You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Who else still holds the Citibank Free For Life Premier Card?

- Thread starter one9

- Start date

I hope so, but there have been plenty of surprise ‘enhancements’ over the yrsthe letter said in very clear language that fees and charges will remain unchanged.

No.Yeah but will the conversion rates be different(more) ie. Australian Bank rates?

uBank is a division of NAB, and ubank "General terms Effective 1 June 2023" has:

If you use your debit card overseas, or to buy goods or services in a foreign currency, Visa will convert the foreign currency amount into

Australian dollars and we’ll take the Australian dollar amount out of your Spend account. The rate at which the foreign currency is

converted into Australian dollars is determined by Visa.

oz_mark

Enthusiast

- Joined

- Jun 30, 2002

- Posts

- 22,166

It's not the Australian bank rate now. Using the card overseas results in the scheme provider doing the conversion.Yeah but will the conversion rates be different(more) ie. Australian Bank rates?

This card is the gift that keeps on giving - a nice update to the complementary travel insurance effective 1st Nov:

Prior to 1 November the complementary insurance was much more complex to activate, ie, charging the entire cost of a return ticket, transferring points to the program where the booking is made (minimum of 15k citi) etc. Annoyingly for my recent trips transferring points to VFF then eventually on to krisflyer did not satisfy activation - even spending many thousands on travel costs charged to the card.

As for the policy itself its got to be one of the most generous policies around with covid19 well documented/covered. For an upcoming trip to the US i would value this policy at equal or even better than many policies i have been quoted $800-$1000. Its now a really great benefit.

| The eligibility criteria for International Travel Insurance now includes spending at least $500 on any prepaid travel costs (i.e., your travel costs that you pay for before leaving Australia). |

Prior to 1 November the complementary insurance was much more complex to activate, ie, charging the entire cost of a return ticket, transferring points to the program where the booking is made (minimum of 15k citi) etc. Annoyingly for my recent trips transferring points to VFF then eventually on to krisflyer did not satisfy activation - even spending many thousands on travel costs charged to the card.

As for the policy itself its got to be one of the most generous policies around with covid19 well documented/covered. For an upcoming trip to the US i would value this policy at equal or even better than many policies i have been quoted $800-$1000. Its now a really great benefit.

If Nab kills it I'm closing the account.Good spot, hadn’t noticed that. Makes it much more worthwhile. Getting the ‘free for life’ card was one of the best points/card benefits decisions I ever made. I pray NAB don’t kill it.

When you say fee-free international transactions - do you mean it didn't charge the same spread as the underlying Citi card does?Sad indeed. Fee free card, fee free international transactions, earned points. RIP.

MELso

Established Member

- Joined

- Nov 12, 2011

- Posts

- 1,472

- Qantas

- Gold

- Virgin

- Red

- Oneworld

- Sapphire

The Diners spread was slightly worse than the MC/Visa standard rate (probably ~1%), but much, much better than the 3.4% charged when using the Citi MC.When you say fee-free international transactions - do you mean it didn't charge the same spread as the underlying Citi card does?

Given the costs, you've probably already done the sums though, wouldn't a fee-free zero international FX spread card like 28 Degrees be a good replacement?The Diners spread was slightly worse than the MC/Visa standard rate (probably ~1%), but much, much better than the 3.4% charged when using the Citi MC.

I stopped using other cards for international transactions many years back for that reason although I always stock one of each type when going overseas - just in case.

For example, 28 Degrees will OK (normally) a physical overseas transaction (say at a restaurant in Europe) with no trouble but try doing an online Toll pass purchase and then you need to receive a code on an Australian number pre-registered before you leave Australia...

Can be a major nuisance when the mobile provider doesn't allow overseas roaming whilst providing free unlimited overseas calling from Australia to 20+ countries for $25/m plus more data than we've come close to using 1/10th of.

Nuisance increases when you plan ahead and change the number to someone else in Australia who turns out to sleep so soundly their phone does not wake them up....

MELso

Established Member

- Joined

- Nov 12, 2011

- Posts

- 1,472

- Qantas

- Gold

- Virgin

- Red

- Oneworld

- Sapphire

Once NAB gets my Platinum card out and I churn and burn that (and possibly do a churn and burn of their Qantas Platinum card too before the FFFL Citi Premier is migrated - EDIT the Signature card offers 120K but I'm fairly conservative with churns), I'm going to churn either the Coles Rewards Mastercard (currently 50K bonus Flybuys points, so 25K Velocity points but hoping for more from November; $95 annual fee) or the BankWest Qantas card (40K Qantas points; $160 annual fee) next to get a points-earning card which offers fee-free international transactions.Given the costs, you've probably already done the sums though, wouldn't a fee-free zero international FX spread card like 28 Degrees be a good replacement?

I stopped using other cards for international transactions many years back for that reason although I always stock one of each type when going overseas - just in case.

After that, I'll probably go back to the Commbank Smart Rewards card in 12 months time once my exclusion period is up (I churned their Ultimate card last month). Depending on what NAB do with the FFFL Citi Premier card, the Coles Mastercard (for its decent earn rate up to $3k of 1 Velocity point per dollar) or Commbank card (fee free if over $2k spent, no OS fees charged either, and more fully featured, if lower earning) may well become a permanent fixture in my wallet.

In addition, I'll carry my Macquarie Bank debit card and pack my Citi debit card (so that I have a backup - I only keep $1 as a placeholder in my Citi account as MacBank pays 4.5%).

So two credit cards and two debit cards. Should be okay I hope...

Last edited:

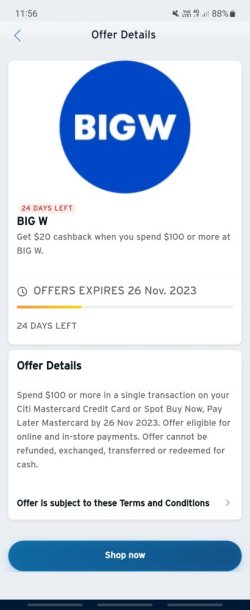

Yes it popped up in my Citi appHello everyone. Anyone here has Cash back offer for BigW on Citi Premier?

Happy Dude

Established Member

- Joined

- Oct 13, 2006

- Posts

- 3,287

I don't have it. Using Amex as a guide, I'd say GC's would trigger the cashback.

I have offers for Special Gift Cards (10% back up to $10), EG fuel ($5 back on $50 spend). Not sure if these can be used more than once.

I have offers for Special Gift Cards (10% back up to $10), EG fuel ($5 back on $50 spend). Not sure if these can be used more than once.

nthd_nthd

Active Member

- Joined

- Oct 29, 2023

- Posts

- 706

Just read the T&C, just once per merchant and paid by the card not thru 3rd party i.e. PayPal.I don't have it. Using Amex as a guide, I'd say GC's would trigger the cashback.

I have offers for Special Gift Cards (10% back up to $10), EG fuel ($5 back on $50 spend). Not sure if these can be used more than once.

AIRwin

Enthusiast

- Joined

- Apr 13, 2013

- Posts

- 13,312

- Qantas

- LT Gold

- Virgin

- Silver

- Oneworld

- Sapphire

$20 cashback just posted for me from a gift card purchase on SundayAnyone here has Cash back offer for BigW on Citi Premier? Spend $100 or more to get $20 back? Just wondering if I can buy GC with this.

MELso

Established Member

- Joined

- Nov 12, 2011

- Posts

- 1,472

- Qantas

- Gold

- Virgin

- Red

- Oneworld

- Sapphire

Yes, also got $20 cash back from buying a Wish card (and 800 QFF points from having my card linked at Qantas shopping)…

EDIT - note also Bonus 10% on Ultimate Gift Cards | 20x EDR on $50 Uber & Apple Gift Cards @ Big W (buy a $100 Apple card and you might get 1000 QFF points from the 30x promo, 800 QFF points from Qantas shopping and $20 cashback from Citi).

EDIT - note also Bonus 10% on Ultimate Gift Cards | 20x EDR on $50 Uber & Apple Gift Cards @ Big W (buy a $100 Apple card and you might get 1000 QFF points from the 30x promo, 800 QFF points from Qantas shopping and $20 cashback from Citi).

Last edited:

Become an AFF member!

Join Australian Frequent Flyer (AFF) for free and unlock insider tips, exclusive deals, and global meetups with 65,000+ frequent flyers.AFF members can also access our Frequent Flyer Training courses, and upgrade to Fast-track your way to expert traveller status and unlock even more exclusive discounts!

AFF forum abbreviations

Wondering about Y, J or any of the other abbreviations used on our forum?Check out our guide to common AFF acronyms & abbreviations.

Recent Posts

-

Qantas unveils the biggest changes to status in program history

- Latest: Laptop Jockey

-

-

-

Currently Active Users

Total: 1,765 (members: 15, guests: 1,750)