What you were advised verbally certainly makes practical sense. But it's not their definition, which is in the singular. Hopefully the assessor would also be practical and not use their literal definition as stated. As you say, would be nice in writing.Seems like those interpretations are not correct.

So I just called Allianz a few minutes ago, and asked them if "return overseas travel ticket means an air or cruise ticket departing from and returning to Australia" means both must be on one ticket because of the word "AN", or OK if on separate tickets. (I wanted to use their online form in order to get a written response, but the submit button of their online form doesn't work)

The staff said that, the word "an" means a ticket to come back, it does not say and does not mean one ticket for going and coming. I then asked if I were to fly out on one ticket one airline, come back on a different airline on a different ticket, he said this is OK. I then asked if I take a cruise ship to another country, then fly back on another? He said this is also OK, as I have "an" return ticket to come back.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Who else still holds the Citibank Free For Life Premier Card?

- Thread starter one9

- Start date

What you were advised verbally certainly makes practical sense. But it's not their definition, which is in the singular

Actually, I get what that staff member was saying. The keyword was not "AN", but "RETURN".

When you and I read it, the word "return" means going and coming back; but from the way explained and emphasised to me, the word "return" means coming back, only.

I know that we only use Oxford and Macquarie for legal purposes, but both are behind paywall, so if we look at:

- Cambridge: "to come or go back to a previous place", so it's one way, not both ways.

- Collins: "Your return is your arrival back at a place where you had been before." "Ryle explained the reason for his sudden return to London"

So if we were to read 'an air return ticket', that would mean a tix to come back, not going and coming back.

Does that mean we all failed English???

I did consider that definition, i.e. "return" meaning coming back rather than the common airline usage of both ways, but still thought that Citi's definition to include the "and" in their definition..."ticket departing from and returning" (as distinct from "a return ticket") precluded or may preclude that.Actually, I get what that staff member was saying. The keyword was not "AN", but "RETURN".

When you and I read it, the word "return" means going and coming back; but from the way explained and emphasised to me, the word "return" means coming back, only.

I know that we only use Oxford and Macquarie for legal purposes, but both are behind paywall, so if we look at:

- Cambridge: "to come or go back to a previous place", so it's one way, not both ways.

- Collins: "Your return is your arrival back at a place where you had been before." "Ryle explained the reason for his sudden return to London"

So if we were to read 'an air return ticket', that would mean a tix to come back, not going and coming back.

Does that mean we all failed English???

It shouldn't be like this but it often is, considering the various t&c updates often issued just to clarify; the t&c authors failing clear English.

MELso

Established Member

- Joined

- Nov 12, 2011

- Posts

- 1,387

- Qantas

- Gold

- Virgin

- Red

- Oneworld

- Sapphire

The key phrase is a lesser known interpretive one before the definitions requiring close reading: “The use of the singular shall also include the use of the plural and vice versa.”

Basically, this has the effect that ‘ticket’ can mean ‘tickets’.

Basically, this has the effect that ‘ticket’ can mean ‘tickets’.

Call them to confirm and note who you speak with, time & date...What does chatgpt say

Good pickup. I'm glad these are Allianz "plain language" contracts Plain Language Contracts launches with certification for Allianz Partners, Youi - Insurance News - insuranceNEWS.com.auThe key phrase is a lesser known interpretive one before the definitions requiring close reading: “The use of the singular shall also include the use of the plural and vice versa.”

Basically, this has the effect that ‘ticket’ can mean ‘tickets’.

ecst

Intern

- Joined

- Apr 1, 2011

- Posts

- 77

Thanks all for your input - Let's put some more context and nuances into this without intending to hijack the Citi FFFL thread.

My hesitation with the definitions of one-way and return tickets were weighted more towards the economic costs of the various tickets.

Let's say we wanted to travel to Finnish Lapland to watch the Northern lights, staying at very nice accomodation and also doing some snow/winter related activities around the region. Put a cost of AUD20-40K total for 2pax for that.

To get there, let's hypothetically say I booked a one-way CX PER-HKG-LHR-HEL-etc and do a SQ return one-way; and to quality for CC insurance, I instead hypothetically pivoted to book a QF PER-SIN-PER return (AUD 2k total) + nested a SQ SIN-Europe-SIN with that booking.

Would we have a leg to stand on, say if a dog sled were to crash requiring an extensive hospital stay in Finland; and instead the CC insurance company insisted their limits of liability was only up (to the return overseas ticket limit) of AUD 2000, ie "tough luck my friend and all the best"? or would it be no holds barred as long as we plebs have booked our travel in compliance with the qualification requirements?

To further push the point, what if it was a AUD 50k, 100k trip, (whatever) across 3-4 months involving several continents, luxury cruises etc (nothing within the exclusions) with the nested PER-SIN-PER to kick it all off?

I must say I don't have too much faith even in stand alone purchased insurance coverage only hope for good luck, good weather and good health...

only hope for good luck, good weather and good health...

My hesitation with the definitions of one-way and return tickets were weighted more towards the economic costs of the various tickets.

Let's say we wanted to travel to Finnish Lapland to watch the Northern lights, staying at very nice accomodation and also doing some snow/winter related activities around the region. Put a cost of AUD20-40K total for 2pax for that.

To get there, let's hypothetically say I booked a one-way CX PER-HKG-LHR-HEL-etc and do a SQ return one-way; and to quality for CC insurance, I instead hypothetically pivoted to book a QF PER-SIN-PER return (AUD 2k total) + nested a SQ SIN-Europe-SIN with that booking.

Would we have a leg to stand on, say if a dog sled were to crash requiring an extensive hospital stay in Finland; and instead the CC insurance company insisted their limits of liability was only up (to the return overseas ticket limit) of AUD 2000, ie "tough luck my friend and all the best"? or would it be no holds barred as long as we plebs have booked our travel in compliance with the qualification requirements?

To further push the point, what if it was a AUD 50k, 100k trip, (whatever) across 3-4 months involving several continents, luxury cruises etc (nothing within the exclusions) with the nested PER-SIN-PER to kick it all off?

I must say I don't have too much faith even in stand alone purchased insurance coverage

Would we have a leg to stand on, say if a dog sled were to crash requiring an extensive hospital stay in Finland; and instead the CC insurance company insisted their limits of liability was only up (to the return overseas ticket limit) of AUD 2000, ie "

Where do you get $2000 from? Medical is currently unlimited, reduced to $20m from July. I would think $20 million should be enough to charter a medical flight evacuation?

I must say I don't have too much faith even in stand alone purchased insurance coverageonly hope for good luck, good weather and good health...

I have claimed rental car twice no problem, a friend of mine claimed flight cancellation due to typhoon in Asia and also got paid out. So I don't see any reason to worry.

Happy Dude

Established Member

- Joined

- Oct 13, 2006

- Posts

- 3,226

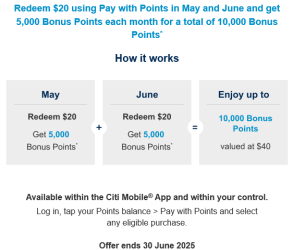

Hey Happy Dude, would you be able to paste the T&Cs for this offer? I'm not subscribed to marketing emails so don't have the details, but keen to give it a try anyway. Thanks!Interesting new offer:

It's a nett square proposition so the nicest thing I can say about it is that it makes a nice change from the devaluation emails of late.

Happy Dude

Established Member

- Joined

- Oct 13, 2006

- Posts

- 3,226

Here you go @GDale. Apologies if it's targetted - I didn't think to check prior to posting. Here's what's on the bottom of the email:

Important Information |

Please do not reply to this email, this inbox is not monitored. If you have any questions, please contact us at citibank.com.au/contactus. |

* To be eligible to receive up to 10,000 Bonus Points, you must redeem a minimum of $20 in one or more redemptions per month in May and June 2025 using Pay with Points. 5,000 Bonus Points will be credited to your account within 30 business days from the end of the qualifying month. Your Citi Credit Card must remain open, in good standing (for example - your account is not in default, suspended or closed) and enrolled in the Citi Rewards Program for the Bonus Points to be awarded. |

~ In order to use Pay with Points or Spend and Redeem to redeem your reward Points for statement credits to cover recent eligible purchases, you must have a credit card enrolled in the Citi Rewards Program and agree to the following terms and conditions. Customers who are enrolled in the Citi Qantas Rewards Program will not be eligible for Pay with Points or Spend and Redeem. Pay with Points statement credits can be requested online through the Citi Mobile® App and Citi Online. Spend and Redeem can only be accessed through a unique link contained in a text message that will be sent to your mobile device registered with us. Your credit card account must not be cancelled or suspended at the time you use Pay with Points or Spend and Redeem. An eligible purchase is a transaction we will present to you in your Citi Mobile® App, Citi Online or via SMS that can be paid by redeeming your reward Points. The types of transactions that may be paid by redeeming your reward Points may change and we will present these to you in the Citi Mobile® App, Citi Online or via SMS. The amount of reward Points you use to redeem for statement credits to cover your eligible purchases, whether in full or partially, will be deducted from your reward Points balance. You may select to pay for an eligible purchase with points (in full or partially) up to your available balance. There is a maximum limit of five eligible purchases at any one time. The Spend and Redeem offer is valid for 14 days after you receive a text message that contains instructions on how to redeem. Only the primary cardholder can redeem these Points. If you make a request to redeem Points for Pay with Points or Spend and Redeem, this request cannot be reversed, cancelled or changed after it has been accepted. Pay with Points or Spend and Redeem statement credits will post to your credit card within two business days of redemption and will appear in your next month's credit card statement or on Citi Online. Pay with Points or Spend and Redeem statement credits cannot be used towards your current month's minimum or total payment due. The required minimum and total payment reflected on your credit card statement must be paid pursuant to the terms of your credit card Agreement. If you receive a refund for the transaction, your statement credit will not be affected. There is no fee to use the Pay with Points or Spend and Redeem feature to redeem your reward Points. Citi Rewards may set minimum and/or maximum reward Points redemption requirements for Pay with Points or Spend and Redeem. Citi Rewards has the right to change the reward Points to dollar conversion rate for Pay with Points or Spend and Redeem statement credits or any other changes to these programs at any time. We will provide at least 30 days prior notice of changes, unless we reasonably consider the change to be non-material in nature. For any changes we consider to be non-material, we will publish this on our website and may notify you at the time you redeem your Reward. These Terms and Conditions are pursuant to your Citi Rewards Program Terms and Conditions. |

MELso

Established Member

- Joined

- Nov 12, 2011

- Posts

- 1,387

- Qantas

- Gold

- Virgin

- Red

- Oneworld

- Sapphire

I redeemed $20.63 worth of charges for 5165 points (the closest I could get to $20). Next month some time, I should get 5,000 points back, and will repeat the process in June, so it's effectively two lots of $20 credit free.To be eligible to receive up to 10,000 Bonus Points, you must redeem a minimum of $20 in one or more redemptions per month in May and June 2025 using Pay with Points. 5,000 Bonus Points will be credited to your account within 30 business days from the end of the qualifying month. Your Citi Credit Card must remain open, in good standing (for example - your account is not in default, suspended or closed) and enrolled in the Citi Rewards Program for the Bonus Points to be awarded.

(Annoying that it popped up in the same month as the Velocity transfer bonus but c'est la vie.)

Thank you!Here you go @GDale. Apologies if it's targetted - I didn't think to check prior to posting. Here's what's on the bottom of the email:

I redeemed $20.63 worth of charges for 5165 points (the closest I could get to $20). Next month some time, I should get 5,000 points back, and will repeat the process in June, so it's effectively two lots of $20 credit free.

(Annoying that it popped up in the same month as the Velocity transfer bonus but c'est la vie.)

you can use the 'edit' icon to get to exactly $20 for any payment over $20

just imagine those specific velocity points you would have transferred would be transferred from velocity to Krisflyer at some stage....then better off staying as Citi rewards points

MELso

Established Member

- Joined

- Nov 12, 2011

- Posts

- 1,387

- Qantas

- Gold

- Virgin

- Red

- Oneworld

- Sapphire

Ah, neat.you can use the 'edit' icon to get to exactly $20 for any payment over $20

just imagine those specific velocity points you would have transferred would be transferred from velocity to Krisflyer at some stage....then better off staying as Citi rewards points

But, since NAB has taken over I tend to transfer my Citi points to Velocity when transfer bonuses are on because they offer better bang for buck if an award is available through Velocity and, if I do end up needing to transfer to KF, the penalty is only about 7%.

Yes same, I was able to access it a couple of weeks ago but has been broken for the last week.I can't access the my cashback section in the app, been having the same issue for a while, anyone experiencing the same issue by any chance?

Ok thanks for confirming, I was about to reset everything from my phone, app, and Citi password to get it work.Yes same, I was able to access it a couple of weeks ago but has been broken for the last week.

Post automatically merged:

Ok thanks for confirming, I was about to reset everything from my phone, app, and Citi password to get it work.Yes same, I was able to access it a couple of weeks ago but has been broken for the last week.

Just tried, if you mean Offers > Exclusive Care Offers > My Cashback, I eventually got "Sorry, we are unable to process your request right now. Please try again later."I can't access the my cashback section in the app

Yes same, I was able to access it a couple of weeks ago but has been broken for the last week.

I last accessed and used it back in Feb (3 months ago), for Star car wash $5 back. Let me send Citi a message

Become an AFF member!

Join Australian Frequent Flyer (AFF) for free and unlock insider tips, exclusive deals, and global meetups with 65,000+ frequent flyers.AFF members can also access our Frequent Flyer Training courses, and upgrade to Fast-track your way to expert traveller status and unlock even more exclusive discounts!

AFF forum abbreviations

Wondering about Y, J or any of the other abbreviations used on our forum?Check out our guide to common AFF acronyms & abbreviations.

Currently Active Users

- Askance

- Penny Carter

- nickderm

- Pete98765432

- leesionn

- FlyingKangaroo

- FF98

- tigertraveller

- AIRwin

- kerfuffle

- PDog

- BrianQQ

- fkcn

- AndyQB

- SJF211

- Flyerqf

- madrooster

- Doctore1003

- jastel

- jase05

- christine-louise

- Hunter4vr

- dajop

- andygfee

- MELso

- VPS

- swellington

- soliloguy

- A321

- Arkana

- hossein_au

- Recycling

- TheRealTMA

- SYD

- thebmw

- abt323

- Harrison_133

- utaussiefan

- Quickstatus

- Doug_Westcott

- TonyDoh

- Peasant

- leadman

- Ads22

- Foz

Total: 1,057 (members: 56, guests: 1,001)