If your Florida address isn't on your credit file, I believe they'll want to verify it by, for example, requiring a bank statement with the address on it.I didn't get any verification text on my Textnow as part of the application. At what stage of the process does this happen? Experian shows my old USA afddress in California. I applied with a friend's address in Florida. Is this going to be a problem?

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Strategy to obtain US Amex

- Thread starter ithongy

- Start date

- Featured

ithongy

Member

- Joined

- Mar 3, 2009

- Posts

- 274

My understanding from the US bloggers is that Chase requires at least 12 months of credit history before even considering you for a card, especially a high end one such as the CSP.

Have a SSN or ITIN no before applying for any Chase cards. If you have an accountant set up S/C Corp it was really easy to open a business checking account & apply for a business credit card & get approved.

Did you open your business checking account and credit card online? or went into a Chase branch?Have a SSN or ITIN no before applying for any Chase cards. If you have an accountant set up S/C Corp it was really easy to open a business checking account & apply for a business credit card & get approved.

Tiki

Established Member

- Joined

- Jul 21, 2004

- Posts

- 1,793

I checked the status of my Amex Delta gold application online and there was a message they wanted more information about my home address. I called the number and they said the high risk fraud department is looking at the app. The csr couldn't transfer me.

Has this happened to anyone else? How do I get around this?

It's probably related to having a new address. An old friend said i could use his address but I don't want to stress him out as he has health issues.

I don't think they are worried about my credit rating or ability to pay. They seem to think I am not "me" or the victim of identity theft.

Has this happened to anyone else? How do I get around this?

It's probably related to having a new address. An old friend said i could use his address but I don't want to stress him out as he has health issues.

I don't think they are worried about my credit rating or ability to pay. They seem to think I am not "me" or the victim of identity theft.

Provide proof of that address (eg open a checking account with that address listed on it). If you can't prove you live there, Amex isn't going to send a card there.Has this happened to anyone else? How do I get around this?

Tiki

Established Member

- Joined

- Jul 21, 2004

- Posts

- 1,793

I do have accounts at B of A (checking, savings since 1987, 2 credit cards. The old address was on there until yesterday when I updated it to my friend's address. I just made small charitable donations online to one B of A credit card and a Chase Freedom I have had for years because it is free. I also added my new address to Chase and limked it to the Freedom card. I am hoping the transaction will trigger my Experian being updated to Florida. Both banks also have my Australia address on file and never had an issue sending me cards to Australia before.Provide proof of that address (eg open a checking account with that address listed on it). If you can't prove you live there, Amex isn't going to send a card there.

It's like damned if I do, damned if I don't. They won't approve me with Aussie address for sure and that address isn't on Experian inspite of using it for years. But if I use the new address in Florida it still triggers fraud alerts. Don't Americans change addresses as part of normal life? What about digital nomads, millions of Americans living overseas like retirees in Costa Rica and such.

I am just getting really sick of being treated like a criminal when I have been a solid customer for 39 years.

While I understand the frustration, US credit cards aren't really intended for people who have no residence in the US. Hence why we all have to engage in various forms of creativity to attain them.I am just getting really sick of being treated like a criminal when I have been a solid customer for 39 years.

In any case, I wouldn't worry. Once you have a bank statement with your new address, contact Amex and they'll prompt you to send a copy of it to them and that should satisfy them.

If you updated your address with BoA, you should be able to do a 3-way call with Amex and BoA to verify your new address.While I understand the frustration, US credit cards aren't really intended for people who have no residence in the US. Hence why we all have to engage in various forms of creativity to attain them.

In any case, I wouldn't worry. Once you have a bank statement with your new address, contact Amex and they'll prompt you to send a copy of it to them and that should satisfy them.

Tiki

Established Member

- Joined

- Jul 21, 2004

- Posts

- 1,793

Should I proactively call or wait for the email? How long does it take for Experian to recognize the new address?If you updated your address with BoA, you should be able to do a 3-way call with Amex and BoA to verify your new address.

You can always call to check the status and if they question the new address, they will usually ask you to do a 3-way call or provide a bank statement or a utility bill to verify the address.Should I proactively call or wait for the email? How long does it take for Experian to recognize the new address?

If you updated your address on a credit card, the next time it gets reported to the bureaus, it should be reported with the new address.

So it might take 30-45 days to reflect on your record.

Tiki

Established Member

- Joined

- Jul 21, 2004

- Posts

- 1,793

I was born in the USA and am technically an expat American. I had heaps of US credit cards going to my parent’s house between 2007-2018. I cancelled all but 4. Definitely not a churner, no new credit cards since 2018.While I understand the frustration, US credit cards aren't really intended for people who have no residence in the US. Hence why we all have to engage in various forms of creativity to attain them.

In any case, I wouldn't worry. Once you have a bank statement with your new address, contact Amex and they'll prompt you to send a copy of it to them and that should satisfy them.

Tiki

Established Member

- Joined

- Jul 21, 2004

- Posts

- 1,793

What did you guys do? Did they call or email you? Or did you call them first? I was given this number 1 800 450 8738. I just called my own TextNow and left a voicemail. But it answers with “The TextNow subscriber is not available please leave a message”. So they will know it is TextNow, not a regular phone.

I didn't get asked to verify my address but heard many stories of people calling in to verify their address and did a 3-way call.What did you guys do? Did they call or email you? Or did you call them first? I was given this number 1 800 450 8738. I just called my own TextNow and left a voicemail. But it answers with “The TextNow subscriber is not available please leave a message”. So they will know it is TextNow, not a regular phone.

for TextNow, you can follow this guide to change your voicemail greeting message: How to customize your TextNow number for your side gig: Voicemail greeting and text signature

Tiki

Established Member

- Joined

- Jul 21, 2004

- Posts

- 1,793

Thanks! I now have a very normal voicemail message!I didn't get asked to verify my address but heard many stories of people calling in to verify their address and did a 3-way call.

for TextNow, you can follow this guide to change your voicemail greeting message: How to customize your TextNow number for your side gig: Voicemail greeting and text signature

None of that really matters. US credit card companies don't give out credit cards to non-residents, even US citizens, for obvious reasons.I was born in the USA and am technically an expat American. I had heaps of US credit cards going to my parent’s house between 2007-2018. I cancelled all but 4. Definitely not a churner, no new credit cards since 2018.

As for what to do, if you need the credit card (and points) ASAP, call to try to set up a three way call between you, Amex and BoA. If you don't need the card ASAP, wait for your credit report to update.

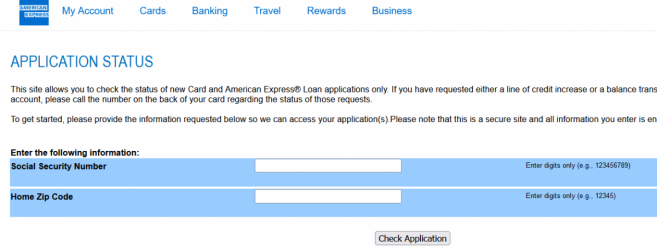

Yeah I believe they wanna verify the new address. Give them a call again and if asked, do the 3-way call with BoA.I used this to check

View attachment 277712

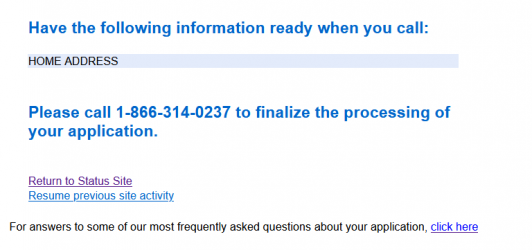

Post automatically merged:

This was the resultView attachment 277713 I called the number and they gave me that other number 800 450 8738. I actually googled the number and a few people reported it as a scam number.

If they refuse, hang up and call again.

Also, one thing that I noticed will help a lot is to call from the same number that's on your profile if you're an existing Amex user or the one on your credit report if you're not.

My experience with Amex when I applied directly through the website (got my first card via GT) was the fraud department. I'd already provided proof of residence for my first card. They just wanted to ask me some questions - it was relatively painless though I wasn't sure what to expect. They needed my passport number which I gave them and made sure to point out it was my Australian Passport as I don't have a US one. They did call me back on my TextNow number which was working on my phone at the time. I've found that when receiving a verification message, need ot make sure TextNow is active as it doesn't sit in the background if not used very much.

ithongy

Member

- Joined

- Mar 3, 2009

- Posts

- 274

Did you open your business checking account and credit card online? or went into a Chase branch?

Opened checking account & applied for business credit card in branch after obtaining paperwork setup from Daniel Hagen. Also applied for a Chase Freedom on same day, basically just 1 hard pull on credit. Got Chase Ink Cash & Freedom approved, but think this loop hole to apply for 2 Chase cards (business & personal) has been closed.

Become an AFF member!

Join Australian Frequent Flyer (AFF) for free and unlock insider tips, exclusive deals, and global meetups with 65,000+ frequent flyers.AFF members can also access our Frequent Flyer Training courses, and upgrade to Fast-track your way to expert traveller status and unlock even more exclusive discounts!

AFF forum abbreviations

Wondering about Y, J or any of the other abbreviations used on our forum?Check out our guide to common AFF acronyms & abbreviations.