Dr Ralph

Enthusiast

- Joined

- Jan 21, 2014

- Posts

- 13,622

- Qantas

- Bronze

- Virgin

- Red

Seems like a long time between drinks with Commonwealth bank credit card offerings, but I've noticed the following new offers:

1) Platinum Awards credit card – Earn 100,000 Bonus CommBank Points when you apply for a new CommBank Platinum Awards credit card by 31 July and spend $4,000 on eligible purchases with your new card by 31 October 2019. $249 annual fee.

Platinum Awards credit card - CommBank

2) Diamond Awards credit card - 120,000 Bonus Points when you apply for a new CommBank Diamond Awards credit card by 31 July and spend $6,000 on eligible purchases with your new card by 31 October 2019. $349 annual fee.

Diamond Awards credit card - CommBank

3) Awards credit card - 30,000 Bonus Points when you apply a new CommBank Awards credit card by 31 July and spend $2,000 on eligible purchases with your new card by 31 October 2019. $59 annual fee.

Awards credit card - CommBank

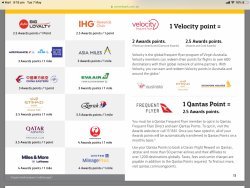

Long time since I've had a Commonwealth bank card so I'm not sure what each point is worth. I assume that they feed into some type of rewards program that you can transfer to some airlines?

Note 12 month exclusion period.

1) Platinum Awards credit card – Earn 100,000 Bonus CommBank Points when you apply for a new CommBank Platinum Awards credit card by 31 July and spend $4,000 on eligible purchases with your new card by 31 October 2019. $249 annual fee.

Platinum Awards credit card - CommBank

2) Diamond Awards credit card - 120,000 Bonus Points when you apply for a new CommBank Diamond Awards credit card by 31 July and spend $6,000 on eligible purchases with your new card by 31 October 2019. $349 annual fee.

Diamond Awards credit card - CommBank

3) Awards credit card - 30,000 Bonus Points when you apply a new CommBank Awards credit card by 31 July and spend $2,000 on eligible purchases with your new card by 31 October 2019. $59 annual fee.

Awards credit card - CommBank

Long time since I've had a Commonwealth bank card so I'm not sure what each point is worth. I assume that they feed into some type of rewards program that you can transfer to some airlines?

Note 12 month exclusion period.