- Joined

- Jan 26, 2011

- Posts

- 30,319

- Qantas

- Platinum

- Virgin

- Red

M.A. work for you then?Just a minor point.. but MA is Malev and not Malaysian which is MH.

M.A. work for you then?Just a minor point.. but MA is Malev and not Malaysian which is MH.

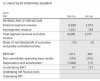

This is just the beginning of the change process. In the short term our objective is to return Qantas International to profitability. In five years we intend that the Qantas airline business, domestic and international combined, will be exceeding its cost of capital on a sustainable basis.

"Jetstar Japan is not offshoring, it is building a new business in Japan," he says.

Jetstar Japan, for example, will be allocated 24 Qantas aircraft, thus removing them from the Australian operator's balance sheet.

Talk to us again when Qantas enhance away your J lounge access as part of your LTG

Talk to us again when Qantas enhance away your J lounge access as part of your LTG

What! I thought jetstar Japan was a purely domestic operation. Joyce said they are getting new A320s. We're told the problem with capital is QFi. So what is happening? what are these 24 aircraft that are going to be transferred? They can't be from QFd, why would Jetstar Japan want a fleet of 737s and A320s? How would moving aircraft from QFd books help QFi capital return? But if they are from QFi, why does a purely domestic Japanese airline need international aircraft? (if not to fly international routes :shockI guess another possibility is that QFd or i actually have A320s on their books. But hang on they don't operate those aircraft. QF wouldnt be subsidizing Jetstar by having jetstar aircraft on their capital account, would they?

Can you quantify the loss you have suffered from this alleged breach?

What is trivial to you, may not be to others. I remember in my uni days, a case about a painter quoting and charging for 3 coats of paint but only actually painting 2. The complainant was not successful in their claim for total reimbursement,due to substantial performance, but was successful for the cost of contracting another painter to paint the final coat. Did the complainant "really" suffer a loss because they only got 2 coats? Despite its "intangibility", the courts seemed to think they did and I think I agree. They did NOT get whet they paid for, irrespective of how trivial it may have been. That is not to say id care enough to purse the non provision of priority boarding...I think the case would be dead before it started for being a trivial matter.

I am used to just walking on board - the concept of queuing behind 200 people is unpalatable.

(You mean international J lounges, yeah, not domestic?)

Basically:

1. J* Japan will get Aus Domestic fleet for short haul around there. As these planes are already depreciated the return on capital for this new LCC venture should be ok as the capital base is lower.

2. New neos and other short haul airlines will come into QFd which is fantastically good on the return on captial and take the cost of new airlines and depreciation hits.

3. They rationalise their QFi routes so that they're just flying the profitable routes and improve return on captial.

4. All of the above will result in QF as a whole having a good return on capital.

Above is how I'd interpret the information and would make the most sense for me from a financial/tax/strategy perspective.

surely its singapore? but who is the partner?

More and more USA airlines are doing this - it seems that unless a VLA, widebodies are not as popular as they once were.I am still scratching my head as to how you can have a premium carrier without wide bodied aircraft? A 4hr flight in a 320 is not my idea of fun.

This strategy would make more sense if they had Qantas Asia flights from asia to europe, as well as intra-asia flights.

I am still scratching my head as to how you can have a premium carrier without wide bodied aircraft? A 4hr flight in a 320 is not my idea of fun.

This strategy would make more sense if they had Qantas Asia flights from asia to europe, as well as intra-asia flights.

More and more USA airlines are doing this - it seems that unless a VLA, widebodies are going the way of the dodo.

The article is just not written well.

Basically:

1. J* Japan will get Aus Domestic fleet for short haul around there. As these planes are already depreciated the return on capital for this new LCC venture should be ok as the capital base is lower.

2. New neos and other short haul airlines will come into QFd which is fantastically good on the return on captial and take the cost of new airlines and depreciation hits.

3. They rationalise their QFi routes so that they're just flying the profitable routes and improve return on captial.

4. All of the above will result in QF as a whole having a good return on capital.

Above is how I'd interpret the information and would make the most sense for me from a financial/tax/strategy perspective.

More and more USA airlines are doing this - it seems that unless a VLA, widebodies are not as popular as they once were.

I am still scratching my head as to how you can have a premium carrier without wide bodied aircraft? A 4hr flight in a 320 is not my idea of fun.

This strategy would make more sense if they had Qantas Asia flights from asia to europe, as well as intra-asia flights.

In which the choice of a320s seems even more puzzling. A330s are the better aircraft or flying between AUS and Asia, and probably would not be too difficult to fill up intra-Asia, given the size of the market there.

Furthest I have ever flown in Economy on AA was DFW-ONT, 2 hour flight, ~9pm, S80 - 10B Aisle seat with no seat companion. I slept.You've flown on a premium airline in the US sefty??? (please don't say AA - the back of their buses are not premium)

AFF Supporters can remove this and all advertisements

The article is just not written well.

Basically:

1. J* Japan will get Aus Domestic fleet for short haul around there. As these planes are already depreciated the return on capital for this new LCC venture should be ok as the capital base is lower.

2. New neos and other short haul airlines will come into QFd which is fantastically good on the return on captial and take the cost of new airlines and depreciation hits.

3. They rationalise their QFi routes so that they're just flying the profitable routes and improve return on captial.

4. All of the above will result in QF as a whole having a good return on capital.

Above is how I'd interpret the information and would make the most sense for me from a financial/tax/strategy perspective.

“The first of the A320s will be allocated to the new Jetstar Japan venture between the Qantas Group, Japan Airlines and Mitsubishi. We are using the Qantas Group’s scale in the aircraft purchasing market to establish this exciting new airline. Financial management of the fleet will rest with Jetstar Japan and will be funded independently of the Group’s balance sheet.

“The remainder of the A320 order will go to other new ventures, including Qantas’ premium airline serving the Australia-Asia market, and to renewing Jetstar’s global fleet – giving us the flexibility to meet growth requirements where needed.

The airline will launch with an initial fleet of three new Airbus A320 aircraft, configured for 180 customers in a single class, growing to 24 aircraft within its first few years. Total capitalization commitment for the new airline is up to ¥12 billion