You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Superannuation Discussion + market volatility

- Thread starter JohnK

- Start date

OATEK

Senior Member

- Joined

- Apr 12, 2013

- Posts

- 5,784

I contributed max for the last 10years of full time (varied according to rules) and this was a massive help. But also used proceeds of sale of investment property to contribute to MrsOatek, who had a very small balance 10years out from retirement. The main things is to keep up with changes, opportunities as time to contribute runs out.Yes indeed. We are certainly maximizing it now plus put personal contributions in when we sold the home last year.

We did get a nasty surprise one year from ATO because the employer was slow to transfer, so we had 11 contribs one year and 13 the next - putting us over the second year. But the ATO was helpful, we got a letter from the employer (although they didn't say the real reason for delay was cash flow, claimed "error") and ATO agreed to move the extra back to the previous year. We were running within asbout $50 of the limit each year as we juggled the extra contribs, because the SGT can vary as your salary changes.

Happy Dude

Established Member

- Joined

- Oct 13, 2006

- Posts

- 3,260

- Joined

- Jun 20, 2002

- Posts

- 17,861

- Qantas

- LT Gold

- Virgin

- Platinum

No online calculators that I've seen @Happy Dude - this MLC page with it's example and table are a lot easier to understand than the ATO one:

Alternatively, this SuperGuide explanation is good, but no handy calculator: How carry-forward (catch-up) super contributions work | SuperGuide

Alternatively, this SuperGuide explanation is good, but no handy calculator: How carry-forward (catch-up) super contributions work | SuperGuide

- Joined

- Jan 26, 2011

- Posts

- 30,289

- Qantas

- Platinum

- Virgin

- Red

Not quite old enough to use the downsizerDownsizer contributions or just using the personal contributions cap x 2, or both? Excellent strategies

- Joined

- Jun 20, 2002

- Posts

- 17,861

- Qantas

- LT Gold

- Virgin

- Platinum

One should never ask a lady her age  . I didn't think you were - but always easier to put all the alternatives down.

. I didn't think you were - but always easier to put all the alternatives down.

@QF WP - is there a calculator for determining unused amounts over a 5 year period? Or is it just a case of subtracting employer (and personal, if applicable) contributions from the cap for a particular year?

If you have a MyGov account you can see unused Concessional amounts from past years by linking your ATO details.

Caps, limits and tax on super contributions | Australian Taxation Office

Find out the caps and limits on super contributions and how they are taxed.

Happy Dude

Established Member

- Joined

- Oct 13, 2006

- Posts

- 3,260

Thanks @QF WP - so can I catch up on 5 years from this year, ie back to 2016, or only from 2018 onwards?No online calculators that I've seen @Happy Dude - this MLC page with it's example and table are a lot easier to understand than the ATO one:

Alternatively, this SuperGuide explanation is good, but no handy calculator: How carry-forward (catch-up) super contributions work | SuperGuide

- Joined

- Jun 20, 2002

- Posts

- 17,861

- Qantas

- LT Gold

- Virgin

- Platinum

Only from 2018/19 FY, as it says in the MLC article:

2018/19 was the first financial year you could accrue unused cap amounts

If in doubt, seek advice, as you don't want to get it wrong.

2018/19 was the first financial year you could accrue unused cap amounts

If in doubt, seek advice, as you don't want to get it wrong.

Only from 2018/19 FY, as it says in the MLC article:

2018/19 was the first financial year you could accrue unused cap amounts

If in doubt, seek advice, as you don't want to get it wrong.

This lines up with what I see on my myGov account. 2018/19 is the first year to show my contributions for that year and the balance of 25k remaining.

- Joined

- Jan 14, 2013

- Posts

- 6,601

- Qantas

- Qantas Club

- Virgin

- Red

- Oneworld

- Sapphire

- Star Alliance

- Silver

I have found it useful to transfer my employer contributions to mrsandye each year. I will almost certainly go over the cap even then but she wouldn't be close otherwise

- Joined

- Jun 20, 2002

- Posts

- 17,861

- Qantas

- LT Gold

- Virgin

- Platinum

All public offer super funds must offer the option to switch concessional contributions (known as spouse superannuation contribution splitting). Now, it's a different matter whether all their CS staff are properly trained in the knowledge and it's application.

It's a great way to re-balance the inequity in fund balances between spouses and the ATO form is relatively easy to complete. Details explaining the concept are here: Contributions splitting

Before you do anything, seek appropriate advice from a professional.

It's a great way to re-balance the inequity in fund balances between spouses and the ATO form is relatively easy to complete. Details explaining the concept are here: Contributions splitting

Before you do anything, seek appropriate advice from a professional.

CaptJCool

Established Member

- Joined

- May 31, 2012

- Posts

- 4,646

March 2021 figures now inIn Dec 2016, the first period in which Country of Birth was available

Italy 103,595

Greece 72,494

Dec 2019

Italy 90,394

Greece 67,341

Ref Search

| Italy | 86,978 |

| Iraq | 7,761 |

| Greece | 65,864 |

....with Census 2021 looming to provide updated population figures...

Aged pension recipients numbers as follows;

Sept 2013 2,359,215

June 2014 2,404,902

June 2015 2,486,195

June 2016 2,538,161

Census total over 65 3,676,763 so 69.5% by Sept 2016

Sept 2016 2,556,410

June 2017 2,498,765

June 2018 2,477,861

June 2019 2,533,359

June 2020 2,556,017

Sept 2020 2,568,302

Ref DSS Payment Demographics

Search

data.gov.au

Dec 2020. 2,581,354

Mar 2021. 2,591,187 64.2%

that’s an extra net 35,000 In a three-quarters of a year out of approx 217,000 turning 66(?) many or their partners still working or ? and with from July 2021 another 6 months added to eligibility age (66.5)

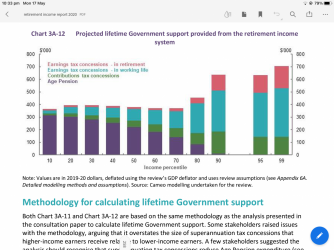

the Retirement Income Review

https://treasury.gov.au/sites/default/files/2019-11/c2019-36292-v2.pdf

shows 80% plus of those over 80 are on age pension, And On the new recipients it’s about 42/100 turning 66

Based on my reading of the net difference, it’s barely 15/100...

If that’s the case, superannuation is biting

and it turns labor voters into scale capitalists. 85% home ownership, tax-free drawdowns..

were one to consider the total “salary package” of an elder Australian (cash, concessions and Freebies like Medicare plus aged care plus PBS heavily subsidised) TOTAL all up spend is ??.?

Spongbob

Established Member

- Joined

- Sep 11, 2011

- Posts

- 1,224

Calculating the total costs of a public policy program is a novel idea.... were one to consider the total “salary package” of an elder Australian (cash, concessions and Freebies like Medicare plus aged care plus PBS heavily subsidised) TOTAL all up spend is ??.?

This should include both the direct costs (outlays and subsidies) and the indirect costs (e.g. forgone revenue).

CaptJCool

Established Member

- Joined

- May 31, 2012

- Posts

- 4,646

Aside the PC.gov.AuCalculating the total costs of a public policy program is a novel idea.

This should include both the direct costs (outlays and subsidies) and the indirect costs (e.g. forgone revenue).

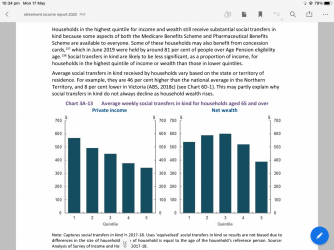

the Retirement income review made a half-baked effort to show it on page 249

this shows the “WEEKLY” in kind support....

this second chart would need the first annualised then split by household size then chucked on top for as many years as one remains alive. ( at current timing, the average length of Age pension payments is a decade.

so for Quintile 1 lowest single household earners

$580 a week x 520 weeks = $301,600 which effectively nearly DOUBLES lifetime support ($360k plus $300k = $660k)

versus $330 x 520 weeks = $171,600 (at 80th total $450k plus $171k = $621k)

Denali

Senior Member

- Joined

- Sep 17, 2012

- Posts

- 6,147

Flashback

Enthusiast

- Joined

- Oct 29, 2006

- Posts

- 13,682

Remember when we had a AFF workgroup on Jobkeeper implementation/processingNow we have Super Stapling to look forward to. Pretty simple for me because I always get a Superchoice form before employee starts as standard doc pack but put it on your radar.

View attachment 251078

Is that a big stapler being done at a rapid pace with extreme skill? That's what I think of, when I see Super Stapling.

- Joined

- Nov 16, 2004

- Posts

- 49,291

- Qantas

- Platinum

- Virgin

- Platinum

- Oneworld

- Emerald

Pretty strait forward - some "interest Groups" trying to indicate that it locks an employee into to the one fund 'for life', but that is incorrect.Remember when we had a AFF workgroup on Jobkeeper implementation/processingNow we have Super Stapling to look forward to. Pretty simple for me because I always get a Superchoice form before employee starts as standard doc pack but put it on your radar.

An employee can change their "stapled" fund if they wish, it just takes it out of the control of the employer.

Become an AFF member!

Join Australian Frequent Flyer (AFF) for free and unlock insider tips, exclusive deals, and global meetups with 65,000+ frequent flyers.AFF members can also access our Frequent Flyer Training courses, and upgrade to Fast-track your way to expert traveller status and unlock even more exclusive discounts!

AFF forum abbreviations

Wondering about Y, J or any of the other abbreviations used on our forum?Check out our guide to common AFF acronyms & abbreviations.

Currently Active Users

- lychees

- SYD

- million_thanas1968

- DejaBrew

- VPS

- Fernanda

- kelvedon

- Nate-Dawg

- markis10

- Rugby

- Peter78

- mrsterryn

- flyingfan

- Pete98765432

- Feebs

- QFFHntrGthr

- Harrison_133

- ricco

- A321

- albyd

- Hawk529

- lazblue

- gxia

- aspro2

- andy2015

- SCM

- mviy

- jswong

- http_x92

- Foz

- asdiojne

- JBDflyer

- bjhearne

- Virgin Bart

- jc123

- Hampton Mike

- Seat0B

- drron

- wentworthmeister

- LiamR

- SOPOOR

- twinaisle

- _TheTraveller_

- kpro

- Triben

- Aussie_flyer

- affal

Total: 1,751 (members: 56, guests: 1,695)