Daver6

Enthusiast

- Joined

- Dec 31, 2011

- Posts

- 12,229

- Qantas

- Platinum

- Virgin

- Gold

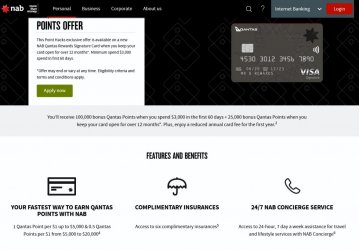

@Daver6 , are you sure about that? T&Cs indicate I should get full 120k w/in 60 days after spend.

tbh, when I first applied, the staggered 100k pts (and then extra if I stuck around one yr) was what I was expecting - and I'd ditch before then - but the fine print makes it look even better.

View attachment 251932

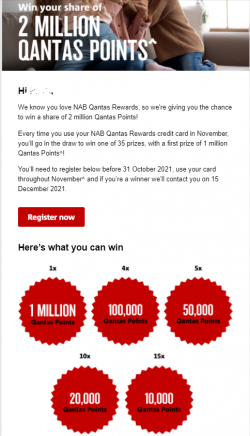

Sorry, I must have been thinking of a different offer. This is what I was thinking of