You can't really rely on the travel insurance of a churned card unless you keep it open for several months while you do the trip, defeating the point of churning.

This is actually a big problem. Even reading the insurance PDSs from AmEx, they do specify that, if you buy something on one card, then you change to another card, then you claim, and your second card does not have the coverage you had with your first card, then you are not covered.

I really don't get this.

why is everyone so desperate to hang on to just one card?

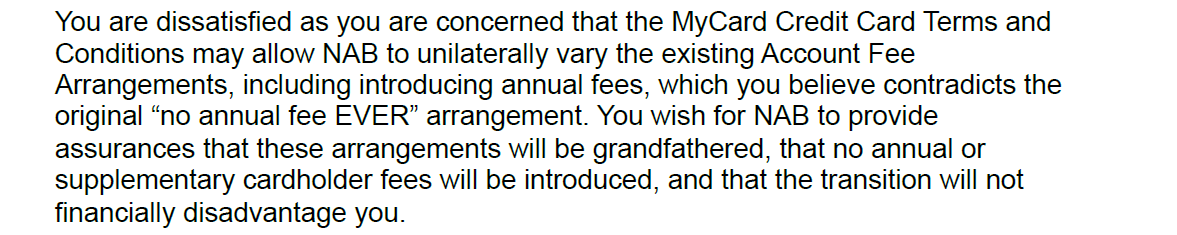

We got it for free for life. You tell us, where can you get a card which is free and give you free Priority Pass access? This itself is free money. Don't you like free money? Then you get VA points, travel insurance.

I have learnt that when you get something which is too good to be true, you don't throw it away. Here are my lessons.

I am currently on an AmEx promo package from decades ago, $400 annual for Reserve + Edge + Gold charge. I get $600 travel credit, yes, AmEx is losing $200 to me every year, and I get access to AmEx lounge at Sydney Airport, I also get Priority Pass access, travel insurance, and $100k rental car insurance. Where can you get all these for $400 a year today? When AmEx offered me the Edge then Gold charge, I didn't have any need for them, I could have ignored the offers, but I didn't, I took them. Imagine if I only thought about churning and didn't take this package up. I give AmEx $400, they give me $600. I'm basically scamming AmEx

Another lesson which I regretted. Diners sent me an unsolicited offer in the mail, for a no annual free Diners. That's a Diners Diners, not Citi Diners. I thought no one takes Diners, useless most of the time, so I didn't take up the offer. What a mistake. Diners included unlimited access to lounges worldwide. Imagine if I had taken up on that offer, I would have had 20 years of free unlimited access to lounges around the world. Who cares if Diners is useless in Australia? This is the mistake I made, only focus on earning points, ignoring other considerations.

Imagine, if RBA cut interchange fees to 0% one day. Point earning cards would charge $1000 annual fees, and earn you 0.0001 VA point per dollar spend. I would still have this free for life card, which may only earn 0.0001 VA point per dollar, but at least, I would not have to pay $1000 annual fee, and I would have travel insurance without having to pay $1000 annual fee.

Hence I have learnt my lessons, if something is too good to be true, take it, don't miss it. You can always throw it away if it turns into rubbish in future; but you cannot take it back if you don't grab it when it's here.

And those who cancel? They have let emotions affected their judgement. Think about it, you are not paying annual fee today, not tomorrow, so why cancel. And why ask NAB, why "poke the bear" (someone described as)? If and when you are asked to pay, you can then make a decision and cancel, but until then, just stay below the radar and keep enjoying the free lounges and etc.

You are already sitting at the casino and enjoying the buffet, no one is asking you to pay extra for sitting here for too long, no one is saying you have been here for too long, why would you get up and leave? Worse, why would you stop the staff and ask them if you have been sitting here for too long? Just keep quiet and keep eating! You can leave when a staff actually stands next to you and ask you to pay.