If you’ve tried booking an international flight recently, you’ve probably noticed that flights to and from Australia are expensive right now. Award flight availability is also particularly limited at the moment.

There are clearly a few factors at play which have combined to create a perfect storm of poor availability and high airfares. For example, rising fuel prices and Russian airspace issues have made it more expensive for airlines to operate flights. A lack of price competition from Chinese airlines – which had forced prices down in key long-haul markets to Asia and Europe in the years before the pandemic – is also a key part of the equation.

But ultimately, it comes down to basic economics. Airlines have added a lot of capacity back onto international routes over the past year, but demand for international flights has recovered more quickly and is now well in excess of supply.

Throughout the pandemic, an enormous number of international flights were cancelled due to a lack of demand. Airlines had the planes available and crew ready to work. But with IATA predicting that travel demand would not fully recover until 2024, most airlines put aircraft into deep storage and furloughed or sacked workers.

Now, airlines are playing “catch up” and can’t bring more aircraft out of storage – or people back to work – fast enough.

Airlines including Qantas and Air Canada have even had to cancel large numbers of flights in advance because they didn’t have enough crew to reliably operate them all. In some cases, airports such London Heathrow and Amsterdam Schiphol have even had to instruct airlines to cap the number of tickets sold or cancel flights because the airport was under-resourced and couldn’t cope with the sudden rise in demand.

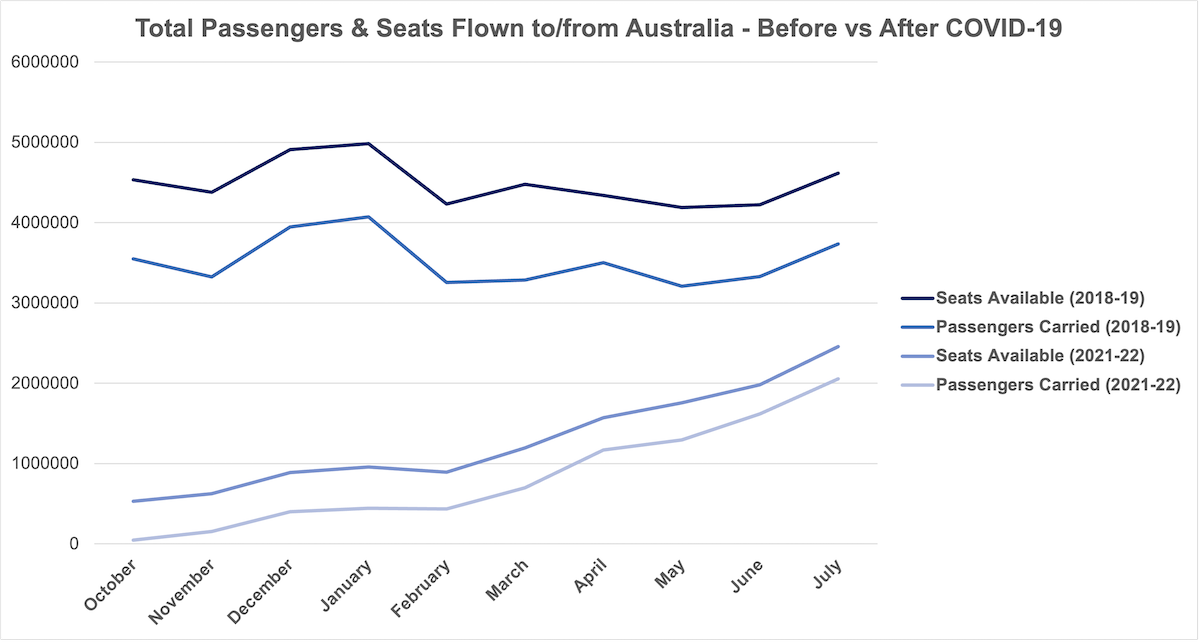

Airline capacity and passenger numbers before vs after COVID-19

This chart, put together using Australian government international airline activity data published by the Bureau of Infrastructure and Transport Research Economics (BITRE), shows that the number of seats available on international flights to & from Australia is still well below pre-COVID levels:

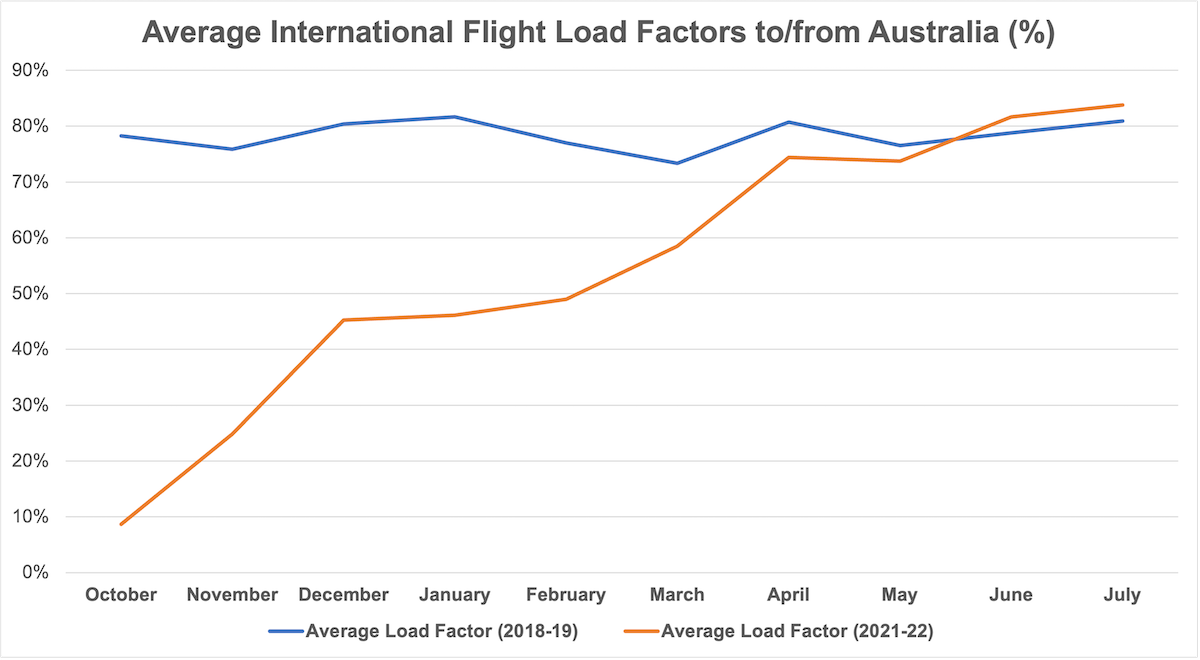

In July 2022, the most recent month for which data is available, capacity was only at around 54% compared to July 2019. The number of passengers carried to and from Australia in July 2022 was just over 55% of the number in July 2019. This means that load factors, or the percentage of occupied seats, have been higher in recent months than in pre-COVID times – something that is contributing to higher airfares.

As you can see from these graphs, both capacity and demand have steadily increased since the Australian government first reopened the international border in November 2021. Demand was initially a bit slow to return, but things really started to pick up after the government removed most remaining COVID-19 travel restrictions including pre-departure testing in April 2022.

Keep in mind that these charts only show the actual number of passengers that have flown, despite the high airfares, COVID-19 travel restrictions still affecting some destinations and the chaos at airports over recent months. If flights were available in July 2022 at July 2019 prices, passenger numbers would have been even higher.

It’s also worth noting that the load factors shown represent an average across all routes, including to/from destinations which are still closed or subject to quarantine on arrival. On many routes to destinations which have fully reopened, load factors have been significantly higher than the average.

For example, the average load factor on Delta flights between the United States and Australia in July 2022 was 95%. United Airlines filled an average of 94% of its seats.

Other notable load factors from July 2022 include:

- Etihad Airways – more than 98% of seats filled to/from Abu Dhabi

- Emirates – 96% of seats filled to/from Dubai

- Qatar Airways – 96% of seats filled to/from Doha

- Qantas – 95% of seats filled to/from Rome and 94% to/from London & Johannesburg

- Both Jetstar and Virgin Australia filled 93% of seats to/from Bali

- LATAM Airlines filled 92% of seats on Australia’s only flight to/from South America

We don’t yet have access to the full data for this month. But it appears that many flights over the current school holiday period between Australia and Europe, as well as Bali, are completely sold out.

This is not a permanent change – things will improve!

Supply and demand will eventually normalise. Airfares will return to reasonable levels and more award availability will appear. It will just take a bit more time for airlines to fully restore the capacity that was taken away in 2020.

The good news is that airlines are continuing to add international flights out of Australia to their schedules. This month alone, Qantas resumed flights from Sydney to Tokyo and launched a new route from Sydney to Bengaluru.

Around a month from now, a huge number of seats will also be added back into the market. International routes due to launch or resume in late October or early November 2022 include:

- AirAsia X – Melbourne to Kuala Lumpur

- AirAsia X – Perth to Kuala Lumpur

- AirAsia X – Sydney to Auckland

- Air Mauritius – Perth to Mauritius

- Jetstar – Sydney to Seoul

- Qantas – Perth to Johannesburg

- Qantas – Sydney to Santiago

- United Airlines – Brisbane to San Francisco

- United Airlines – Melbourne to Los Angeles

- United Airlines – Sydney to Houston

- Virgin Australia – Brisbane to Queenstown

- Virgin Australia – Melbourne to Queenstown

- Virgin Australia – Sydney to Queenstown

Qantas will also launch Perth-Jakarta and Sydney-Seoul flights in December, and some existing routes like Perth-Dubai on Emirates will shortly be upgraded to larger aircraft types.

Even all of these extra flights might not be enough to keep up with the surging demand right now – particularly for premium cabin bookings. But the extra capacity will certainly help, and even more flights will continue to be added in the months that follow.

If you need to fly overseas in the coming months, you can unfortunately expect to pay a bit more than usual. But there are already signs of prices returning to normal in 2023. Singapore Airlines and Lufthansa are currently running “early bird” sales for travel in 2023, with prices similar to pre-COVID discounted fares. Both of those sales end tomorrow.

In the meantime, we can at least be thankful that we’re able to travel overseas this year and aren’t being forced to pay over $10,000 for a one-way flight back home – as was the case for many Australians stuck overseas just a year ago!

You can leave a comment or discuss this topic on the Australian Frequent Flyer forum.