You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Superannuation Discussion + market volatility

- Thread starter JohnK

- Start date

OATEK

Senior Member

- Joined

- Apr 12, 2013

- Posts

- 5,778

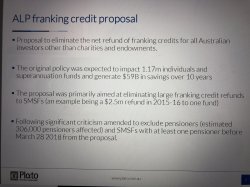

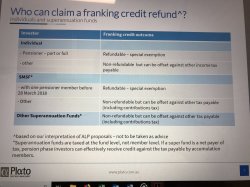

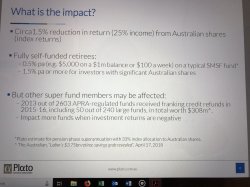

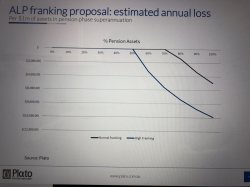

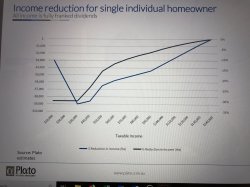

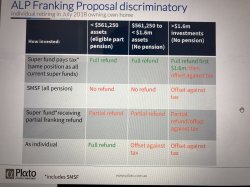

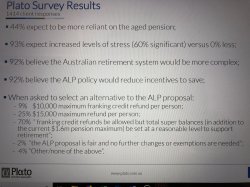

The link provided by QFWP argues that "about 33% of cash refunds go to individuals, 60% to SMSFs (mostly in pension phase) and 7% to APRA regulated funds". I assume that the individuals affected may be SFRs or just those with incomes below the tax free threshhold.Well, I'm confused, as are many others I speak to. So, which type of funds are actually going to be affected?

I thought it wasn't all SFRs in general, just those getting a cash tax refund for tax that has not actually been paid, a scheme that came in in 2001 and which is stated to cost $100m a week.

Some clarification will be coming soon I'm sure once we get an election date and will find out some more during the govt's 10 days of sitting in 8 months.

- Joined

- Jun 20, 2002

- Posts

- 17,851

- Qantas

- LT Gold

- Virgin

- Platinum

- Joined

- Jun 20, 2002

- Posts

- 17,851

- Qantas

- LT Gold

- Virgin

- Platinum

- Joined

- Jan 26, 2011

- Posts

- 30,165

- Qantas

- Platinum

- Virgin

- Red

So an SMSF with one person on the pension by 28 March will receive the IC, except - subject to provisions?

- Joined

- Jun 20, 2002

- Posts

- 17,851

- Qantas

- LT Gold

- Virgin

- Platinum

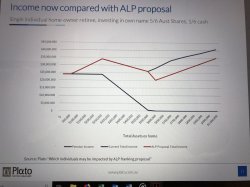

For those interested, particularly SYD-based AFF'ers:

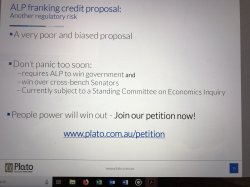

Plato appears at Franking Credit Inquiry

Plato Investment Management’s Managing Director Dr Don Hamson and Senior Portfolio Manager Dr Peter Gardner will be appearing at the Standing Committee for Economics Inquiry into the implications of removing refundable franking credits on February 8th at the Bondi Junction RSL (1/9 Gray St) at 1.30pm. As this is a public hearing, interested parties are welcome to attend and may also be able to make public statements from 2pm.

There is a further public hearing being held at Chatswood Club, Chatswood at 9am on February 8th.

Plato has provided a detailed submission to the Inquiry.

Time and Date

February 8th at 1:30pm

Location

Bondi Junction RSL - 1/9 Gray St, Bondi Junction NSW 2022

Plato appears at Franking Credit Inquiry

Plato Investment Management’s Managing Director Dr Don Hamson and Senior Portfolio Manager Dr Peter Gardner will be appearing at the Standing Committee for Economics Inquiry into the implications of removing refundable franking credits on February 8th at the Bondi Junction RSL (1/9 Gray St) at 1.30pm. As this is a public hearing, interested parties are welcome to attend and may also be able to make public statements from 2pm.

There is a further public hearing being held at Chatswood Club, Chatswood at 9am on February 8th.

Plato has provided a detailed submission to the Inquiry.

Time and Date

February 8th at 1:30pm

Location

Bondi Junction RSL - 1/9 Gray St, Bondi Junction NSW 2022

I love to travel

Established Member

- Joined

- Jun 4, 2016

- Posts

- 3,360

- Qantas

- Silver Club

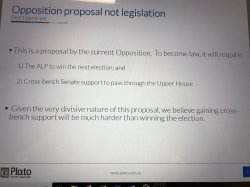

Is cross bench support also required for proposed negative gearing changes? Will Labour get it?

- Joined

- Jun 20, 2002

- Posts

- 17,851

- Qantas

- LT Gold

- Virgin

- Platinum

Will depend on both the make-up of the Lower House and Senate cross benches, assuming they win the election. Nothing surer than there will be some changes before they even get to table any Bill (pun intended)

The current opposition want to raise about $200 billion off the 50% of the population who pay a net amount of tax. That is a ridiculous amount and needs to be stopped before they start their spendathon with your money. The last lot of idiots did us for about $500 billion and this lot are just as stupid.

- Joined

- Jan 26, 2011

- Posts

- 30,165

- Qantas

- Platinum

- Virgin

- Red

The current opposition want to raise about $200 billion off the 50% of the population who pay a net amount of tax. That is a ridiculous amount and needs to be stopped before they start their spendathon with your money. The last lot of idiots did us for about $500 billion and this lot are just as stupid.

Well, people who get capital gains are very rich cove.

love_the_life

Senior Member

- Joined

- Dec 21, 2012

- Posts

- 5,838

- Qantas

- LT Gold

Very much depends on your political persuasion. Not getting involved.The current opposition want to raise about $200 billion off the 50% of the population who pay a net amount of tax. That is a ridiculous amount and needs to be stopped before they start their spendathon with your money. The last lot of idiots did us for about $500 billion and this lot are just as stupid.

- Joined

- Jun 20, 2002

- Posts

- 17,851

- Qantas

- LT Gold

- Virgin

- Platinum

Yes, best this thread doesn't go off topic an into a political dissertation. We want to stick to the subject matter

JohnK

Veteran Member

- Joined

- Mar 22, 2005

- Posts

- 44,436

And don't have any debt and are ready to retire now.Well, people who get capital gains are very rich cove.

I would think it would be harder now. Bell Potter has Bell Direct as their no advice internet broker.

I looked up Cromwell and their quarterly distributions are unfranked but you have to believe commercial property is not going to fall like residential property.

I looked up Cromwell and their quarterly distributions are unfranked but you have to believe commercial property is not going to fall like residential property.

RB

Established Member

- Joined

- Nov 17, 2004

- Posts

- 4,559

Rather a sweeping statement? Isn't it possible to have a capital gain on one transaction that is a small part of an overall nest egg?Well, people who get capital gains are very rich cove.

Become an AFF member!

Join Australian Frequent Flyer (AFF) for free and unlock insider tips, exclusive deals, and global meetups with 65,000+ frequent flyers.AFF members can also access our Frequent Flyer Training courses, and upgrade to Fast-track your way to expert traveller status and unlock even more exclusive discounts!

AFF forum abbreviations

Wondering about Y, J or any of the other abbreviations used on our forum?Check out our guide to common AFF acronyms & abbreviations.

Currently Active Users

- RooFlyer

- Jenya

- torks

- Hunter4vr

- OZDUCK

- ShelleyB

- PointsDude

- JBone

- ben95

- Virgin Bart

- Happy Dude

- mhen

- Wanderlust_tim

- JohnM

- Human

- SJF211

- jase05

- Up in the clouds

- r21111

- drron

- equus

- Beer_budget

- Le_Champion

- TheRealTMA

- ADLhighflyer

- Harrison_133

- bablong

- Harry Laumets

- MELso

- Pele

- XavierP

- markis10

- simong

- dh3mike

- acestooge

- dajop

- blackcat20

- Anthology

- kpc

- DejaBrew

- Pete98765432

- Rich

- Austman

- larry40

- suprnova

- Flyfrequently

- Thomas088

- MEL_Traveller

- fkn_ace

- Hawk529

Total: 2,427 (members: 64, guests: 2,363)