Update:

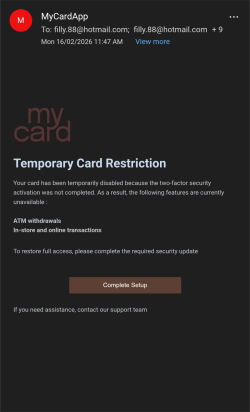

I responded to mycards email offering of $2000 goodwill gesture. I rejected that offer and sent a decent email highlighting concerns etc my counter offer was $10,000 or im happy to let afca proceedings continue. They sent a new offer of just over $7000 50% of the original loss wich was there finale offer. After some googling and reading other people's experiences in similar situations I've accepted the offer its better then the initial $2000 and certainly better then nothing.

If you google citibank fraud/scam there are 100's of complaints of similar types of fraud and unauthorised transactions. Im sure there is a leak of data within that company probably from an employee.

I responded to mycards email offering of $2000 goodwill gesture. I rejected that offer and sent a decent email highlighting concerns etc my counter offer was $10,000 or im happy to let afca proceedings continue. They sent a new offer of just over $7000 50% of the original loss wich was there finale offer. After some googling and reading other people's experiences in similar situations I've accepted the offer its better then the initial $2000 and certainly better then nothing.

If you google citibank fraud/scam there are 100's of complaints of similar types of fraud and unauthorised transactions. Im sure there is a leak of data within that company probably from an employee.