When there are too many options, sometimes it's nice to have the decision made for you -It was easy for me to rule out companies. We always used TID but they won't issue a multi trip policy for anyone 70 or over.

So switched to QF. They won't issue one for anyone 75 or older. That is a common cut off point.

So STC will sell me a policy even at 100. At the moment they will let me choose 30,60 or 90 day trips. Most others that sell to us ancients limit trips to 30 days.

- Forums

- Community Announcements & Discussion

- Archive Forum

- Coronavirus (COVID-19)

- Refunds & Travel Insurance

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Travel Insurance which covers COVID-19?

- Thread starter garybatz

- Start date

-

- Tags

- covid-19 travel insurance

Elevate your business spending to first-class rewards! Sign up today with code AFF10 and process over $10,000 in business expenses within your first 30 days to unlock 10,000 Bonus PayRewards Points.

Join 30,000+ savvy business owners who:

✅ Pay suppliers who don’t accept Amex

✅ Max out credit card rewards—even on government payments

✅ Earn & transfer PayRewards Points to 10+ airline & hotel partners

Start earning today!

- Pay suppliers who don’t take Amex

- Max out credit card rewards—even on government payments

- Earn & Transfer PayRewards Points to 8+ top airline & hotel partners

Join 30,000+ savvy business owners who:

✅ Pay suppliers who don’t accept Amex

✅ Max out credit card rewards—even on government payments

✅ Earn & transfer PayRewards Points to 10+ airline & hotel partners

Start earning today!

- Pay suppliers who don’t take Amex

- Max out credit card rewards—even on government payments

- Earn & Transfer PayRewards Points to 8+ top airline & hotel partners

AFF Supporters can remove this and all advertisements

k_sheep

Established Member

- Joined

- Apr 2, 2009

- Posts

- 2,246

- Qantas

- Platinum

- Virgin

- Gold

- Oneworld

- Emerald

- Star Alliance

- Gold

I started kicking myself for having a 62 day trip planned ... but there's actually not too much difference between 60 and 90 day policies with SCTI. I need to trawl the T+Cs though because I've already booked a bunch of stuff.

mrsterryn

Established Member

- Joined

- Mar 29, 2015

- Posts

- 2,457

So Southern Cross won't cover me with my conditions

Insure and Go aren't doing annual ones at this stage however they will cover my conditions and include covid coverage on a couple of their policies.

Though it is on the steep cost side, it does appear to meet the criteria. I will just need to buy another policy for later on in the year

Insure and Go aren't doing annual ones at this stage however they will cover my conditions and include covid coverage on a couple of their policies.

Though it is on the steep cost side, it does appear to meet the criteria. I will just need to buy another policy for later on in the year

Danger

Suspended

- Joined

- Jun 19, 2006

- Posts

- 7,819

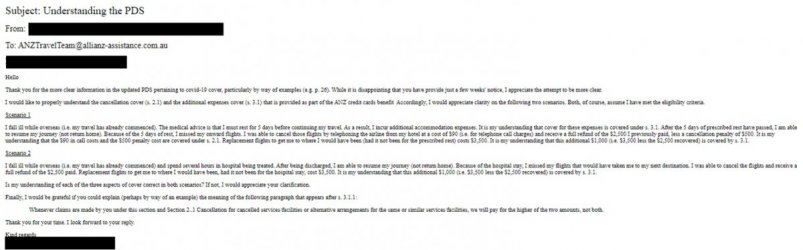

A few weeks ago, my brother-in-law set about trying to get some clarity from Allianz on the ANZ credit card cover, specifically related to additional expenses.

He finally got a response today.

Hello

Thank you for the more clear information in the updated PDS pertaining to covid-19 cover, particularly by way of examples (e.g. p. 26). While it is disappointing that you have provide just a few weeks' notice, I appreciate the attempt to be more clear.

I would like to properly understand the cancellation cover (s. 2.1) and the additional expenses cover (s. 3.1) that is provided as part of the ANZ credit cards benefit Accordingly, I would appreciate clarity on the following two scenarios. Both, of course, assume I have met the eligibility criteria.

Scenario 1

I fall ill while overseas (i.e. my travel has already commenced). The medical advice is that I must rest for 5 days before continuing my travel. As a result, I incur additional accommodation expenses. It is my understanding that cover for these expenses is covered under s. 3.1. After the 5 days of prescribed rest have passed, I am able to resume my journey (not return home). Because of the 5 days of rest, I missed my onward flights. I was able to cancel those flights by telephoning the airline from my hotel at a cost of $90 (i.e. for telephone call charges) and receive a full refund of the $2,500 I previously paid, less a cancellation penalty of $500. It is my understanding that the $90 in call costs and the $500 penalty cost are covered under s. 2.1. Replacement flights to get me to where I would have been (had it not been for the prescribed rest) costs $3,500. It is my understanding that this additional $1,000 (i.e. $3,500 less the $2,500 recovered) is covered by s. 3.1.

Scenario 2

I fall ill while overseas (i.e. my travel has already commenced) and spend several hours in hospital being treated. After being discharged, I am able to resume my journey (not return home). Because of the hospital stay, I missed my flights that would have taken me to my next destination. I was able to cancel the flights and receive a full refund of the $2,500 paid. Replacement flights to get me to where I would have been, had it not been for the hospital stay, cost $3,500. It is my understanding that this additional $1,000 (i.e. $3,500 less the $2,500 recovered) is covered by s. 3.1. Is my understanding of each of the three aspects of cover correct in both scenarios? If not, I would appreciate your clarification.

Finally, I would be grateful if you could explain (perhaps by way of an example) the meaning of the following paragraph that appears after s. 3.1.1:

Whenever claims are made by you under this section and Section 2..1 Cancellation for cancelled services/facilities or alternative arrangements for the same or similar services/facilities, we will pay for the higher of the two amounts, not both.

He finally got a response today.

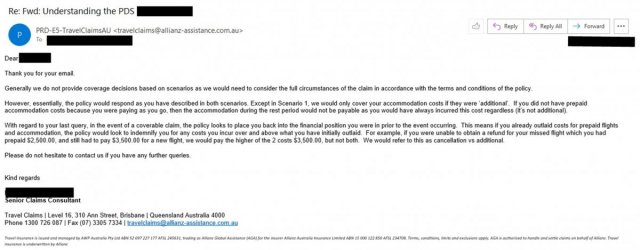

Thank you for your email.

Generally we do not provide coverage decisions based on scenarios as we would need to consider the full circumstances of the claim in accordance with the terms and conditions of the policy.

However, essentially, the policy would respond as you have described in both scenarios. Except in Scenario 1, we would only cover your accommodation costs if they were ‘additional’. If you did not have prepaid accommodation costs because you were paying as you go, then the accommodation during the rest period would not be payable as you would have always incurred this cost regardless (it’s not additional).

With regard to your last query, in the event of a coverable claim, the policy looks to place you back into the financial position you were in prior to the event occurring. This means if you already outlaid costs for prepaid flights and accommodation, the policy would look to indemnify you for any costs you incur over and above what you have initially outlaid. For example, if you were unable to obtain a refund for your missed flight which you had prepaid $2,500.00, and still had to pay $3,500.00 for a new flight, we would pay the higher of the 2 costs $3,500.00, but not both. We would refer to this as cancellation vs additional.

Please do not hesitate to contact us if you have any further queries.

Attachments

MEL_Traveller

Veteran Member

- Joined

- Apr 27, 2005

- Posts

- 31,946

That’s pretty good danger! I had interpreted it - out of wishful thinking more than anything else - the same as your BIL. Good to have ‘confirmation’ (well, as close as that gets).

ANZ continues to have an excellent CC cover.

ANZ continues to have an excellent CC cover.

k_sheep

Established Member

- Joined

- Apr 2, 2009

- Posts

- 2,246

- Qantas

- Platinum

- Virgin

- Gold

- Oneworld

- Emerald

- Star Alliance

- Gold

I'm finding it's basically impossible to get cover for cruises (antarctica) and travelling to level 3 countries (chile and ethiopia) for my end of year trip.

Does anyone know if it's possible to get 2 different covers, or will they just argue with each other in the event I need to actually claim?

Does anyone know if it's possible to get 2 different covers, or will they just argue with each other in the event I need to actually claim?

Hopefully Allianz updates it's coverage for some of the other bank's cards soon - I'd love an update for the St George or Westpac card coverage.That’s pretty good danger! I had interpreted it - out of wishful thinking more than anything else - the same as your BIL. Good to have ‘confirmation’ (well, as close as that gets).

ANZ continues to have an excellent CC cover.

Danger

Suspended

- Joined

- Jun 19, 2006

- Posts

- 7,819

I'm finding it's basically impossible to get cover for cruises (antarctica) and travelling to level 3 countries (chile and ethiopia) for my end of year trip.

Does anyone know if it's possible to get 2 different covers, or will they just argue with each other in the event I need to actually claim?

I almost routinely travel with more cover provided by more than one credit card. When things go pear shaped I claim under both and have no issues doing so. I've paid for it. If I want to take out 10 policies, that's up to me.

I thought that if you had 2 different covers they would both argue to use the other.

Good to see the ANZ Covid cover kicking in on the 28th now will apply to more of their cards-

ANZ Frequent Flyer Platinum

• ANZ Frequent Flyer Black

• ANZ Rewards Platinum

• ANZ Rewards Travel Adventures

• ANZ Rewards Black

• ANZ Platinum

Good to see the ANZ Covid cover kicking in on the 28th now will apply to more of their cards-

ANZ Frequent Flyer Platinum

• ANZ Frequent Flyer Black

• ANZ Rewards Platinum

• ANZ Rewards Travel Adventures

• ANZ Rewards Black

• ANZ Platinum

Gold Member

Established Member

- Joined

- Feb 12, 2008

- Posts

- 2,321

Well I’ve spent the past week analysing and comparing TI‘s and I’m confident I’ve found a suitable Provider; for my circumstances Allianz is the most comprehensive and for some reason the cheapest as well.I'm finding it's basically impossible to get cover for cruises (antarctica) and travelling to level 3 countries (chile and ethiopia) for my end of year trip.

Does anyone know if it's possible to get 2 different covers, or will they just argue with each other in the event I need to actually claim?

For my upcoming trips I’ll be travelling to Europe and North America, and both will have multi-night cruises. I don’t have any special circumstances or health issues. But my travel and hotel stays are business/first and suites - some are booked with points and some paid commercial.

WRT Cruises @k_sheep, the Allianz Cruise pack includes C19 cover both DURING and AFTER the cruise. Almost every other Cruise option does not cover C19 at any time during or after. Of all the time travelling, I figure if I’m going to get C19 a cruise would be the most likely environment so this inclusion was critical for me.

For Allianz, the default Cancellation allowance is $10K which for my circumstances of mostly refundable bookings should suffice. The premium increase to $20k is very little and presents good value for others with non-refundable bookings. The Additional Expenses is set at $50K and this covers quite a lot of the remaining non-“Cancellation Expenses“ situations.

Anyone got any insights or opinions before I pull the trigger?

I'm finding their policies really hard to understand. On the page where you choose which level of cover, it just says 'Choose trip cancellation cover' but not whether that includes Covid cancellation or not. And it the PDS, lots of "This policy has a general exclusion with limited exceptions against epidemics and pandemics ... however you are covered if you or your travel companion are positively diagnosed with Covid-19. There is no general cover for cancellation arising out of an epidemic or pandemic". Could they have worded it any more confusingly? It's on purpose if you ask me. And can't get through on the phone to clarify, been waiting 12 mins so far. Inclined not to go with them.Anyone got any insights or opinions before I pull the trigger?

Gold Member

Established Member

- Joined

- Feb 12, 2008

- Posts

- 2,321

Yep, of all the PDSs I read, Allianz was by far the most difficult to get my head around. If that complexity and difficulty is indeed intended, they sure know how to turn away prospective customers who find it all too hard.I'm finding their policies really hard to understand. On the page where you choose which level of cover, it just says 'Choose trip cancellation cover' but not whether that includes Covid cancellation or not. And it the PDS, lots of "This policy has a general exclusion with limited exceptions against epidemics and pandemics ... however you are covered if you or your travel companion are positively diagnosed with Covid-19. There is no general cover for cancellation arising out of an epidemic or pandemic". Could they have worded it any more confusingly?

I spoke with one of their agents in some detail to clarify all of the double negatives and exclusion exceptions. It was like pulling teeth trying to get them to walk through a hypothetical situation and apply some logic as they just kept reading back the PDS verbiage. But ultimately Covid is covered under both Cancellation and Additional Expenses. Of course it must be you or your travelling companion that contracts Covid (supported by relevant paperwork from authorised practitioner etc), however like most policies if you have been deemed a close contact you are not covered.

however like most policies if you have been deemed a close contact you are not covered.

Actually there are quite a few that do cover you for being a close contact. GoInsurance has basically everything we need (would have preferred a little higher rental car excess) but the downside is their reviews are terrible for if you have to claim, puts me off :/

I’m also using Allianz ( Worldcare ). I emailed both companies with all my specific concerns re Covid and they replied reasonably quickly with everything answered in full.,Yep, of all the PDSs I read, Allianz was by far the most difficult to get my head around. If that complexity and difficulty is indeed intended, they sure know how to turn away prospective customers who find it all too hard.

I spoke with one of their agents in some detail to clarify all of the double negatives and exclusion exceptions. It was like pulling teeth trying to get them to walk through a hypothetical situation and apply some logic as they just kept reading back the PDS verbiage. But ultimately Covid is covered under both Cancellation and Additional Expenses. Of course it must be you or your travelling companion that contracts Covid (supported by relevant paperwork from authorised practitioner etc), however like most policies if you have been deemed a close contact you are not covered.

What they told you on the phone was confirmed in my email. Good to have it in writing.

- Joined

- Jun 24, 2008

- Posts

- 4,726

- Qantas

- Gold

- Virgin

- Red

I had a similar situation back in 2019 when I had a trip of around 67 days. I spoke to the insurance company and they said to take a separate policy just for the additional 7 days to effectively extend the cover for the full trip.I started kicking myself for having a 62 day trip planned

I actually had to make a claim for the first day of the additional policy and it went through without issue. Perhaps give your policy provider a call and see if they will offer something similar?

I ended up going with GoInsurance. Could actually speak to an Australian human being without too long of a wait with my queries, and their Covid cancellation is per person on the policy as well, which is good. Their reviews aren't awesome but in the end, the best of a not great bunch.

k_sheep

Established Member

- Joined

- Apr 2, 2009

- Posts

- 2,246

- Qantas

- Platinum

- Virgin

- Gold

- Oneworld

- Emerald

- Star Alliance

- Gold

Sadly they don't offer cover for level 3 countries so they are no good for meWRT Cruises @k_sheep, the Allianz Cruise pack includes C19 cover both DURING and AFTER the cruise. Almost every other Cruise option does not cover C19 at any time during or after. Of all the time travelling, I figure if I’m going to get C19 a cruise would be the most likely environment so this inclusion was critical for me.

I have also just done my due diligence on this topic. I read PDSs as part of my job quite regularly but Allianz is indeed a hard one!Well I’ve spent the past week analysing and comparing TI‘s and I’m confident I’ve found a suitable Provider; for my circumstances Allianz is the most comprehensive and for some reason the cheapest as well.

For my upcoming trips I’ll be travelling to Europe and North America, and both will have multi-night cruises. I don’t have any special circumstances or health issues. But my travel and hotel stays are business/first and suites - some are booked with points and some paid commercial.

WRT Cruises @k_sheep, the Allianz Cruise pack includes C19 cover both DURING and AFTER the cruise. Almost every other Cruise option does not cover C19 at any time during or after. Of all the time travelling, I figure if I’m going to get C19 a cruise would be the most likely environment so this inclusion was critical for me.

For Allianz, the default Cancellation allowance is $10K which for my circumstances of mostly refundable bookings should suffice. The premium increase to $20k is very little and presents good value for others with non-refundable bookings. The Additional Expenses is set at $50K and this covers quite a lot of the remaining non-“Cancellation Expenses“ situations.

Anyone got any insights or opinions before I pull the trigger?

Having said that, I was after a cheap policy with unlimited C19 medical cover only (ie no other travel benefits) and concluded that Allianz has the best offer (presumably actually the only one) with its BASIC FAMILY Plan within the worldwide travel offering.

JohnK

Veteran Member

- Joined

- Mar 22, 2005

- Posts

- 44,436

As posted in other thread I just checked Southern Cross and annual multi trip is <$300.

I am more interested in the rental vehicle excess but Covid cover is also good. So they will cover cost of hospitalisation due to Covid but not cost of return flight?

I am more interested in the rental vehicle excess but Covid cover is also good. So they will cover cost of hospitalisation due to Covid but not cost of return flight?

Become an AFF member!

Join Australian Frequent Flyer (AFF) for free and unlock insider tips, exclusive deals, and global meetups with 65,000+ frequent flyers.AFF members can also access our Frequent Flyer Training courses, and upgrade to Fast-track your way to expert traveller status and unlock even more exclusive discounts!

AFF forum abbreviations

Wondering about Y, J or any of the other abbreviations used on our forum?Check out our guide to common AFF acronyms & abbreviations.

Currently Active Users

- hugamuga

- J_Dee

- ayebee

- Auzzieflyer

- kiwipino

- citrusb

- New to this

- bam71

- Pete98765432

- kittystar

- Tonedoggy

- MattA

- Chrizztofa

- Mother

- Steady

- significance

- http_x92

- MooTime

- tielec

- Justinf

- sader

- flyingfan

- sudoer

- Beer_budget

- CorporateFlyerMEL

- KIZI

- csugowdz

- Mrmrbagley

- Franky

- Material16

- swellington

- Noel Mugavin

- QF1

- SOPOOR

- snowy150

- bluecoconut

- r21111

- Human

- velli25

- Darkpulsar

- muppet

- nige_perth

- jimmywise

- Stone

- Koosc

- crosscheck

- fletty

- dajop

- downgraded

- Beano

Total: 2,011 (members: 76, guests: 1,935)