Scarlett

Established Member

- Joined

- Jun 27, 2011

- Posts

- 2,044

- Qantas

- LT Gold

- Virgin

- Platinum

Genuine question.

I'm not an economist and suggest I know as much about national finance and the economy as the average person, ie: when I hear anything about 'macro economic reform' I just really hear 'blah, blah, blah, it's definitely not a Ponzi scheme, blah, blah..'.

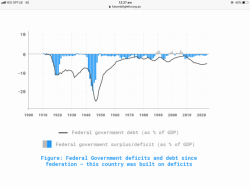

But I've been wondering how we're going to pay back the hundreds of billions that are being magicked up by the nations leaders (of all political persuasions - I'm not interested in a political discussion), seemingly out of thin air? (we're increasing national debt - I get that much)

So how are we going to pay it back? Anything like:

- GST rise for a temporary period (say 15 or 20% rate for the next 5 years?)

- A % cut to all Federal public sector wages/salaries (10-20% cut?)

- A 'haircut' of some amount from all bank accounts in the country over say $100K?

- Reduction in the size of pension payments?

- Simply printing it all and wearing the inflationary pressure? (do those words even make sense)

- All of the above?

- None of the above. Do nothing? (what's the practical difference between a national debt of $100 billion and $500 billion?)

Do we even 'pay it back' in the regular household sense?

Lots of questions, sorry, but genuinely interested in the thoughts of those who follow or understand such things.

I'm not an economist and suggest I know as much about national finance and the economy as the average person, ie: when I hear anything about 'macro economic reform' I just really hear 'blah, blah, blah, it's definitely not a Ponzi scheme, blah, blah..'.

But I've been wondering how we're going to pay back the hundreds of billions that are being magicked up by the nations leaders (of all political persuasions - I'm not interested in a political discussion), seemingly out of thin air? (we're increasing national debt - I get that much)

So how are we going to pay it back? Anything like:

- GST rise for a temporary period (say 15 or 20% rate for the next 5 years?)

- A % cut to all Federal public sector wages/salaries (10-20% cut?)

- A 'haircut' of some amount from all bank accounts in the country over say $100K?

- Reduction in the size of pension payments?

- Simply printing it all and wearing the inflationary pressure? (do those words even make sense)

- All of the above?

- None of the above. Do nothing? (what's the practical difference between a national debt of $100 billion and $500 billion?)

Do we even 'pay it back' in the regular household sense?

Lots of questions, sorry, but genuinely interested in the thoughts of those who follow or understand such things.