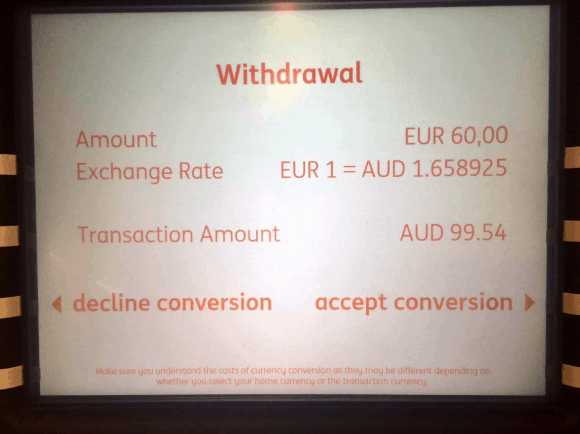

Have you ever been asked while travelling whether you wanted to pay in Australian dollars or the local currency? The offer to pay in Australian dollars overseas is known as “dynamic currency conversion”, and it’s a complete and total rip-off.

When a customer pays using dynamic currency conversion, the merchant makes a commission. So it’s in their interest for you to pay in your home currency. But this is most definitely not in your interest!

Dynamic currency conversion may be offered at ATMs or credit card terminals overseas when using a Visa or MasterCard. It’s where the merchant offers to convert the transaction amount to the card’s native currency at the point of sale, rather than letting your bank do the conversion.

This may appear to be more convenient for the customer, but the exchange rate used for the conversion (or the merchant’s mark-up) is typically very poor value. You can expect to pay a lot more for the privilege, compared to allowing your bank to convert the currency.

If you’re paying for an overseas transaction with a credit card without international transaction fees, you’ll be particularly worse-off as your own bank will convert the amount at a rate which is much more favourable to you. But even if your credit card charges a 3% forex fee, you’ll still be better off by declining dynamic currency conversion.

Dynamic currency conversion is also a trap if you’re using a pre-loaded travel money card, such as Qantas Travel Money or Velocity Global Wallet. If you’ve already loaded foreign currency onto your card, this means your Australian dollars have already been converted to the local currency. By paying in Australian dollars, your foreign currency will be converted back to Australian dollars at a terrible rate. What’s more, many travel money cards charge an additional “non-native currency” fee if you complete a transaction in a currency that’s not pre-loaded onto the card. So you’ll lose even more money.

AFF member luxury-lizard noticed on a recent trip to Europe that more and more ATMs and businesses are now offering dynamic currency conversion by default.

We are currently travelling in Europe (which we do at least once per year) – this time I’ve noticed that often both ATMs and credit card terminals default to DCC (Dynamic Currency Conversion) – the uplift (i.e. less favourable exchange rate and fees) are up to 10% more than when paying in local currency (particularly with a credit card with no foreign exchange fees; e.g. ANZ Travel Adventurer). This has been particularly prevalent in Croatia where merchants just put though the transaction without even offering you the choice. All ATMs (so far) also default to DCC and you really need to be paying close attention to opt out.

Even Paypal offers dynamic currency conversion by default when paying for something in a foreign currency. Furthermore, some retailers will select the “AUD” option for you without your consent. So, you need to be careful to ensure you’re not getting ripped off.

Retailers using DCC is common in many places OS for credit card purchases so one always has to be on alert for this (even PayPal has this!!). Had a hotel in Malaysia automatically charge me in AUD without asking so I refused to sign the bill…told him to cancel the transaction and start again which he did not know how to do and had to call a supervisor – who I then gave a lecture about what a RIP OFF DCC is!

Next time you’re asked which currency you wish to pay in, always select the local currency!

Join the discussion on the Australian Frequent Flyer forum: Beware of DCC in Europe