You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Best Annual Multi-Trip Travel Insurance in the new COVID World?

- Thread starter RSD

- Start date

-

- Tags

- covid-19 travel insurance

Read our AFF credit card guides and start earning more points now.

AFF Supporters can remove this and all advertisements

JohnK

Veteran Member

- Joined

- Mar 22, 2005

- Posts

- 44,447

I purchased SCTI policy for myself and daughter last night. Wife is Thai and has full insurance in Thailand so no need for separate travel insurance.

I declared type 2 diabetes plus cholesterol but decided to leave $100 excess and premium was ~$475 less 12% cashback from CashRewards so happy with result.

I declared type 2 diabetes plus cholesterol but decided to leave $100 excess and premium was ~$475 less 12% cashback from CashRewards so happy with result.

eastwest101

Established Member

- Joined

- Oct 26, 2010

- Posts

- 3,456

- Qantas

- Gold

- Virgin

- Silver

So bit of a noob question, I was shopping around for a domestic multi trip annual policy, mostly flying around domestically within Australia. Here is an example I plucked from the Cover-More (underwriter Allianz).

For me its lots of flying around with the only real benefit I want is an airline cancellation/rescheduling event that misconnects me and leaves me stranded overnight in a random Australian town somewhere and costs of rebooking flights if necessary.

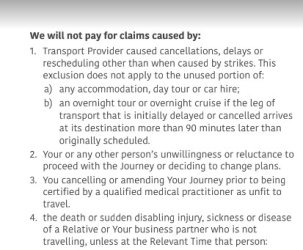

Here is an extract of the PDS:

So basically - this policy is junk right? If an airline cancels/reschedules you into a misconnection situation nothing is covered right?

Examples being A-B on Airline X then B-C flying airline Y in the situation when Airline X reschedules to arrive missing flights of airline Y.

I do a lot of flights where you can't ticket on one PNR/itenarary eg: Qatas to Rex, or Virgin to Rex or vice versa.

For me its lots of flying around with the only real benefit I want is an airline cancellation/rescheduling event that misconnects me and leaves me stranded overnight in a random Australian town somewhere and costs of rebooking flights if necessary.

Here is an extract of the PDS:

So basically - this policy is junk right? If an airline cancels/reschedules you into a misconnection situation nothing is covered right?

Examples being A-B on Airline X then B-C flying airline Y in the situation when Airline X reschedules to arrive missing flights of airline Y.

I do a lot of flights where you can't ticket on one PNR/itenarary eg: Qatas to Rex, or Virgin to Rex or vice versa.

RooFlyer

Veteran Member

- Joined

- Nov 12, 2012

- Posts

- 31,782

- Qantas

- Platinum

- Virgin

- Gold

- Star Alliance

- Gold

COTA insurance was great after a bit of hiccup at first

So I'm looking at multis now - I have 5 O/S trips planned in the next 10 months. Turns out COTA is the same as NIB that I usually look at!

VPS

Enthusiast

- Joined

- Apr 2, 2011

- Posts

- 10,690

- Qantas

- LT Gold

- Virgin

- Gold

yes but for some reason COTA insurance was cheaper than NIB - go figureSo I'm looking at multis now - I have 5 O/S trips planned in the next 10 months. Turns out COTA is the same as NIB that I usually look at!

ellen10

Established Member

- Joined

- Jul 18, 2008

- Posts

- 3,801

Trying to sort out our travel insurance policy for next year to Europe. This will be a single policy (I know this thread says annual, but there has been lots of good information for both). We have paid a substantial amount up front so I need a good cancelation amount included.

If you read the product reviews you would be worried to take out any policy. My TA does Covermore (really bad reviews and NIB ( which is the same as COTA?)

I have used SCTI before, although I didn't have to claim, ( I think @drron recommended it?). Also TID and InsureandGo.

I have only ever had to claim once in all our travels, that was with InsureandGo, eventually got my claim paid but lots of back and forward and fortunately we had transcripts from agents.

We are not so young anymore so I am more cautious.

If you read the product reviews you would be worried to take out any policy. My TA does Covermore (really bad reviews and NIB ( which is the same as COTA?)

I have used SCTI before, although I didn't have to claim, ( I think @drron recommended it?). Also TID and InsureandGo.

I have only ever had to claim once in all our travels, that was with InsureandGo, eventually got my claim paid but lots of back and forward and fortunately we had transcripts from agents.

We are not so young anymore so I am more cautious.

RooFlyer

Veteran Member

- Joined

- Nov 12, 2012

- Posts

- 31,782

- Qantas

- Platinum

- Virgin

- Gold

- Star Alliance

- Gold

Have just taken out a NIB annual multi-trip, non USA & Nepal, through my TA, who also quoted Covermore.

Covermore pay-outs are a bit higher and I was tempted, but the premium cost (incl cruises) is almost double the NIB premium. I used to always take Covermore, but went NIB last time after a careful comparison; NIB a little more generous with existing medical conditions and automatically covers cruises (which I think is odd), while with Covermore you select it as an option

For me, the difference was quite small.

Covermore pay-outs are a bit higher and I was tempted, but the premium cost (incl cruises) is almost double the NIB premium. I used to always take Covermore, but went NIB last time after a careful comparison; NIB a little more generous with existing medical conditions and automatically covers cruises (which I think is odd), while with Covermore you select it as an option

yes but for some reason COTA insurance was cheaper than NIB - go figure

For me, the difference was quite small.

ellen10

Established Member

- Joined

- Jul 18, 2008

- Posts

- 3,801

Thanks for your reply @RooFlyer. The travel agent has given me a good discount. So I have decided to go with Covermore, which is cheaper than NIB, but not cheaper than SCTI. She is a local travel agent and said that she has used Covermore for the last 20 years with no problems for clients claiming.

She also said that if there are problems whilst overseas and with claims she would attend to all the paperwork and details.

Certainly premiums have increased since our last big overseas trip in late 2019.

And I am more wary as I have a friend who was on a cruise in south America, had to get off the ship in Mexico, has had an operation and still can't fly home yet. Navigating all the travel insurance details is quite the nightmare.

So I am purchasing it through the TA.

She also said that if there are problems whilst overseas and with claims she would attend to all the paperwork and details.

Certainly premiums have increased since our last big overseas trip in late 2019.

And I am more wary as I have a friend who was on a cruise in south America, had to get off the ship in Mexico, has had an operation and still can't fly home yet. Navigating all the travel insurance details is quite the nightmare.

So I am purchasing it through the TA.

whole-lotta-moxie

Member

- Joined

- Oct 14, 2013

- Posts

- 364

I know this is going to sound very morbid but ...... does anyone know if there are any policies that would cover you if you needed to get home in a hurry if something happens to a close relative?

I have looked at various policies and your relative can not be older than 85.

These are the PDS that i looked at:

Southern Cross

Go Insurance

Allianz

Covermore - void if they have been in hospital in the last 12 mths

Any ideas?

I have looked at various policies and your relative can not be older than 85.

These are the PDS that i looked at:

Southern Cross

Go Insurance

Allianz

Covermore - void if they have been in hospital in the last 12 mths

Any ideas?

VPS

Enthusiast

- Joined

- Apr 2, 2011

- Posts

- 10,690

- Qantas

- LT Gold

- Virgin

- Gold

To be honest I think you'll struggle to find anyone that covers a relative over 85 but good luck if you do and please shareI know this is going to sound very morbid but ...... does anyone know if there are any policies that would cover you if you needed to get home in a hurry if something happens to a close relative?

I have looked at various policies and your relative can not be older than 85.

These are the PDS that i looked at:

Southern Cross

Go Insurance

Allianz

Covermore - void if they have been in hospital in the last 12 mths

Any ideas?

whole-lotta-moxie

Member

- Joined

- Oct 14, 2013

- Posts

- 364

I defiantly will.To be honest I think you'll struggle to find anyone that covers a relative over 85 but good luck if you do and please share

I just made an assumption that if i needed to get home in a hurry and I buy top travel insurance this would be covered and i was surprised that it isn't. I think lots of people might make that assumption too

whole-lotta-moxie

Member

- Joined

- Oct 14, 2013

- Posts

- 364

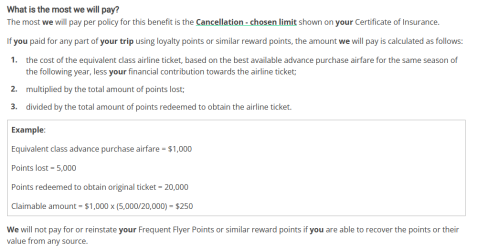

Can anyone please explain this to me?

So i have been doing a deep dive on what is the best insurance for points flights and there seems to be a lot of tricky wording out there. So i have found a couple that have this wording and found an example but I am still confused.

So in this example if i use a biz class flight from Mel to BKK using qantas point

To travel in Nov in Biz = $4,700

Qantas points lost = 68,400

Fees (I think) = $500

How do i work this out?

$4,700 x (68,400/?) - $500 = ?????

NB - some policies don't seem to cover for the same class of travel and will only cap the amount back at $2,500 pp

Lynda2475

Suspended

- Joined

- May 1, 2009

- Posts

- 9,402

- Qantas

- Platinum

- Virgin

- Red

- Oneworld

- Emerald

Prior to departure most flights booked on points are refundable if you cant fly less a small cancellation fee. If the airline refunds your points no need to make a claim.

So for TI when travelling on points flight, Id want assurance that if I am injured and cant return home on the originally booked J flight, that the insurer will fly me home on a replacement flight in the same class my original ticket was in. If that happens who cares about points refund, just get me how in the same comfort level.

So for TI when travelling on points flight, Id want assurance that if I am injured and cant return home on the originally booked J flight, that the insurer will fly me home on a replacement flight in the same class my original ticket was in. If that happens who cares about points refund, just get me how in the same comfort level.

whole-lotta-moxie

Member

- Joined

- Oct 14, 2013

- Posts

- 364

I agree 100% I guess i am just going down a rabbit hole with thisPrior to departure most flights booked on points are refundable if you cant fly less a small cancellation fee. If the airline refunds your points no need to make a claim.

So for TI when travelling on points flight, Id want assurance that if I am injured and cant return home on the originally booked J flight, that the insurer will fly me home on a replacement flight in the same class my original ticket was in. If that happens who cares about points refund, just get me how in the same comfort level.

Happy to get a refund if the trip hasn't started so no need to do a claim

BUT.... will they get me home on a J booking if my travel has started? I just want to get home and some of the wording kind of looks like that you are on your own and they will just refund the points and you have to find your own way home

whole-lotta-moxie

Member

- Joined

- Oct 14, 2013

- Posts

- 364

So for TI when travelling on points flight, Id want assurance that if I am injured and cant return home on the originally booked J flight, that the insurer will fly me home on a replacement flight in the same class my original ticket was in. If that happens who cares about points refund, just get me how in the same comfort level.

So, what companies will give you assurance that they will get you home and on a J or F flight? Or any flight home?

I continue to look into this and it is murky.

I called Allianz and they said they would refund my points but not get me home. They would not be responsible to get me home even if i pay extra for the cancellation supplement because I have been given refunded points. I don't want a points refund i just want to get home. So, the problem still exists, I am sitting in an airport with a cancelled flight and now i have to pay full price for tix (this is all hypothetical, the rabbit hole continues)

What insurance company will get me home for the equivalent flight?

Given that most of us here use frequent flyer points I would assume that this is a key point for all of us.

whole-lotta-moxie

Member

- Joined

- Oct 14, 2013

- Posts

- 364

What clause are we assuming you are using?

Medical? Death of someone at home etc?

The death of someone at home is only if they are under the age of 85 or have not been in hospital in the last 12 months, varies from company to company. Yes, for this scenario

Could be medical. Or any other scenario.

Given how many flights are being cancelled esp by Qantas these days, I wondering what happens if Qantas or any airline then cancel my frequent flyer seats on my flight home? If the airline doesn't have another frequent flyer seat or do not want to help you, will insurance get you home? Allianz won't help? I would be on my own.

I think in terms of airline cancellation, you are on your own.

Most of the others will pay out to the value of what you booked or your points as defined.

They then don’t care what class you book to get home, but if short you fought up and if in excess they won’t pay the extra!

To be honest anything that gets me fixed up and home in an emergency is why I pay for insurance.

Business class is a bonus, and won’t choose my insurance cover based on it.

Most of the others will pay out to the value of what you booked or your points as defined.

They then don’t care what class you book to get home, but if short you fought up and if in excess they won’t pay the extra!

Post automatically merged:

To be honest anything that gets me fixed up and home in an emergency is why I pay for insurance.

Business class is a bonus, and won’t choose my insurance cover based on it.

Become an AFF member!

Join Australian Frequent Flyer (AFF) for free and unlock insider tips, exclusive deals, and global meetups with 65,000+ frequent flyers.AFF members can also access our Frequent Flyer Training courses, and upgrade to Fast-track your way to expert traveller status and unlock even more exclusive discounts!

AFF forum abbreviations

Wondering about Y, J or any of the other abbreviations used on our forum?Check out our guide to common AFF acronyms & abbreviations.

Currently Active Users

- Dmac59

- Cool Cat Phil

- Staph

- asdiojne

- zig

- clarkkent

- metaphase

- diamondhands

- Quickstatus

- Darkpulsar

- csg001

- Austman

- cartz

- funnybrus

- CaptJCool

- angetho663

- MEL_Traveller

- Zinger

- tgh

- Peter78

- riteshshah

- vyralmonkey

- FF98

- IGetAround

- blackcat20

- kelvedon

- Berlin

- hydrabyss

- jeffleecw

- WTV

- justinbrett

- Lux

- MVM

- Dr_Goz

- swellington

- ellen10

- Futureaussie

- JackMiles

- cjd600

- pauly7

- madrooster

- Zanzaid

- Bitten

- Mutilla2

- vmile

- SCM

- Cessna 180

- Chardonnay

- Aeryn

- Becstar101

Total: 5,835 (members: 77, guests: 5,758)