spent on eligible purchases thereafter, uncapped

- Notable Benefits

-

- 0% interest for 6 months on flight bookings made directly through participating Star Alliance member airlines (reverts to standard variable purchase of 19.99% p.a.)

- Complimentary Travel Insurances with Rental Vehicle Excess Insurance in Australia, Transit Accident Insurance, Extended Warranty Insurance and Purchase Protection Insurance

- Annual fee

- $0 in the first year, $499 p.a. thereafter

The owner of Australian Frequent Flyer may receive a commission from the card issuer for each applicant of this card.

Why we like the HSBC Star Alliance Card

The HSBC Star Alliance credit card is the first of its kind anywhere in the world. Cardholders can earn Star Alliance Points which are transferable to a choice of seven Star Alliance member airlines at a time of your choosing. You can also earn Star Alliance Silver or Gold status just by spending on the card, with no flying required!

Once you qualify for the welcome offer and are fast tracked to Star Alliance Gold status with any of the seven participating carriers, you’ll soon be enjoying perks like airport priority lanes and lounge access when flying across the whole Star Alliance network. It is the largest airline alliance in the world with 26 airlines, including Air New Zealand, ANA, Lufthansa and Singapore Airlines!

This welcome offer is not available to existing HSBC customers transferring from another HSBC credit card, or if you have previously held a HSBC Star Alliance credit card within the last 18 months. Refer to the full T&C’s for more information.

Key Information & How to Apply

Key facts about this cards

- Card type

- Visa

- Signup bonus

- Fast Track to Star Alliance Gold Status , when you spend $4,000 or more on eligible purchases in the first 90 days from account opening

- Annual fee

- $0 in the first year, $499 p.a. thereafter

- Interest rate

- 19.99% p.a.

- Interest-free days

- Up to 55 days

- Minimum credit limit

- $6,000

- Minimum income requirement

- $75,000 p.a.

- International transaction fee

- 3% of the transaction amount

To apply for this card, you will need

- To be an Australian citizen, resident or long-term visa holder aged 18 or over

- $75,000 p.a.

- Have a good credit history and no payment defaults

- Your Australian driver’s licence number and proof of income

- 10-15 minutes to complete your application

The owner of Australian Frequent Flyer may receive a commission from the card issuer for each applicant of this card.

Contents

Travel benefits

Here’s an overview of the travel benefits you can expect…

Earn Star Alliance Silver or Gold status

To earn Star Alliance status, you would usually need to credit a minimum amount of flying to a member airline’s frequent flyer program. But the HSBC Star Alliance credit card makes it a whole lot easier for Australians to earn Star Alliance status. And you don’t even need to set foot on an aircraft!

Upon registering your card, you’ll be asked to select your preferred “status airline”. You can choose from any of the seven airlines participating Star Alliance frequent flyer programs:

- Air Canada

- Air New Zealand

- EVA Air

- Singapore Airlines

- South African Airways

- Thai Airways

- United Airlines

Star Alliance status with your choice of airline

If you then qualify for Star Alliance Silver or Gold status, you’ll automatically receive the corresponding status tier with that airline.

Choosing a status airline will not affect your ability to transfer Star Alliance points to other airlines. You can transfer your Star Alliance points to any – or all – of the seven participating airlines, at any time.

If you spend $30,000 or more on eligible purchases within 12 months of your card account opening date (known as your “qualification year”), you’ll be rewarded with the equivalent of Star Alliance Silver status in your choice of airline.

Spend at least $60,000 during your qualification year, and you’ll receive Star Alliance Gold status with your chosen status airline.

You’ll then get to enjoy the benefits of your status when flying across the entire Star Alliance network. This also extends to any of your chosen airline’s other partners. Your status will be granted at least until the anniversary of your account opening. Please note any status granted under the HSBC Star Alliance Credit Card is withdrawn immediately if you close your HSBC Star Alliance Credit Card account.

If you happen to already hold status with your chosen status airline and meet the spend criteria to earn Star Alliance status through your credit card, you may receive some bonus Star Alliance points instead.

Star Alliance Gold benefits

As a Star Alliance Gold member, you can receive benefits when flying with any alliance member including:

- Airport lounge access

- Priority check-in

- Priority baggage

- Priority boarding

- Access to Gold Track security lanes at selected airports

- Extra baggage allowance (excludes Air New Zealand “Seat” tickets and intra-Europe fares that normally exclude checked baggage on Lufthansa, Austrian, SWISS, Brussels Airlines & SAS)

- Free upgrade to Business First Class on the Heathrow Express train in London

See the Star Alliance website for a full list of alliance-wide benefits.

Enjoy benefits on Virgin Australia

Virgin Australia is not part of an alliance. But it does partner with several Star Alliance member airlines.

If you live in Australia, it could make the most sense to select a Virgin Australia partner airline such as Singapore Airlines, Air Canada, or United as your chosen “status airline”. That’s because Gold status with either of these airlines also entitles you to benefits including lounge access when flying with Virgin Australia!

Complimentary travel insurance

The HSBC Star Alliance credit card comes with complimentary domestic and international travel insurances, underwritten by Allianz. This also covers rental vehicle excess insurance in Australia. There’s also transit accident insurance, extended warranty insurance and purchase protection insurance.

To activate the international travel insurance, you would need to have a return overseas travel ticket. Plus, you must spend at least $500 on prepaid travel expenses for your trip using your HSBC Star Alliance credit card before leaving Australia.

Before using this insurance, we encourage you to read the PDS here.

0% interest for six months on flights

A unique benefit of the HSBC Star Alliance credit card is that you’ll pay no interest for the first six months when you book flights directly with any of the seven participating airlines. This means you’ll need to book on the respective websites of Air Canada, Air New Zealand, EVA Air, Singapore Airlines, South African Airways, Thai Airways and United Airlines, and pay using your HSBC Star Alliance credit card.

The current interest rate on the card is 19.99% p.a. So if you pay everything off within six months, you won’t be charged any interest. After six months, any outstanding balance will revert to the standard interest rate.

Earning Star Alliance Points

Rather than earning points with a specific airline, HSBC Star Alliance credit card holders earn “Star Alliance Points” in a Star Alliance Rewards account.

The card’s earn rate is 1 Star Alliance point per dollar spent up to the first $3,000 per month. After that, it’s 0.5 Star Alliance points per $1 spent each month.

So, with the conversion rates, you would effectively earn up to 0.8 airline miles per dollar on the first $3,000 spent on your HSBC Star Alliance credit card each month. Amounts spent over this monthly cap effectively earn up to 0.4 miles per $1 with a Star Alliance airline.

It is possible that individual airlines could also offer their own bonuses or promotions from time to time, to entice Star Alliance Rewards members to transfer points to their respective frequent flyer programs.

Star Alliance Points don’t expire as long as you earn or transfer at least one point every 14 months. But Star Alliance Points that haven’t yet been transferred to an airline do expire if you cancel your account or it is inactive for more than 14 months. See the Star Alliance Rewards Program T&Cs for more on this.

Earning points for ATO & government payments

The HSBC Star Alliance credit card does not award any points on payments made directly to the ATO or other government bodies in Australia. Government fees and charges also do not count as eligible spend towards Star Alliance Silver or Gold status.

However, you can use a payment service such as pay.com.au to pay tax and other bills with this card and still earn points at the full rate!

Using Star Alliance Points

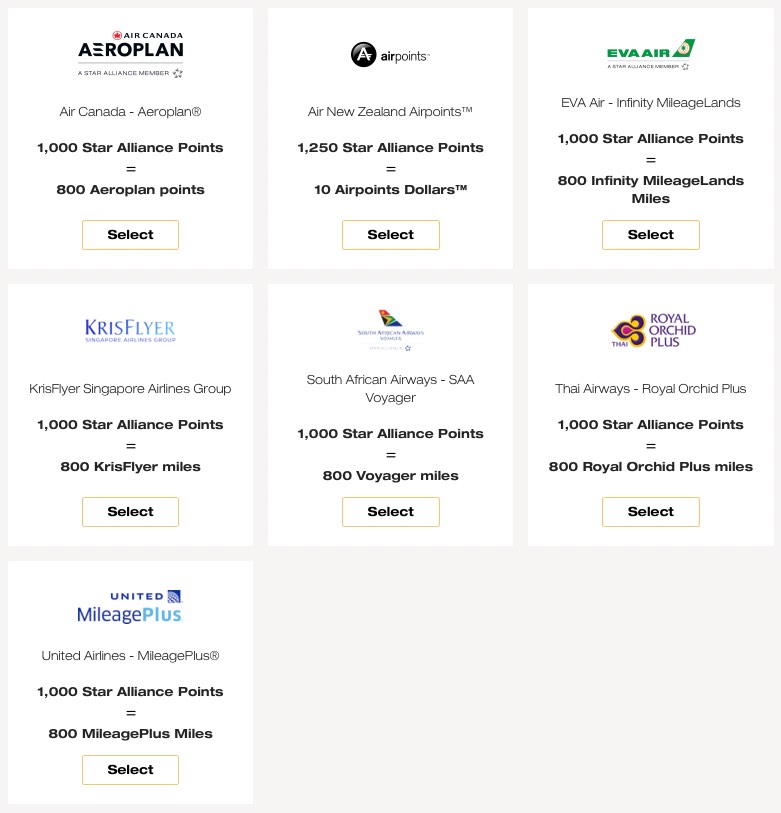

You can transfer your Star Alliance points to a selection of different Star Alliance airlines’ frequent flyer programs, as needed. There are seven participating airlines to convert your points. This includes Singapore Airlines KrisFlyer, Air Canada Aeroplan, United MileagePlus and EVA Air Infinity MileageLands.

And you’re not limited to one program, either. You can convert some Star Alliance points to KrisFlyer miles, and some to MileagePlus miles – the choice is yours! Star Alliance points can also be converted at any time.

In most cases, you’ll receive up to 0.8 airline miles for every 1 Star Alliance point converted. The exception is Air New Zealand Airpoints, which uses a different type of program currency where 1 Airpoints Dollar is literally worth $1. There may also be a limit to the number of Star Alliance points you can convert per transaction.

Here’s a full list from the Star Alliance Rewards website:

After transferring your Star Alliance Points to an airline of your choice, you can redeem them for any reward offered by that loyalty program. This includes flights and upgrades across the Star Alliance network!

Summary

Pros

- Earn Star Alliance Gold status without flying

- Earn Star Alliance Points which can be converted to any or all of the seven Star Alliance member frequent flyer programs at a time of your choosing

- No annual fee in the first year

- Complimentary travel insurance

- Compatible with Apple Pay and Google PayTM

Cons

- International transaction fees apply

- Full points earn rate capped at $3,000 spend per month

- High interest rate (this could be a problem if you don’t think you’ll be able to repay your balance in full each month)

- Signup bonus

- Fast Track to Star Alliance Gold Status , when you spend $4,000 or more on eligible purchases in the first 90 days from account opening

- Points Earned

- Earn 1 Star Alliance Point per $1 on eligible purchases, up to $3,000 per statement period and 0.5 Star Alliance Points per $1 spent on eligible purchases thereafter, uncapped

- Notable Benefits

-

- 0% interest for 6 months on flight bookings made directly through participating Star Alliance member airlines (reverts to standard variable purchase of 19.99% p.a.)

- Complimentary Travel Insurances with Rental Vehicle Excess Insurance in Australia, Transit Accident Insurance, Extended Warranty Insurance and Purchase Protection Insurance

- Annual fee

- $0 in the first year, $499 p.a. thereafter

The owner of Australian Frequent Flyer may receive a commission from the card issuer for each applicant of this card.

Frequently Asked Questions (FAQs)

To apply, you would need to be an Australian citizen, resident or long-term visa holder. You’ll also need a gross income of at least $75,000 per year. Other criteria may apply.

The minimum credit limit is $6,000.

Following the introductory Fast Track to Gold Status offer, you earn Star Alliance Gold Status with your preferred airline when your combined account spend is $60,000 or more on eligible purchases in a qualification year. This comes with benefits including lounge access when flying with any Star Alliance airline. If you select Singapore Airlines, United or Air Canada as your status airline, you’ll also receive access to Virgin Australia Lounges when flying on Virgin Australia. But if you choose United Airlines as your “status airline”, you won’t be eligible for entry into United Club lounges when flying on domestic United flights within the USA.

You’ll earn Star Alliance Points into your Star Alliance Rewards account. These points can then be transferred from your Star Alliance Rewards account into your choice of seven frequent flyer programs. Select from Air Canada Aeroplan, Air NZ Airpoints, EVA Air Infinity MileageLands, Singapore Airlines KrisFlyer, South African Airways Voyager, THAI Royal Orchid Plus and/or United MileagePlus.

Yes, Star Alliance Points can expire if you do not earn or transfer any points for 14 months. They’ll also expire if you cancel your HSBC Star Alliance credit card. However, as long as your card remains open and your account has activity at least once every 14 months, your points won’t expire.

Yes, the HSBC Star Alliance card supports both Apple Pay and Google PayTM. So, you can still use this card to make purchases when you’re out and about without carrying the physical card.

Yes, additional credit cards can be issued to anyone aged 16 or above, with no additional cardholder fees.

No. While you need to nominate a particular Star Alliance carrier as your preferred “status airline”, you are free to transfer your Star Alliance Points to your choice of any (or all) of the seven participating frequent flyer programs.

* Disclaimer

Complimentary Insurance covers: AWP Australia Pty Ltd ABN 52 097 227 177 AFSL 245631 trading as Allianz Global Assistance (AGA) under a binder from the insurer, Allianz Australia Insurance Limited ABN 15 000 122 850 AFSL 234708, has issued a group policy to HSBC Bank Australia Limited ABN 48 006 434 162 AFSL and Australian Credit Licence 232595 (HSBC), which allows eligible HSBC account holders and cardholders to claim under the group policy as third party beneficiaries by operation of s48 of the Insurance Contracts Act 1984 (Cth). Any advice on insurance is general advice only and not based on any consideration of your objectives, financial situation or needs. The eligibility criteria, terms, conditions, limits and exclusions of the group policy are set out in the Information Booklet available at www.hsbc.com.au/credit-cards/terms/ find out more about Credit Card Terms and Conditions which may be amended from time to time. Consider its appropriateness to these factors before acting on it. You can contact AGA on 1800 648 093. An excess may apply. HSBC does not issue these insurances and does not receive commissions on these policies or guarantee any benefits under this cover.

If during the period of your cover, you (and your spouse/dependents, if they’re eligible for cover) are positively diagnosed as suffering a sickness recognised as an epidemic or pandemic (such as COVID-19) cover may be available under selected International Travel Insurance benefits. The eligibility criteria, terms, conditions, limits and exclusions of the group policy are set out in the Information Booklet available at www.hsbc.com.au/credit-cards/terms/ find out more about Credit Card Terms and Conditions.

HSBC BANK AUSTRALIA

Credit provided by HSBC Bank Australia Limited ABN 48 006 434 162 Australian Credit Licence 232595. Offer is not available for product transfers or in conjunction with any other offer. HSBC may change or end this offer at any time. Fees, charges, min. spend, terms, conditions and HSBC’s lending criteria applies to all credit cards issued by HSBC. Go to www.hsbc.com.au or call 1300 308 880. Interest rates are valid at the time of publication and are subject to change. See terms and conditions for more information.

ABOUT STAR ALLIANCE

The Star Alliance network was established in 1997 as the first truly global airline alliance, based on a customer value proposition of global reach, worldwide recognition and seamless service. Since inception, it has offered the largest and most comprehensive airline network, with a focus on improving customer experience across the Alliance journey.

The member airlines are: Aegean Airlines, Air Canada, Air China, Air India, Air New Zealand, ANA, Asiana Airlines, Austrian, Avianca, Brussels Airlines, Copa Airlines, Croatia Airlines, EGYPTAIR, Ethiopian Airlines, EVA Air, LOT Polish Airlines, Lufthansa, Scandinavian Airlines, Shenzhen Airlines, Singapore Airlines, South African Airways, SWISS, TAP Air Portugal, THAI, Turkish Airlines, and United.

Overall, the Star Alliance network currently offers more than 10,000 daily flights to almost 1,200 airports in 184 countries. Further connecting flights are offered by Star Alliance Connecting Partners Juneyao Airlines and THAI Smile Airways.

ABOUT STAR ALLIANCE AUSTRALIA

Star Alliance Australia Pty Ltd (ABN 57 661 145 080) was established in July 2022 to operate as principal of the Star Alliance Rewards program.<!-