High grade gold is good - but call me a nit-picker when it comes to stating resources and reserves. For those who didn't pick it up - they say, on their front page of their

web site:

The Company has a global JORC Mineral Resource of 3.0 Moz at 9.9 g/t gold, including a Maiden Probable Ore Reserve of 2.7Mt @ 8.0 g/t gold for 690,000oz, making it one of the highest grade gold discoveries in the world.

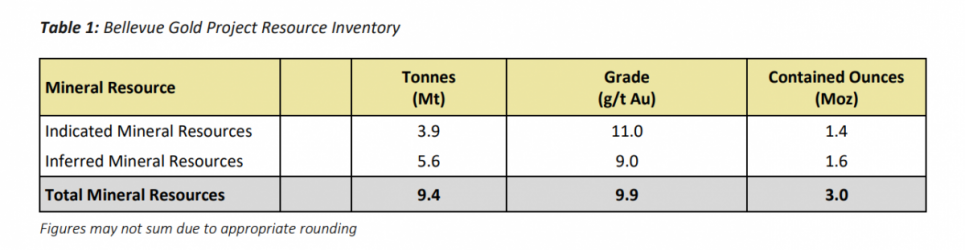

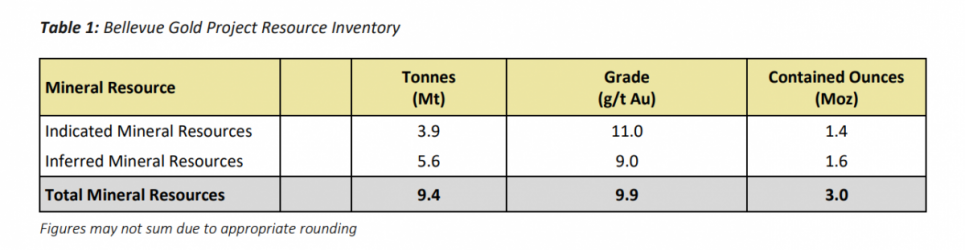

My bolding, which I think is an odd thing to write. Resources and reserves of gold mineralisation are usually (?always) stated in so many tonnes of mineralisation at such-and-such a grade. So, looking at the table published in their 21 July 2021 ASX announcement of upgraded Resource figure:

I would have expected them to write

The Company has a

global total JORC Mineral Resource of 9.4 Mt at 9.9 g/t gold for 3.0 M ozs, including a

Mmaiden Probable Ore Reserve of 2.7Mt @ 8.0 g/t gold for 690,000oz,

making it one of the highest grade gold discoveries in the world., making it one of the higher grade gold discoveries in the past XX years.

3.0 Moz at 9.9 g/t reads to me as: 3.0 mill ozs = 93.3 million grams = 93.3 tonnes. So 93.3 tonnes @ 9.9 g/t = about 300 ozs

I thought the JORC code mandated reporting as tonnes @ grade but on a quick re-read it doesn't actually mandate it, so probably no JORC breach.

But, like I say, I'm a nit-picker (and a JORC 'Competent person' for over 30 years up to about 4 years ago).

Edit: their

Diggers [opens a PDF] presentation is pretty slick!