- Joined

- Aug 21, 2011

- Posts

- 16,684

- Qantas

- Platinum

- Virgin

- Platinum

- Star Alliance

- Gold

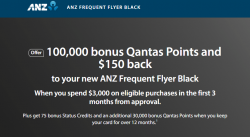

It looks like ANZ released a new offer on its Frequent Flyer Black credit card at the beginning of this month.

The offer is now 100,000 bonus Qantas points, 75 status credits and $150 cash back in the first year if you spend at least $3,000 in 3 months. Renew for a second year to get an additional 30,000 Qantas points.

Interesting to see another card offering status credits as part of the sign-up bonus.

www.anz.com.au

www.anz.com.au

The offer is now 100,000 bonus Qantas points, 75 status credits and $150 cash back in the first year if you spend at least $3,000 in 3 months. Renew for a second year to get an additional 30,000 Qantas points.

Interesting to see another card offering status credits as part of the sign-up bonus.

ANZ Frequent Flyer Black

Earn Qantas Points at our highest earn rate with ANZ Frequent Flyer Black credit card. Plus, check out our Qantas Points offer for new cardholders. Learn more.