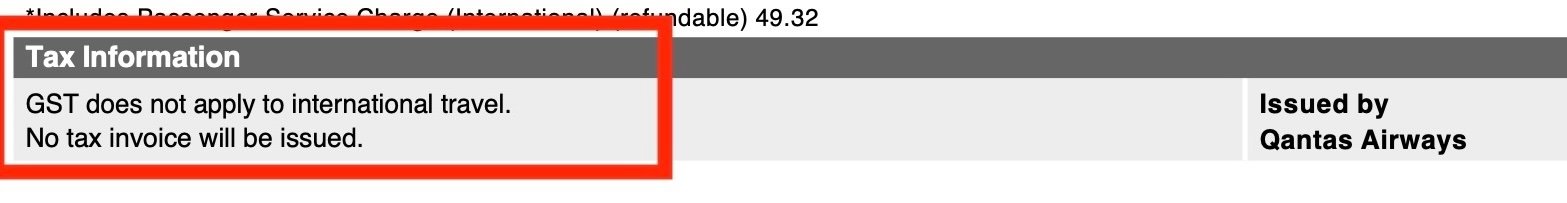

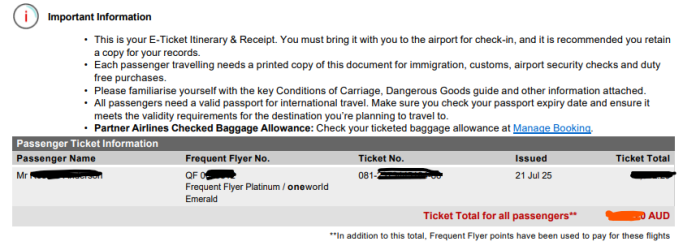

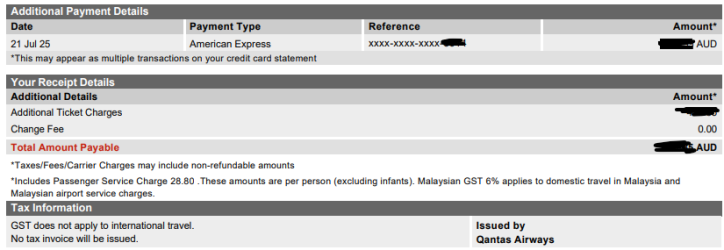

Has Qantas changed the information they provide for award bookings. I booked an award today with Qantas for flights on Emirates, the confirmation came in ok. But the attached document was an "Itinerary Receipt". There was no receipt included for the $1500 in +++!!!!

This is rather annoying as reimbursement options are open to me for that co-pay, but not without a tax invoice/receipt.

Booking appears with Sri Lankan and have used Emirates to select seats already. Seems to be confirmed.

My previous award booking was in November 2024 and that had a tax invoice that showed the cash component.

I plan to call tomorrow, but asking in case there has been some kind of change.

This is rather annoying as reimbursement options are open to me for that co-pay, but not without a tax invoice/receipt.

Booking appears with Sri Lankan and have used Emirates to select seats already. Seems to be confirmed.

My previous award booking was in November 2024 and that had a tax invoice that showed the cash component.

I plan to call tomorrow, but asking in case there has been some kind of change.