American Express (Amex) cards have long been popular with frequent flyers for their superior earning power and the additional benefits that come with many cards like travel credits, lounge access or even hotel status. But the regular offers of discounts, bonus points and statement credits available to Amex card members can be just as lucrative.

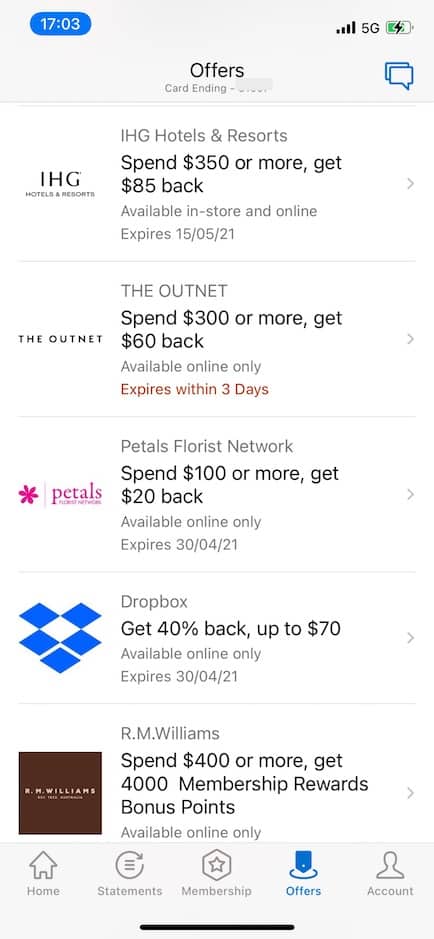

While different Amex cardholders may have access to different offers, these regularly provide generous amounts of bonus points or discounts when spending with participating retailers including (but not limited to) airlines, hotels and car rental companies. For example, recent Amex offers received by many Australian Frequent Flyer members include:

- Spend $250 with Virgin Australia and receive a $40 statement credit (i.e. $40 is taken off your Amex bill)

- Spend $350 with IHG Hotels & Resorts and get $85 back

- Spend $100 at Liquorland and get $10 back

- Spend $400 at R.M. Williams to get 4,000 bonus Amex points

- Spend $20 at The Reject Shop and get $5 back

- Get 10% back (up to $10) at Ampol petrol stations

- Get up to $75 back at NET-A-PORTER (no minimum spend)

If you have an eligible card, you can find your personal Amex offers either by logging in on the American Express website or checking in the Amex Australia smartphone App.

To take advantage of any offer, you’ll first need to register on the Amex App or website. Ensuring you meet the relevant offer terms & conditions, you’ll then just use your Amex card to complete a purchase with the participating merchant. You’ll generally receive the statement credit or bonus points within three days, although it could occasionally take longer.

New offers are updated on a regular basis, but some are only available to a certain number of people who register first. To access the best offers, you might need to register quickly.

AFF members regularly post about their offers on our forum, so subscribing to the Amex statement credits thread could be a good way to avoid missing out!

If you have an Australian Mastercard card that earns Qantas points, you could also be earning bonus Qantas points with the Qantas “My Card Offers” scheme – although these offers generally aren’t as lucrative as the Amex offers. 28 Degrees cardholders may also receive regular offers.

Join the discussion on the Australian Frequent Flyer forum: New Amex statement credits

Community Comments

Loading new replies...

Join the full discussion at the Australian Frequent Flyer →