CaptJCool

Established Member

- Joined

- May 31, 2012

- Posts

- 4,619

Is it true that withdrawals from these defined benefit funds are liable to income tax when in pension phase?

As one of the recipients of the wonderful CSS Federal Govt scheme, and havin now left the office at 54/11 by taking a year of unused leave and 3 months of ‘unemployment’, to ‘declare retirement’ (There’s a tick box on the form) I can safely advise you my tax obligation from 55 (currently under preservation age) is $615 per week.

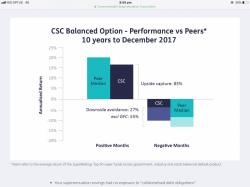

The fund has this interesting chart about the fund policy. Also, CSS members bear only a couple of the 6 charges for fees (0.8% of balance annual fee) and insurances. (Employers pay the others)

Surprisingly, the fund does not invest in Amazon nor Atlassian for that matter

Well the recent volatility saw me seriously contemplate switching from default investment to cash at end of September, I didn’t but did at end of October. October losses (2%) wiped out July August earnings. I didn’t cop November nor December losses (3%) and still lost some of my own money. Since July, I earnt pocket change.

with the way the formula works, and now beginning pension mode, I can catch up the October losses via CPI adjustment within 6 months (I think) AND I no longer need worry about the volatility of the share market.

So the result

I’m am extremely fortunate to be netting $34 per week more than my last full pay in September 2018. And had it not been for the 2% October loss another $20-40 a week roughly. While I gross $15k less than when working, tax has dropped as it’s less becaise of the taxfree component. And of course no 5% post tax contribution so the NET is slightly more. so finishing up now gives time and money to do what pleases including all the Australian Test matches

I was surprised my initial tax-free component (there are 3 parts, previously discussed) is under 10% of the total package. Sighs. By age 60, I would expect tax to further reduce by around A Melbourne LHR QF discount First class airfare , (or around 180 per week). However by then official child support will be long gone (that had been $250 a week), and mortgage near zero balance. Happy days

For some time I had mulled over finishing up early, and I am content that I did. And Santa delivered a perfect Christmas present !

May I note; I found the last decade of working fulfilling and enjoyable and was doing tasks I quite loved. The last year was cleaning up a lot of stuff others had neglected. Logistics and government don’t go well together so people just kept adding and adding without “seeing the bigger picture”. Patchwork at its finest.

However, the opportunity of salary replacement for life was too good a deal to forego. I could never under age retirement make the same amount ever. (Unless made redundant down the track, which relied on someone else’s whim). And I departed on a good note as my last major body of work was a stellar piece. A team effort had a great graphic designer and subject experts to assist. My DC and ACs were very appreciative.

Super. The gift that keeps giving.

For me @Radio8tiv the magic number would be where I get just $1 of Centrelink money as this would give me all the associated concessions. In years to come this is where I intend to be.

You may recall the earlier convo about Accounting Income and Taxable Income

A friend of mine alerted me to this.

He doesn’t qualify for age pension as Super is part of the age pension accounting Income. (Under $45k singles and $77k partnered gives you thst magical $1 of age pension.

BUT since most of his super isn’t in taxable income, he qualifies for a health care card.

the Government view isfor those over 67 via Super to permanently defer age pension or delay it until they’re over 80, or later. 13 years of non claiming still saves Comm budget nearly $450,000 per couple in today’s money.

So for some on income streams, they may exhaust the capital value and then qualify. There’s a handy calculator on the PSSAp website PSSap Retirement modeller. Project how long your super will last. And that’s where the Age Pension becomes a safety net (and you can include it in the modeller).