Right now, Australia’s banks are offering more credit card sign-up offers – with higher amounts of bonus points available – than ever before. These offers of up to 150,000 bonus frequent flyer points, just for applying for a new credit card, are great for frequent flyer point collectors!

However, banks are also getting smarter about their credit card promotions. In an attempt to crack down on credit card churning, these sign-up offers are also now coming with more strings attached.

Credit card churning is lucrative

A lot has changed in the Australian credit card market since the RBA began regulating interchange fees in 2017. In general, you’ll now earn fewer points for everyday spend on your credit card. Yet, most banks are now offering higher amounts of bonus points to new customers as an incentive to apply for their cards. As a result, credit card churning is now an even more lucrative way to earn points compared to everyday credit card expenditure.

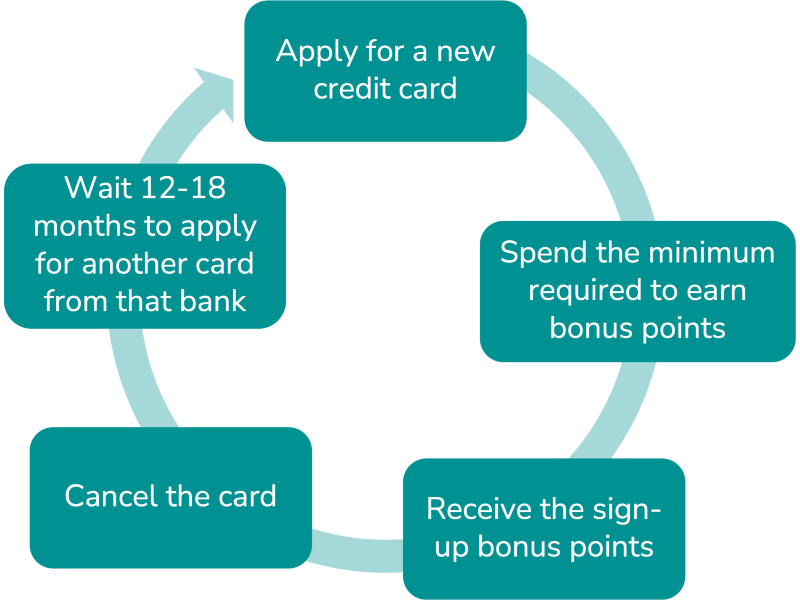

The basic idea of credit card churning is to apply for a new credit card, receive the bonus points for signing up, then cancel the card.

For banks, the problem is that it costs money to offer frequent flyer points to new customers. In general, it’s worth this investment as most new customers will keep their credit card for a long time and be profitable in the long term. On the other hand, it’s unlikely to be profitable for a bank to give away 150,000 frequent flyer points to a customer that then cancels their card after a few months.

The nature of credit card sign-up offers is changing

Traditionally, banks would award the full amount of bonus points up-front to new clients that applied for a credit card and spent the designated minimum amount within 3 months of opening the card.

There are still plenty of these types of offers available in Australia. Of the 59 current personal credit card sign-up offers in Australia where bonus points are available, 49 of these award the full amount of points as a lump sum.

But 4 of these offers require you to spend a certain amount of money each month over several months in order to earn the full amount of bonus points. And 8 offers won’t award you with the full amount of bonus points unless you renew your card for a second year.

From a bank’s perspective, this makes sense. If you have to renew your card for a second year, the bank collects a second annual fee. If you are spending more money on the card over a longer period of time, the bank will also earn more in interchange fees. But, most importantly, they’re assuming you’re less likely to cancel a credit card that you’ve already had for over a year.

Although the “lump sum” offers are still the majority, Australian Frequent Flyer has noticed a steady increase in the number of offers which require a longer-term commitment over the past year or so. We expect this trend to continue.

Examples of credit card offers that require a longer commitment

As an example of this new trend, you can currently earn up to 150,000 bonus Qantas Frequent Flyer points by applying for a Citi Premier Qantas credit card. The $395 annual fee is even being waived for the first year. However, with this offer, if you spend at least $5,000 within the first 90 days you’ll only receive 100,000 Qantas points. You’ll only receive the other 50,000 bonus points in a years’ time, if you renew your card. Of course, the annual fee is not waived in the second year.

Another current sign-up offer is for the Virgin Money Velocity High Flyer credit card. The headline offer is 100,000 bonus Velocity points for new applicants. But these points are awarded in increments. You’ll receive 25,000 bonus Velocity points for each month that you spend at least $3,000 during the first 3 months of holding the card. The final instalment of 25,000 Velocity points is paid out if you renew your card for a second year.

In a more extreme example, Citibank in late 2018 began offering 410,000 bonus Citi Rewards points with one of its cards. But, to earn the full amount of bonus points, you would have had to spend at least $1,000 per month on this card every month for the first 20 months.

There are still plenty of lucrative opportunities

To be clear, these are still very good promotional offers! They just require you to keep the card for a bit longer, and in some cases to process a bit more spend through it. Given the high amounts of bonus points on offer, this will still be worthwhile for most people!

If you’d like to learn more about credit card churning, this informative AFF thread contains lots of useful information: Advice on limits for applications, and more.