- Joined

- Apr 16, 2018

- Posts

- 95

- Qantas

- Platinum

Value of Virgin's Velocity axed in report clearing way for Bain takeover

The value of Virgin Australia's frequent flyer scheme Velocity was slashed from $2 billion to $700 million in an independent report allowing Bain Capital to take full ownership of the company.

From the article;

" The value of Virgin Australia's profitable frequent flyer scheme Velocity was slashed from $2 billion to $700 million in an independent report paving the way for private equity firm Bain Capital to take full ownership of the company. "

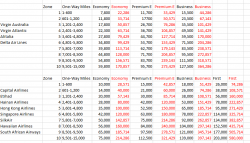

A thought experiment into what an equivalent redemption devaluation (in red) would look like....the answer is not pretty as one would expect.