How Much a Credit Card Point is Worth: Our Valuations

Our detailed AFF Frequent Flyer Point Valuation model estimates the average value of an airline point.

As part of our research, we’ve also done a similar analysis of the average value of one point in Australian credit card and payment platform loyalty programs that let you transfer points to a range of different airline programs. We recently updated these Credit Card Point Valuations, and you can see the latest figures below.

This analysis could help you to determine a ballpark figure for the value you might be able to get when redeeming points with different Australian credit cards.

It also makes it easier to compare the value of points across different bank programs. However, keep in mind that different credit cards offer different earn rates. Our analysis only considers the redemption value of one point.

How our model works

As with frequent flyer programs, it’s impossible to give an exact value of credit card reward points because the value depends on how you use them. Nonetheless, we’ve developed a model that aims to give an average value of a point that’s as accurate as possible.

We’ve included PayRewards in this category, which is the flexible rewards program of payment processing platform Pay.com.au. For full disclosure, this company is affiliated with Australian Frequent Flyer. However, this did not influence the outcome as we’ve applied exactly the same standards to our analysis of PayRewards points as we have with every other program.

How we calculated the value of a credit card reward point

For our Credit Card Point Valuations, we’ve used the same “basket” of 16 typical redemptions Australians might use their points for as we did for our Frequent Flyer Point Valuations.

To calculate the value of redemptions on the ground, such as gift cards, we’ve simply divided the cash value of the reward by the number of points required to get it.

However, to redeem credit card reward points for flights or airline upgrades, you would typically first transfer your points into the frequent flyer program of an airline that partners with your bank. For example, you might convert your Amex Membership Rewards points into Cathay Asia Miles to redeem for a Cathay Pacific flight.

So, for each flight redemption, we’ve calculated the average value you could expect to get for each bank point when transferring your points to the bank’s three airline program partners that offer the highest value for that particular reward. In doing so, we’ve accounted for the rate at which the credit card points transfer into each airline program.

By taking the average of the top three values, bank programs with a higher number of transfer partners are effectively rewarded as there is a higher pool of transfer partners to choose from – and therefore a higher chance of the top three values being higher. (Bank programs with lots of transfer partners also got a bit of a boost through our weightings – more on this later.)

If the bank offers less than three airline transfer partners that you could use to book a particular reward, we’ve applied a small penalty to the value given for that redemption to ensure the model is fair.

By the way, you can use AFF’s Credit Card Points Transfer Assistant or see our Australian Credit Card Points Transfer Matrix to easily find out which programs you can transfer bank reward points into, and at what rates!

After calculating the average redemption value for each of the 16 items in our basket, we’ve then removed the highest and lowest values for each program. This creates a “trimmed mean”, preventing random outliers from skewing the result.

Qualitative weightings

We’ve then applied a weighting based on three different criteria which impacts the usefulness of each program. These weightings may increase or decrease each valuation by up to 10%.

The three criteria we used in determining these weightings were:

- Number of useful transfer partners

- Does the program give notice before changing redemption or transfer rates?

- The credit card program’s points expiration policy

You can read more about these weightings at the end of this article.

Our Credit Card Point Valuations

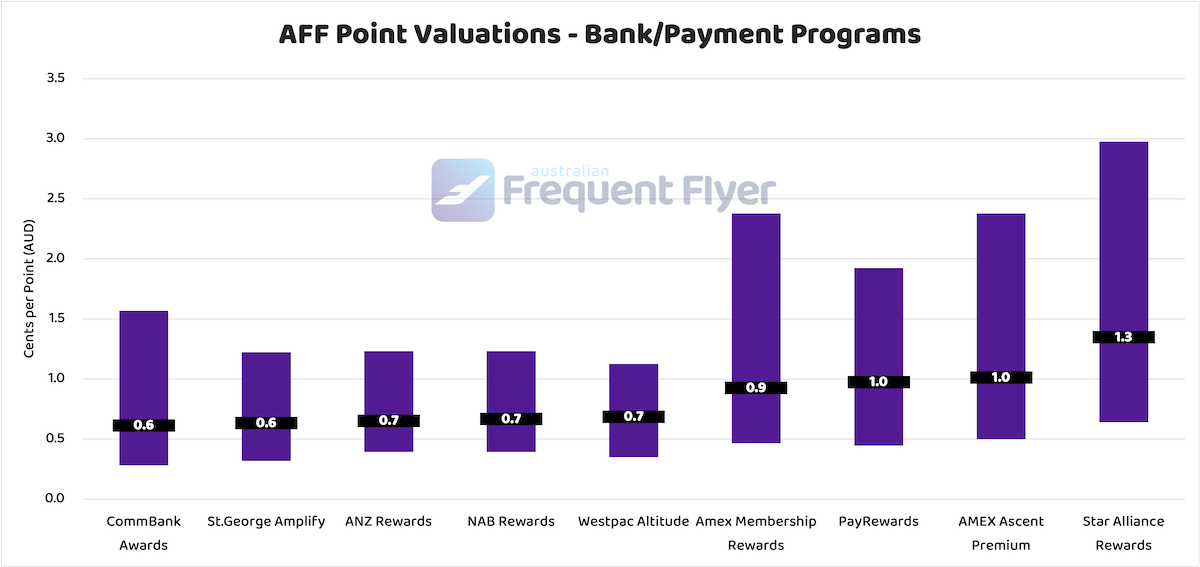

Without further ado, here are our updated Credit Card Point Valuations as of December 2025:

The amounts shown in the black boxes above are the average values. The purple bars show the full range of values we found that each type of points could be worth when redeemed for different things.

Star Alliance Rewards takes the top spot

As you can see, Star Alliance Rewards has the highest value of all of the Australian credit card reward points that we included in our analysis.

This is the program belonging to the HSBC Star Alliance credit card. The points earned with this card are particularly valuable because you can transfer them at a 5:4 rate to your choice of seven different Star Alliance airline programs.

Amex Membership Rewards has dropped in value

The next most valuable points belong to Amex Membership Rewards. Its Ascent Premium variant, for customers with a Platinum charge card, had a higher average point valuation than the regular Membership Rewards program because Ascent Premium points can also be transferred to Qantas Frequent Flyer.

Amex Membership Rewards points can be transferred to around 13 different airline, hotel and retail loyalty programs (or 14 if your card offers Qantas Frequent Flyer as well).

While Amex Membership Rewards still did well, the average value of an Amex point has dropped since our last update. This is because the program just devalued the rates at which you can transfer points to most of its overseas airline program partners.

Which programs did less well?

The loyalty programs offered by the “big four” banks, as well as the Amplify program of St.George, Bank of Melbourne and Bank SA, were towards the bottom of the list. This was mainly because these programs offer fewer airline transfer partners, and transfers are typically at worse rates.

CommBank Awards performs the worst in our current valuations because the program removed all of its airline transfer partners, other than Virgin Australia Velocity, in October 2025.

Our credit card program weightings

For anyone who’s interested, the weightings we applied to the credit card and payment platform programs included in our analysis are based on these three criteria:

| Rating | Number of useful transfer partner programs (40%) | Gives notice before changing redemption/transfer pricing? (30%) | Points expiration policy (30%) |

|---|---|---|---|

| Very good | Large number of useful airline and/or hotel transfer partners, including all major Australian programs | Program must give lots of notice before changing partners/transfer rates; no history of unannounced changes | Points never expire |

| Good | Large number of useful airline and/or hotel transfer partners, but one or more major Australian program excluded | Program must give a reasonable period of notice before changing partners/transfer rates; no history of unannounced changes | Long expiration date (more than 2 years), activity based |

| Average | 3+ useful transfer partners | Gives notice before making major changes | Expiration of 1-2 years, activity based |

| Poor | 2 useful transfer partners | T&Cs allow program to change partners/conversion rates at any time without notice | Activity-based expiration under 1 year, or time stamping expiration policy with long time limit (3+ years) |

| Very poor | 0-1 useful transfer partners | T&Cs allow program to change partners/conversion rates at any time without notice; and program has a history of doing so | Time stamping with short time limit and/or specific activity types required to prevent expiry |

And here’s how each program fared:

| Program | Number of useful transfer partner programs | Gives notice before changing redemption/transfer pricing? | Points expiration policy |

|---|---|---|---|

| Amex Membership Rewards | Good | Good | Very good |

| Amex Membership Rewards (Ascent Premium) | Very good | Good | Very good |

| ANZ Rewards | Average | Poor | Poor |

| NAB Rewards | Average | Poor | Poor |

| Westpac Altitude | Average | Average | Very good |

| St.George Amplify | Poor | Average | Very good |

| CommBank Awards | Very poor | Very poor | Very good |

| PayRewards | Very good | Average | Average |

| Star Alliance Rewards | Good | Poor | Average |