Buzzard

Senior Member

- Joined

- Jan 22, 2013

- Posts

- 6,926

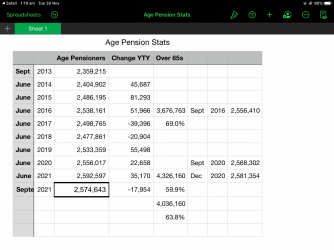

Only 18 months to go and the card is mine!We got the Health Card last year after the government reduced the deeming rates. There was no assets test just an income one which included my Public Service pension plus deemed income from our bank accounts, super etc. But no worries about car values, chattels etc.