The PARTY IS OVER...

[TABLE="width: 638, align: center"][TR][TD][TABLE="width: 638, align: center"][TR][TD][TABLE="width: 568, align: center"][TR][TD]Dear <CUSTOMER>,

Notice of changes to Qudos Bank Visa Platinum Credit Card Terms and Conditions

Please note that we’re making changes to our Visa Platinum Credit Card.

The following changes to the Qudos Bank Visa Platinum Rewards (VPR Program) Terms and Conditions will be effective from 1 December 2016.

We are changing the VPR Program Terms and Conditions to:

- Refer to “Qantas Frequent Flyer Points” as “Qantas Points”

- Make payments made to the Australian Taxation Office Ineligible Transactions, so that Qantas Points are not earned on such payments,

- Make nominated payments Ineligible Transactions from time to time, so that Qantas Points are not earned on such payments (we will let you know before we nominate payments as Ineligible Transactions),

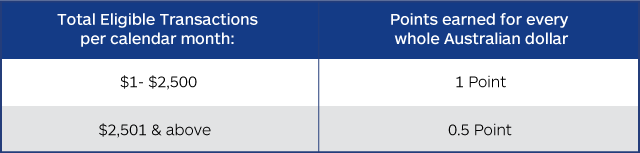

- Allocate Qantas Points for Eligible Transactions in accordance with the table below:

[/TD][/TR][/TABLE][/TD][/TR][/TABLE][/TD][/TR][/TABLE]

[TABLE="width: 638, align: center"][TR][TD][TABLE="width: 638, align: center"][TR][TD][TABLE="width: 568, align: center"][TR][TD]

[/TD][/TR][/TABLE][/TD][/TR][/TABLE][/TD][/TR][/TABLE]

[TABLE="width: 638, align: center"][TR][TD][TABLE="width: 638, align: center"][TR][TD][TABLE="width: 568, align: center"][TR][TD]

- Limit Qantas Points earned to an annual maximum of $200,000 of Eligible Transactions per customer for each 12 month period commencing from the date your account is opened and each account anniversary thereafter (“Eligible Transaction Cap”), regardless of the number of Qudos Bank Visa Platinum Credit Cards held by that Member.

For existing customers, the first Eligible Transaction Cap will apply for the period from 1 December 2016 to your next anniversary date and then annually thereafter. The $200,000 of Eligible Transactions per customer limit will still apply even if this first period is less than 12 months.

Bonus Qantas Points offers and promotions that are offered from time to time do not count towards the annual Eligible Transaction Cap.

The following change to the Qudos Bank Visa Platinum Credit Card Contract will be effective from 1 December 2016.

The Qudos Bank Visa Platinum Credit Card annual fee will increase to $249.

If you would like to discuss these changes, please contact us on

1300 747 747.

Regards,

Michelle Naguib

Manager Retail Banking,

Qudos Bank[/TD][/TR][/TABLE][/TD][/TR][/TABLE][/TD][/TR][/TABLE]