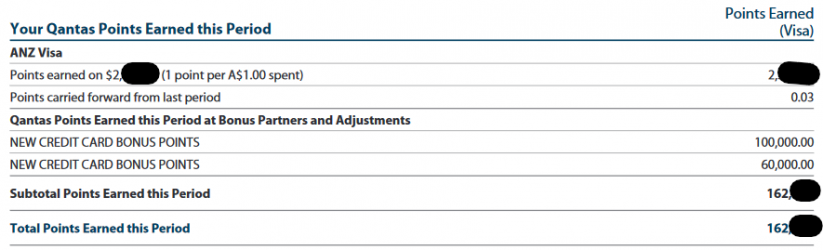

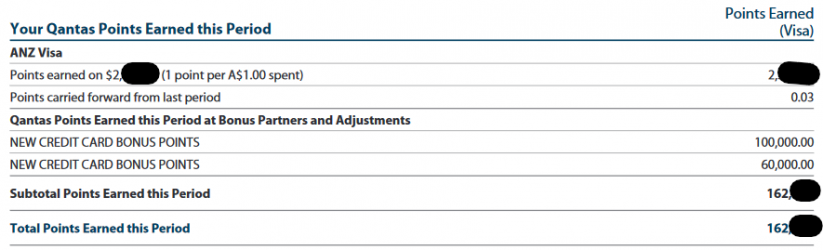

2. Offer available to new and approved applicants who apply for an ANZ Frequent Flyer Black Credit Card Account. This is a limited-time only offer that may be withdrawn or changed at any time without notice. Not available in conjunction with other offers, packages or promotions or when transferring from an existing ANZ credit card. Offer not available where you currently hold an ANZ Frequent Flyer, ANZ Frequent Flyer Platinum or ANZ Frequent Flyer Black credit card, or have closed, or qualified for bonus Qantas Points or a credit back on, any of those ANZ Frequent Flyer credit cards within the previous 12 months. Your application must be approved and you must activate the card and make $5,000 worth of eligible purchases within three months of approval to receive the 110,000 bonus Qantas Points and have the $255 credited to your Credit Card Account. The date of approval of an application is the disclosure date specified in your Letter of Offer. Eligible purchases means purchases which are eligible to earn Qantas Points. Certain transactions and other items are not eligible to earn Qantas Points. For details refer to the

ANZ Frequent Flyer Reward Terms and Conditions (PDF 122kB). The 110,000 bonus Qantas Points will be credited to your Qantas account and the $255 will be credited to your Credit Card Account within three months of the eligible spend criteria being met. The $255 credit will be applied to the purchases balance and does not constitute a payment under your contract with ANZ. If you transfer or cancel your new ANZ Frequent Flyer Black Credit Card Account before the $255 credit and 110,000 bonus Qantas Points are processed to your account, you may become ineligible for this offer. If any repayments are overdue before the $255 credit and 110,000 bonus Qantas Points are processed to your account, you will be ineligible for this offer until any overdue Minimum Monthly Payments and amounts shown on your statement as being immediately payable have been paid. There may be a delay in the process of receiving and/or approving an application or activating the card. Applications for credit are subject to ANZ’s credit approval criteria.

This offer is limited to one credit card application per Qantas Frequent Flyer member.

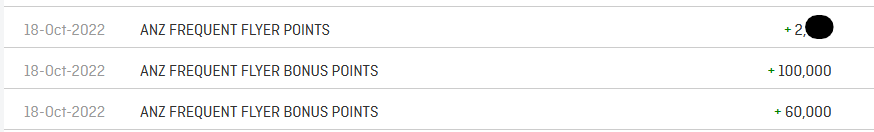

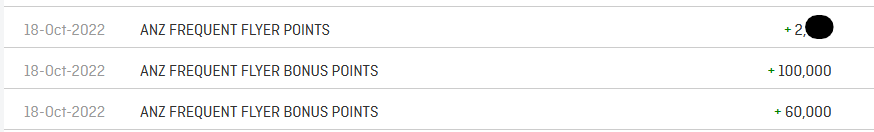

. Timing worked out well for me.

. Timing worked out well for me.