Amex launches “Plan It” payment instalments

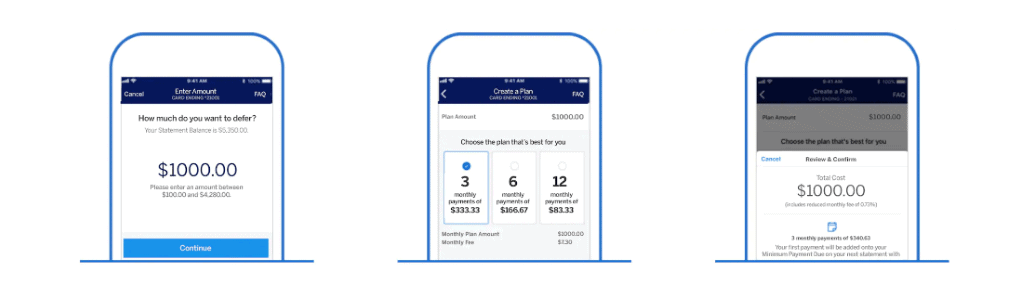

American Express card holders in Australia can now choose to pay back their credit card balances in instalments, with the launch of the “Plan It” payment feature.

Amex card members can chose to move a portion of their credit card balance onto a Plan It payment plan to be paid back over 3, 6, 9 or 12 months. There is no interest payable but there is a fixed monthly fee which will be displayed upfront.

Amex says that customers can use “their existing credit line” to create an instalment plan. An Amex spokesperson told us that using this feature won’t impact a customer’s credit rating as long as payments are made on time. However, it would be reported to the credit bureau if a customer defaulted on their monthly payments.

The feature is available online or via the American Express App. Most personal Amex credit cards in Australia are eligible, excluding David Jones cards.

Marketing this as an alternative to buy-now-pay-later services for customers struggling with their personal finances during COVID-19, Amex Vice President of Consumer Lending Austin Huntsdale says Plan It is designed to help cardholders better plan for expenses.

“Australians are looking carefully at their personal finances. They’re planning more diligently to be able to absorb unexpected expenses. Life’s a bit different now, and customers want more control over their finances. Plan It is one of the ways we can help our Card Members gain that control,” Huntsdale said.

Earn up to 5,000 Qantas points with Afterpay

The announcement comes after Qantas Frequent Flyer announced a new partnership with Afterpay, one of a growing number of “buy now, pay later” services in Australia. Afterpay does not come with any fees for the customer (assuming you make all repayments on time), but is only available at participating retailers. With Afterpay, you would need to pay a quarter of the purchase price upfront, followed by three more fortnightly payments.

With the Qantas Frequent Flyer partnership, new Afterpay customers can earn 500 Qantas points for signing up and linking their Qantas Frequent Flyer number. On top of that, new customers can earn 1 Qantas points per $1 spent with Afterpay up to a maximum of 5,000 Qantas points.

If you’re an existing Afterpay customer, though, the offer isn’t nearly as good. You’ll first have to spend $1,000 after linking your Qantas Frequent Flyer account, and then after that you’ll earn 1 Qantas point per $1 spent up to a total of 5,000 Qantas points. What’s more, the offer is limited to 50,000 existing Afterpay customers that link their Qantas Frequent Flyer membership.

Clearly, this Qantas Frequent Flyer partnership with Afterpay is designed to drive short-term sign-ups. There are no ongoing, long-term opportunities to earn Qantas points via this partnership. This trend towards “churning and burning” customers with short-term offers was strongly criticised earlier this month by a former Qantas Business Rewards program partner.

Unlike Plan It, there are some concerns that using services such as Afterpay could impact your credit rating.

“The issue is that these services are classified as a line of credit, meaning the way you use them can impact on your future borrowing capacity,” said Geraldine Magarey, Thought Leadership & Research Leader at Chartered Accountants Australia & New Zealand.

Join the discussion on the Australian Frequent Flyer forum: Qantas Points with Afterpay