You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

What's your prediction on the Australian Dollar?

- Thread starter Foreigner

- Start date

Cruiser Elite

Enthusiast

- Joined

- Oct 31, 2010

- Posts

- 14,474

Well the little Aussie battler has broken through .72c barrier - 18mth high - is the sky the limit?

Last edited:

I love to travel

Established Member

- Joined

- Jun 4, 2016

- Posts

- 3,409

- Qantas

- Silver Club

I think you mean .72 but the way it is going you may be right soon!!Well the little Aussie battler has broken through .78c barrier - 18mth high - is the sky the limit?

Cruiser Elite

Enthusiast

- Joined

- Oct 31, 2010

- Posts

- 14,474

Yep my bad - corrected - I was having an argument with our Chinese suppliers at time I typed that -I think you mean .72 but the way it is going you may be right soon!!

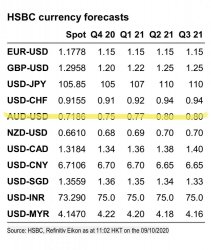

This is not so much AUD strength but USD weakness against most others.

The AUD when viewed on a TWI basis looks very different, slightly stronger not a 8% move.

The current global focus is whether the USD is losing its reserve currency focus due to CV (partly through growing influence of China & control of global supply lines and partly due to -ve impact on US economy. My view - not going to lose reserve currency status as there's too much illegal money involved that does NOT want China to be incontrol of their fortunes (literally & figuratively).

At the moment the glass is half full for world growth, if there was to be an announcement that one of the front-running vaccines was no good after all, then the USD would rebound viciously IMHO.

This article is worth reading for some balance....

www.marketwatch.com

www.marketwatch.com

The AUD when viewed on a TWI basis looks very different, slightly stronger not a 8% move.

The current global focus is whether the USD is losing its reserve currency focus due to CV (partly through growing influence of China & control of global supply lines and partly due to -ve impact on US economy. My view - not going to lose reserve currency status as there's too much illegal money involved that does NOT want China to be incontrol of their fortunes (literally & figuratively).

At the moment the glass is half full for world growth, if there was to be an announcement that one of the front-running vaccines was no good after all, then the USD would rebound viciously IMHO.

This article is worth reading for some balance....

Dr. Osterholm: Americans will be living with the coronavirus for decades

On Jan. 20, just nine days after Chinese health authorities published the DNA sequence for a new coronavirus that was causing concern in China, Dr. Michael...

Sure doesn't especially if a roof springs a leak.Mrscove wants me to buy both pounds and US dollars. That should put a floor under the AUD.

Having homes in other countries isn’t working very well in 2020.

Then having financial clearing houses 'playing the float' delaying the transfer of funds for up to 3 business days despite being a solely electronic process that pre-CV was always same-day value....

Add in a merchant making mistakes & then cancelling the transaction ....

Sometimes what seemed such a great idea.....

wandering_fred

Established Member

- Joined

- Jun 12, 2006

- Posts

- 3,005

- Qantas

- Platinum

- Oneworld

- Emerald

Perhaps foreign currency? The AUD at the moment is not being kind to my USD pension.....Yes Paris, South of France, Germany and Los Angeles are all out of bounds for my family. I can add in Melbourne and Sydney seeing we are in Perth. Getting quite used to going nowhere in 2020 so less need for currency.

Taking risks is wandering

Fred

I love to travel

Established Member

- Joined

- Jun 4, 2016

- Posts

- 3,409

- Qantas

- Silver Club

.7214 tonight hard to believe it went down to 55c in March

Timing - had a large USD cc charge go through yesterday - they timed it perfectly - got the low of the day!.7214 tonight hard to believe it went down to 55c in March

AUD always goes up the stairs & down the fire pole.

From Australian perspective - we see how bad things are done here.

From Rest of World perspective - they don't & but see how bad things are in their country.

Eventually both views mesh on AUD - but as the saying goes, "Being correct too early is indistguishable from being wrong."

Quick poll: How many people expect the world will experience a recession that lasts at least 9 months or more?

In that environment we may see AUD/USD = < 0.5000 at the extreme.

Currently - one explanantion for AUD resurgence was intially due to our (apparent) success with CV, then the unexpected Chinese iron ore demand seeing prices surge > $100 (vs forecasts of $55), and now as everyone knows - you buy AUD when the gold price rallies.

Yes that is the recommendation by the bulge bracket firms in Europe & the US. At the moment the gold price is getting way more airtime overseas than our CV cases. Currently the ratio (yesterday in am Asia & am Europe was 43:1. In late US it dropped to 8:1. Have a look at when the AUD/USD highs happened...

Good example - In October 1987 when the share markets collapsed, the Australian market was close to the worst performer (dropped approx 20% more than US for example). Locals expected the AUD to get smashed, but it barely moved despite globally every talking head saying we're headed for the next Great Depression. So falling world growth = plumetting AUD.

But it didn't.

AUD even gained for 2 weeks (not that much but a bit).

Then one night one large German fund manager dumped their entire Australian Dollar Govt Bond holding & sold the corresponding amount of the AUD. I went to bed that night with 10 yr bond rates arund 12.7% and got a call at 2 in the morning offered $100m at 14.55% (a drop in value of just over 10%), the AUD had dropped around 4 cents I think it was.

Over the next weeks the local talking heads all tried to explain:

- Why it had happened

- Why they missed it

- What was next

The reason that he waited roughly 2 weeks?

Australian bonds & FX were a tiny proportion of what he managed (2% or so). From his perspective he focused on the issues with the other 90+% before turning to his relatively tiny AUD holdings. As he so suavely said, I do not wish to insult you but I had almost forgotten we owned them - the problems with our share holdings what was happening with the USD occupied my mind almost constantly for at least the ten days after the crash.

From the Australian perspective - what he did to the AUD & Australian interest rates hit 75%+ of our portfolio investments (equities, cash, bonds, FX hedges) as well as the relativities for international equities & bonds.

Once he started the move in AUD bond rates & the currency - other overseas fund managers (the fleet of foot ones) started to cut their holding but between transactions the yields moved as much as 0.25% (1.5% loss of bond value) with less than $200m being traded over the phone.

Think of it like the airport arrivals hall in reverse - you come down a corridor to see it widen out suddenly to 50+ counters/auto gates. For the overseas fund managers selling in their timezone when Australia is shut - there were only really 4 or 5 intermediaries who operated 24/5. Of those only 3 would transact in $200m a night IN TOTAL. If they bought or sold a large amount, they would instantly (sometimes at the same time via a colleague sitting next to them) try to offset with another one of the 4 or 5.

Not much has changed 30+ years on, except the volumes of Aust Govt debt are 10x the size now. Meanwhile the dealing limits for these intermediaries have virtually not changed - VAR or Value at Risk limits as a % of capital have declined massively.

So, who knows when but if the world's attention moves from Gold to the looming (IMHO) global recession & begins to get more suspicious about if not when a vaccine may appear - you could wake up and find the AUD 20-30 cents/USD lower.

Or not.

I love to travel

Established Member

- Joined

- Jun 4, 2016

- Posts

- 3,409

- Qantas

- Silver Club

Over 74c now. I remember during GFC AUD kept rising and stock market fell. At times felt like it was in sync, if one side went up the other always went down. I do wonder whether we are heading for a repeat.

defurax

Established Member

- Joined

- Jun 27, 2012

- Posts

- 3,198

- Qantas

- Platinum 1

I would think the RBA hinting last week that they are ready to cut rates again to support the economy will keep the AUD lower.

TheRealTMA

Senior Member

- Joined

- Jul 13, 2012

- Posts

- 8,402

- Qantas

- Platinum

It’s just a shell game making money for currency traders, IMHO.

TheRealTMA

Senior Member

- Joined

- Jul 13, 2012

- Posts

- 8,402

- Qantas

- Platinum

What’s the point in cutting rates any further? Can someone explain the madness?I would think the RBA hinting last week that they are ready to cut rates again to support the economy will keep the AUD lower.

ethernet

Established Member

- Joined

- Aug 10, 2006

- Posts

- 1,100

Um, tracking CAD as well. I expect the AUD to track CNY, little if any change - held down by trade retaliation . The smart money would move to Yen, as I think the US printing QE4, QE5 etc wont save a record breaking stock bull market. I am buying PMGOLD when I see desperate attempts to drive it under usd1800. I foresee a covid vaccine with 60% of effectiveness, which will mean restrictions have to stay. None of the borrowing damage seems to have been factored in, set against other USD loan defaulters. Italy and Spain are weak.

defurax

Established Member

- Joined

- Jun 27, 2012

- Posts

- 3,198

- Qantas

- Platinum 1

I've long given up on trying to understand the real impact of new "unconventional" monetary policy tools of QE and negative rates, but here's the quote from Lowe:What’s the point in cutting rates any further? Can someone explain the madness?

“When the pandemic was at its worst and there were severe restrictions on activity, we judged that there was little to be gained from further monetary easing,” he said.

“As the economy opens up, though, it is reasonable to expect that further monetary easing would get more traction than was the case earlier.”

TheRealTMA

Senior Member

- Joined

- Jul 13, 2012

- Posts

- 8,402

- Qantas

- Platinum

Yes but that’s with a grain of salt.I've long given up on trying to understand the real impact of new "unconventional" monetary policy tools of QE and negative rates, but here's the quote from Lowe:

“When the pandemic was at its worst and there were severe restrictions on activity, we judged that there was little to be gained from further monetary easing,” he said.

“As the economy opens up, though, it is reasonable to expect that further monetary easing would get more traction than was the case earlier.”

SydneySwan

Established Member

- Joined

- Jan 12, 2014

- Posts

- 4,259

- Qantas

- LT Silver

- Virgin

- Red

In my experience currencies always travel in the opposite direction to where I want them to go. Currencies I sell always immediately rise. Currencies I buy always drop. It is best not to worry about it too much.

Become an AFF member!

Join Australian Frequent Flyer (AFF) for free and unlock insider tips, exclusive deals, and global meetups with 65,000+ frequent flyers.AFF members can also access our Frequent Flyer Training courses, and upgrade to Fast-track your way to expert traveller status and unlock even more exclusive discounts!

AFF forum abbreviations

Wondering about Y, J or any of the other abbreviations used on our forum?Check out our guide to common AFF acronyms & abbreviations.

Currently Active Users

- ols

- tgh

- Invisible Monkey

- JohnM

- AIRwin

- Brucetiki

- sudoer

- Shaggy

- SYD

- Harrison_133

- LionKing

- SJF211

- WilsonM

- Falcs

- tomlee1986

- bcworld

- XavierP

- Layslow

- pauldab

- jase05

- N0mad

- http_x92

- eric2011

- chrispy3276

- Phillippe M

- Rhirhi

- acestooge

- Peter78

- bobbinbrisco

- MEL_Traveller

- Steady

- Nate-Dawg

- Hunter4vr

- muppet

- burmans

- simmomelb

- jswong

- ausfox

- jabba

- offshore171

- Flyfrequently

- flyguy77

- defurax

- ABC

- MELso

- Stanley Lambchop

- stu961

- austgap

- Lux

- bluecoconut

Total: 1,560 (members: 76, guests: 1,484)