You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Superannuation Discussion + market volatility

- Thread starter JohnK

- Start date

Quickstatus

Enthusiast

- Joined

- Oct 13, 2013

- Posts

- 17,435

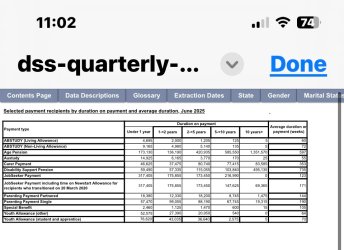

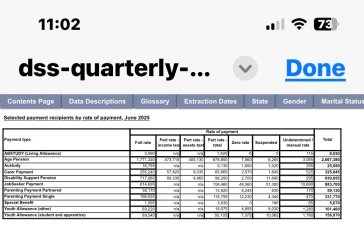

Rumours that the govt considering adjusting the OAG pension access rules by reducing the amount of assets held one can hold outside the family home - this would primarily affect those who have part super and part OAG.

mrsterryn

Established Member

- Joined

- Mar 29, 2015

- Posts

- 2,463

It wouldn't just be the age pension , there is carers payment and disability support pension which all come under the same flag so to speakRumours that the govt considering adjusting the OAG pension access rules by reducing the amount of assets held one can hold outside the family home - this would primarily affect those who have part super and part OAG.

CaptJCool

Established Member

- Joined

- May 31, 2012

- Posts

- 4,655

Yeah that was reported in the Australia’n todayRumours that the govt considering adjusting the OAG pension access rules by reducing the amount of assets held one can hold outside the family home - this would primarily affect those who have part super and part OAG.

Adjusting thresholds reduces the OAG financial liability WITHOUT raising taxes

CaptJCool

Established Member

- Joined

- May 31, 2012

- Posts

- 4,655

A sop to the 2 million age pensioners who own their home who vote LNPI don't understand why deeming is so low currently on financial assets under the social security system. I was quite surprised when they didn't increase the deeming rates this past July 1st .

With interest rates going down, would have been brave.I don't understand why deeming is so low currently on financial assets under the social security system. I was quite surprised when they didn't increase the deeming rates this past July 1st .

mrsterryn

Established Member

- Joined

- Mar 29, 2015

- Posts

- 2,463

At the least they could have gone up half a percent. Especially when superannuation (age pension who are having it assessed ) are getting significantly higher returns on their investments for the most partWith interest rates going down, would have been brave.

CaptJCool

Established Member

- Joined

- May 31, 2012

- Posts

- 4,655

So the 2 other insights in the OAP conversation

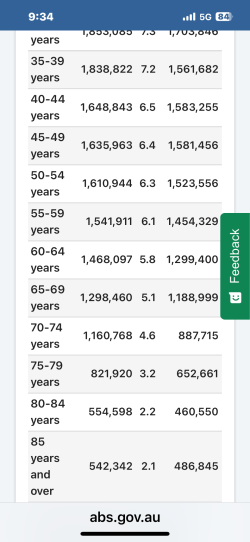

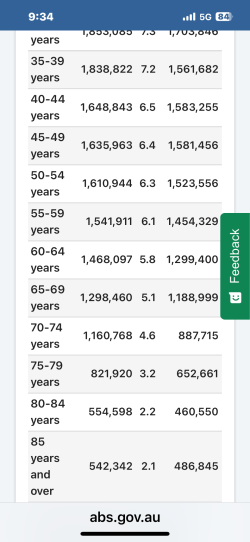

The census data from August 2021

The people turning 67 today were 63 in 2021

In that data, the 60-64 group no more than 290,000 (less deaths around 9,000 per year 60- 70,000 per quarter would be turning 67 this year yet the OAP for that age group has reduced slightly each 3 months.

About 1,400,000 in the cohort

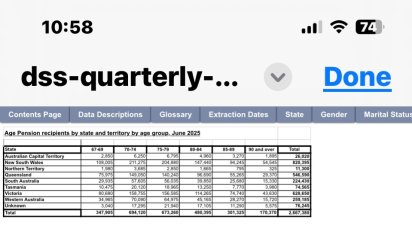

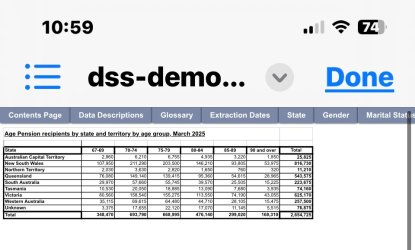

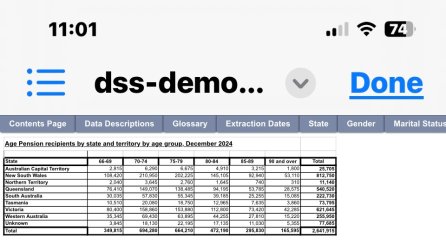

So 720,000 in the age 67-69 of which 349,000 are on OAP

48% and reducing

The other group is the over 85s

They get afflicted with the surviving spouse outcome, they are living longer (and a few cut off because they didn’t sell the house when they went into aged care and after 2 years, it is cut off)

There’s no more than 980,000 in that cohort less a substantial amount of deaths)

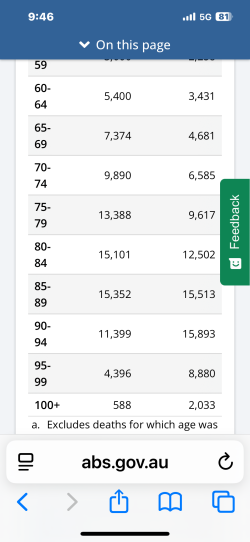

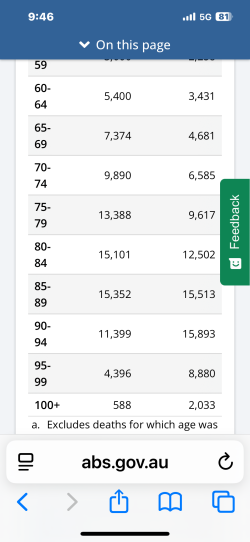

For 2023 Deaths, Australia, 2023

71,000 deaths for those ages 85 & over

So 280,000 deaths over 4 years

700,000 aged over 85 alive

Around 470,000 are on OAP

67%

The census data from August 2021

The people turning 67 today were 63 in 2021

In that data, the 60-64 group no more than 290,000 (less deaths around 9,000 per year 60- 70,000 per quarter would be turning 67 this year yet the OAP for that age group has reduced slightly each 3 months.

About 1,400,000 in the cohort

So 720,000 in the age 67-69 of which 349,000 are on OAP

48% and reducing

The other group is the over 85s

They get afflicted with the surviving spouse outcome, they are living longer (and a few cut off because they didn’t sell the house when they went into aged care and after 2 years, it is cut off)

There’s no more than 980,000 in that cohort less a substantial amount of deaths)

For 2023 Deaths, Australia, 2023

71,000 deaths for those ages 85 & over

So 280,000 deaths over 4 years

700,000 aged over 85 alive

Around 470,000 are on OAP

67%

Quickstatus

Enthusiast

- Joined

- Oct 13, 2013

- Posts

- 17,435

Can you provide a take home message please thanksSo the 2 other insights in the OAP conversation

OATEK

Senior Member

- Joined

- Apr 12, 2013

- Posts

- 5,785

Government has had 2 elections to change, and even now seem reluctant.A sop to the 2 million age pensioners who own their home who vote LNP

VPS

Enthusiast

- Joined

- Apr 2, 2011

- Posts

- 10,651

- Qantas

- LT Gold

- Virgin

- Gold

I had to open a new super account for a recent contract. If I roll it over to my main account and just leave $10 in there and that is eaten up by fees in a couple of months does the account still stay active. I could close it but it's a hassle to reopen if I do another contract

Happy Dude

Established Member

- Joined

- Oct 13, 2006

- Posts

- 3,269

Check if there is any protection from fees for accounts with small balances.I had to open a new super account for a recent contract. If I roll it over to my main account and just leave $10 in there and that is eaten up by fees in a couple of months does the account still stay active. I could close it but it's a hassle to reopen if I do another contract

- Joined

- Jan 14, 2013

- Posts

- 6,601

- Qantas

- Qantas Club

- Virgin

- Red

- Oneworld

- Sapphire

- Star Alliance

- Silver

I recently transferred the proportion of my super in Aware to the Hostplus Choiceplus direct investment option. Has most of the accumulation CGT advantage of an SMSF with much less cost and hassle. Obviously cant use for leveraged property (or other assets) but had no intention of doing so.

Have been impressed so far but any insights from anyone who has done something similar or looked at the fund direct options and rejected it?

(I am also in the initial stages of an smsf, waiting for funds to come through, but this is for a QROPS-mandated UK pension transfer)

Have been impressed so far but any insights from anyone who has done something similar or looked at the fund direct options and rejected it?

(I am also in the initial stages of an smsf, waiting for funds to come through, but this is for a QROPS-mandated UK pension transfer)

SYD

Enthusiast

- Joined

- Oct 5, 2009

- Posts

- 14,227

- Qantas

- Platinum

- Virgin

- Silver

- Oneworld

- Emerald

- Star Alliance

- Gold

Why couldn’t you just nominate your existing Super?I had to open a new super account for a recent contract. If I roll it over to my main account and just leave $10 in there and that is eaten up by fees in a couple of months does the account still stay active. I could close it but it's a hassle to reopen if I do another contract

VPS

Enthusiast

- Joined

- Apr 2, 2011

- Posts

- 10,651

- Qantas

- LT Gold

- Virgin

- Gold

It's a government one and you can't add to it unless you are still with the governmentWhy couldn’t you just nominate your existing Super?

VPS

Enthusiast

- Joined

- Apr 2, 2011

- Posts

- 10,651

- Qantas

- LT Gold

- Virgin

- Gold

I'm still waiting for the last payment. The sooner the rule comes in that they pay super when they pay wages the better. At least people will have a better handle from these small businesses that go bankrupt owing the staff superCheck if there is any protection from fees for accounts with small balances.

- Joined

- Jan 26, 2011

- Posts

- 30,296

- Qantas

- Platinum

- Virgin

- Red

It's going to mean more work for us. Our super payments are always made when currently due and are up to date. But doing it every fortnight is a total pain. We have to pay the price and wear it for those who are bad. And our contracts for the business can take months for us to get paid.I'm still waiting for the last payment. The sooner the rule comes in that they pay super when they pay wages the better. At least people will have a better handle from these small businesses that go bankrupt owing the staff super

SYD

Enthusiast

- Joined

- Oct 5, 2009

- Posts

- 14,227

- Qantas

- Platinum

- Virgin

- Silver

- Oneworld

- Emerald

- Star Alliance

- Gold

Yes, that will do it.It's a government one and you can't add to it unless you are still with the government

But if you were still doing Concessional/Non-Concessional contributions (if able), you'd need a non-Gov super account for those anyway. So maybe not a bad idea to have a low/no fee Super account?

Become an AFF member!

Join Australian Frequent Flyer (AFF) for free and unlock insider tips, exclusive deals, and global meetups with 65,000+ frequent flyers.AFF members can also access our Frequent Flyer Training courses, and upgrade to Fast-track your way to expert traveller status and unlock even more exclusive discounts!

AFF forum abbreviations

Wondering about Y, J or any of the other abbreviations used on our forum?Check out our guide to common AFF acronyms & abbreviations.

Currently Active Users

- crosscheck

- SYD

- tassie6

- TheDefenestrator

- desafinado74

- PineappleSkip

- justinbrett

- cjd600

- jase05

- flyguy77

- Bighead

- SeatBackForward

- VPS

- flightsonpoints

- Solid

- RB001

- RSD

- Matt_H

- jkbaus

- richard.cohen90

- 33kft

- FlyingFiona

- DrJ

- Fruit1008

- Aeryn

- smed63

- Flyfrequently

- dandandan

- asdiojne

- Rhirhi

- gman83

- NSun

- ALEX LANGTON

- IGetAround

- DejaBrew

- Harrison_133

- esquire

- Scarlett

- Luciana Lanza

- Capricornus

- clarkkent

- Happy Trails

- Pete98765432

- martynking

- Larko1

- Skuttlebutt

- JasonD

- acestooge

- kpc

- SnowGoose

Total: 2,054 (members: 101, guests: 1,953)