iangoodwin

Junior Member

- Joined

- Mar 15, 2007

- Posts

- 20

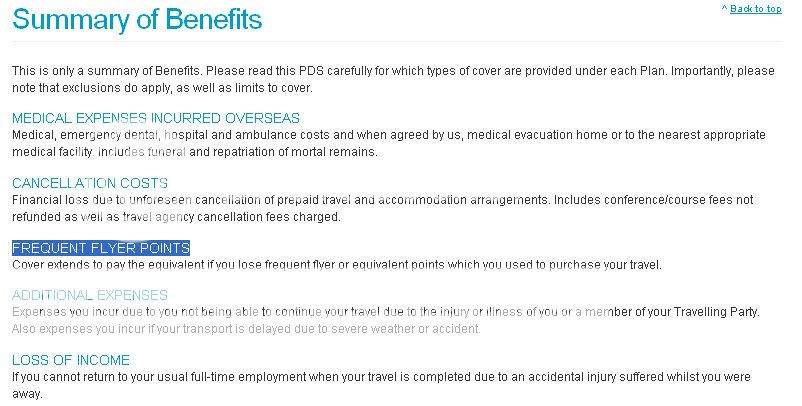

I have managed to find an Australian travel insurance policy that covers flights booked using miles/points against cancellation for reasons of illness etc.

They will refund you the value of your otherwise wasted points in this event (not sure exactly how though)

I'm interested to know if there are any other competing policies around as it took me a fair while to hunt down this one down.

Here's the link...

Travel Insurance Policy Booklets - NRMA Insurance

Go straight to Page 17 (or thereabouts).

They will refund you the value of your otherwise wasted points in this event (not sure exactly how though)

I'm interested to know if there are any other competing policies around as it took me a fair while to hunt down this one down.

Here's the link...

Travel Insurance Policy Booklets - NRMA Insurance

Go straight to Page 17 (or thereabouts).