bobbinbrisco

Junior Member

- Joined

- Jan 7, 2015

- Posts

- 47

Banks gouge $500m in tap-and-go fees: RBA

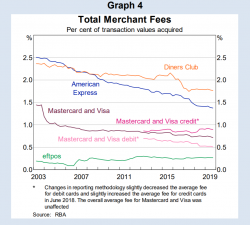

Big banks and major credit card companies face the loss of half a billion dollars in payment charges to retailers for "tap and go" transactions after the RBA said it might force them to use the cheaper Eftpos network.

AFR article today showing RBA proposing to make banks use the cheaper EFTPOS network rather than Visa/Mastercard.

Big banks and major credit card companies face the loss of half a billion dollars in payment charges to retailers for "tap and go" transactions after the Reserve Bank said it might force them to use the cheaper Eftpos network.

The RBA is concerned retailers are paying too much for the increasingly popular payment service, and wants banks to direct them through the cheaper Eftpos network instead of the system operated by the global credit card companies Mastercard and Visa.

The central bank could consider mandating “least-cost routing” as part of its comprehensive review of payments regulation taking place this year. This could save the retailing industry around half a billion dollars each year, improving margins for retailers and reducing prices for customers.

Another devaluation looming...