Mr H

Established Member

- Joined

- Dec 5, 2013

- Posts

- 3,484

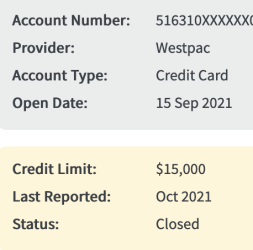

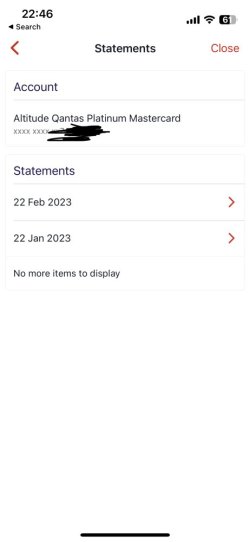

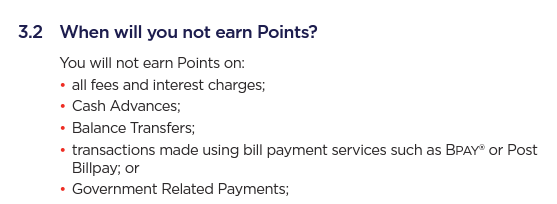

Has anyone had recent experience with the sign up bonus for Westpac Altitude Qantas Black card? I took this card out in December, met the required spend straight away and have just got my first statement - the spend points are there but no bonus points. I know the terms and conditions say the bonus is credited within 12 weeks of meeting the spend requirement, but with other cards I have always got the bonus on the first statement after making the required spend. This is a bit of a curve ball - just wanting to get the points, close the account and move on. I'm wondering how long others have had to wait...