You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Earn up to 110 Qantas Status Credits on the ground

- Thread starter sydks

- Start date

- Featured

- Joined

- Dec 6, 2017

- Posts

- 1,403

- Qantas

- Platinum

- Oneworld

- Emerald

The date the activity occurred, not when it gets posted unfortunately..Do the T and Cs state that it has to be the date when the transfer is made or is it when it gets posted to Qantas?

exceladdict

Senior Member

- Joined

- Mar 26, 2014

- Posts

- 5,162

- Qantas

- Platinum

- Virgin

- Silver

Yeah I figured the same would be easier than trying to argue ithappened to me too! i transferred around 10am on the 1st Oct right after I registered for this promo. i had to transfer again last night... speechless haha

Elevate your business spending to first-class rewards! Sign up today with code AFF10 and process over $10,000 in business expenses within your first 30 days to unlock 10,000 Bonus PayRewards Points.

Join 30,000+ savvy business owners who:

✅ Pay suppliers who don’t accept Amex

✅ Max out credit card rewards—even on government payments

✅ Earn & transfer PayRewards Points to 10+ airline & hotel partners

Start earning today!

- Pay suppliers who don’t take Amex

- Max out credit card rewards—even on government payments

- Earn & Transfer PayRewards Points to 8+ top airline & hotel partners

Join 30,000+ savvy business owners who:

✅ Pay suppliers who don’t accept Amex

✅ Max out credit card rewards—even on government payments

✅ Earn & transfer PayRewards Points to 10+ airline & hotel partners

Start earning today!

- Pay suppliers who don’t take Amex

- Max out credit card rewards—even on government payments

- Earn & Transfer PayRewards Points to 8+ top airline & hotel partners

AFF Supporters can remove this and all advertisements

Yes havent seen any good offers from BP apart from 2x points here and there?In terms of BP rewards to get car based SCs, it seems like bonus offers aren't as present in recent months. Even early this year they pushed it hard.

Fingers crossed I guess

twentyfive

Junior Member

- Joined

- Jul 23, 2014

- Posts

- 10

probably a glitch in their system. haven't had any email offers since march. logged on via browser yesterday and had to agree to new T&C. 500 bonus point offer for $1 spend til oct 5In terms of BP rewards to get car based SCs, it seems like bonus offers aren't as present in recent months. Even early this year they pushed it hard.

Fingers crossed I guess

http_x92

Active Member

- Joined

- Sep 29, 2020

- Posts

- 710

- Qantas

- Gold

- Virgin

- Red

Interesting, tried the browser version and no new offers coming up. Likely targetedprobably a glitch in their system. haven't had any email offers since march. logged on via browser yesterday and had to agree to new T&C. 500 bonus point offer for $1 spend til oct 5

- Joined

- Nov 16, 2004

- Posts

- 49,283

- Qantas

- Platinum

- Virgin

- Platinum

- Oneworld

- Emerald

I do .. sort of.Most would not likely leave it this late for TI for a trip completed by December.

My CC based insurance provides covers for most things, but not overseas medical in relation to pre existing conditions. I don't need that until I actually depart. So cover is purchased shortly before departure as it is generally cheaper the closer to departure it is purchased .

TheCollecter

Intern

- Joined

- Apr 25, 2025

- Posts

- 83

- Qantas

- Gold

I bought some peanuts at WW on Thursday (a lot of peanuts - got to go to Hoyts a heap to get 1,000 points). Anyway i got the same as you in the app... But I didn't get my 10 SC yet eitherView attachment 473524

Nothing has posted yet, but I've just noticed this in the app. I had some everyday rewards points convert yesterday, so assume Ive ticked that box.

Last edited:

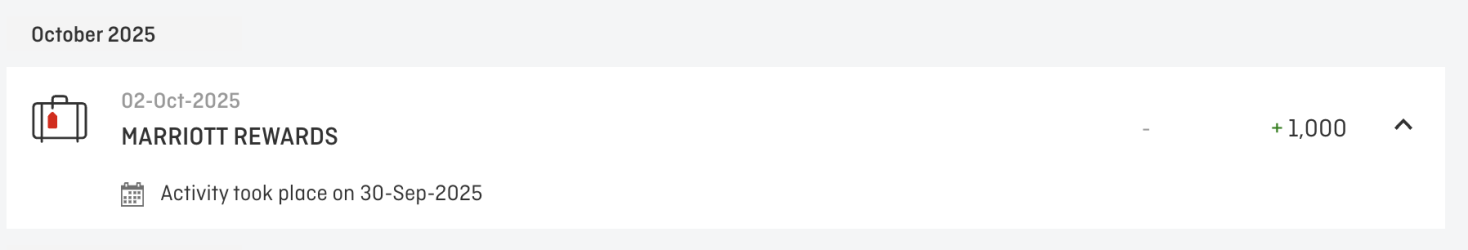

I got caught out the same way too, but being in the UK time zone it was much later on so they posted on 3 Oct with a 30 Sept datei transferred right after registration in the morning 1st Oct. but its still 30th Sept US time. so my Marriott activity date is shown as 30th september although the points hit on 2nd Oct. i guess this wont count because in the T&C the activities need to happen after 1st Oct...

i could probably call up Qantas and show them proof that i transferred after registration on 1st Oct australian time but cant be bothered...

It must literally have been just before midnight US time

I've done another transfer of 3000 Marriott points. No real damage done as the exchange rate although not brilliant isn't terrible and I would happily exchange 6000 Marriott points for 10 SC anytime.

- Joined

- Jan 26, 2011

- Posts

- 30,280

- Qantas

- Platinum

- Virgin

- Red

The risk with that is if you develop a new condition before purchase. And at our age, well, pick a day, find a new health problem you want covered.I do .. sort of.

My CC based insurance provides covers for most things, but not overseas medical in relation to pre existing conditions. I don't need that until I actually depart. So cover is purchased shortly before departure as it is generally cheaper the closer to departure it is purchased .

- Joined

- Nov 16, 2004

- Posts

- 49,283

- Qantas

- Platinum

- Virgin

- Platinum

- Oneworld

- Emerald

I'm not referring to the before departure costs of a few hundred dollars in the cost of losing non refundable booking, change fees, etc. .The risk with that is if you develop a new condition before purchase. And at our age, well, pick a day, find a new health problem you want covered.

I can wear those.

It's cover for the likely tens of thousands of dollars in medical/repatriation costs if medical issues should occur when overseas that I leave purchase to later that is generally cheaper closer to departure.

Note I do not typically buy package tours etc. In December I have a two week trip to Middle East and Europe where I have no less than 15 separate flight/hotel bookings, all but 3 of which are fully refundable.

I did look at Qantas insurance and it 30% more than several other policies I might purchase.

Anyhow, this is getting off topic.

I purchased a combination of Wish (Woolworths Group) and digital Restaurant Choice (add to Apple Wallet and use at any restaurant) from Qantas Marketplace paying with cash rather than points.

The 3 points per $ posted today and have triggered the message about completing one category, if anyone’s looking for an option to hit the Qantas Shopping category. My total spend was $350 on those gift cards I can easily use.

The 3 points per $ posted today and have triggered the message about completing one category, if anyone’s looking for an option to hit the Qantas Shopping category. My total spend was $350 on those gift cards I can easily use.

exceladdict

Senior Member

- Joined

- Mar 26, 2014

- Posts

- 5,162

- Qantas

- Platinum

- Virgin

- Silver

This was my idea for the shopping category too, glad to hear it seems to have triggeredI purchased a combination of Wish (Woolworths Group) and digital Restaurant Choice (add to Apple Wallet and use at any restaurant) from Qantas Marketplace paying with cash rather than points.

The 3 points per $ posted today and have triggered the message about completing one category, if anyone’s looking for an option to hit the Qantas Shopping category. My total spend was $350 on those gift cards I can easily use.

Doctore1003

Established Member

- Joined

- Jul 27, 2015

- Posts

- 1,092

- Qantas

- Platinum

This probably tells you all you need to know on how Qantas is currently faring with elite member retention.

I reckon this promo could be a ‘test run’ for making permanent changes to the status program - ie letting members earn SCs on the ground year-round.This is nothing more than a gimmick promotion. It will be quite difficult, not to mention quite expensive, for the regular FF member to get all of these SC's.

And for a regular member who is not a status chaser what does it really serve? Hardly anything at all I'd suggest.

If you were a Gold FF teetering on the brink of Platinum it would be quicker, easier and cheaper to do a status run somewhere than to chase 20 or 30 SC's from this promo, or worse, to try and chase the full 110 SC;s from this promotion.

I wonder if Olivia would have approved of such a promotion in her time there? I doubt it. She is smarter than this.

After all, Qantas has been hinting that changes to SC earning were coming. It also makes sense if they want to hook more people to the program as the appeal of earning points from cards wanes.

Qantas did a test run of Classic Plus before making it permanent (they ran a 50% off points plus pay promo). So the precedent is there in a way.

Just my hunch!

oz_mark

Enthusiast

- Joined

- Jun 30, 2002

- Posts

- 22,128

I reckon this promo could be a ‘test run’ for making permanent changes to the status program - ie letting members earn SCs on the ground year-round.

After all, Qantas has been hinting that changes to SC earning were coming. It also makes sense if they want to hook more people to the program as the appeal of earning points from cards wanes.

Possible .KrisFlyer.recently added some options on the ground as well. So it may spreadQantas did a test run of Classic Plus before making it permanent (they ran a 50% off points plus pay promo). So the precedent is there in a way.

Just my hunch!

tanahflyer

Junior Member

- Joined

- Aug 28, 2025

- Posts

- 10

Would you have the links to these hints?I reckon this promo could be a ‘test run’ for making permanent changes to the status program - ie letting members earn SCs on the ground year-round.

After all, Qantas has been hinting that changes to SC earning were coming. It also makes sense if they want to hook more people to the program as the appeal of earning points from cards wanes.

Qantas did a test run of Classic Plus before making it permanent (they ran a 50% off points plus pay promo). So the precedent is there in a way.

Just my hunch!

Doctore1003

Established Member

- Joined

- Jul 27, 2015

- Posts

- 1,092

- Qantas

- Platinum

“Although Qantas has not announced any changes to status credits or tier benefits today, we understand that more changes to the Qantas Frequent Flyer program could be on the way later in 2025. For now, watch this space”Would you have the links to these hints?

Qantas Reveals 2025 Frequent Flyer Program Changes

Qantas Frequent Flyer will raise reward flight and upgrade costs, introduce new redemption options and increase points earn on flights in 2025. We breakdown all of the changes for you...

I think Matt has said somewhere on AFF more recently that he thought Qantas was exploring new ways to earn SCs

Become an AFF member!

Join Australian Frequent Flyer (AFF) for free and unlock insider tips, exclusive deals, and global meetups with 65,000+ frequent flyers.AFF members can also access our Frequent Flyer Training courses, and upgrade to Fast-track your way to expert traveller status and unlock even more exclusive discounts!

AFF forum abbreviations

Wondering about Y, J or any of the other abbreviations used on our forum?Check out our guide to common AFF acronyms & abbreviations.

Currently Active Users

- swellington

- borrowlo

- markis10

- maz1

- crosscheck

- JohnJa

- Happy Trails

- ant-au

- Tiki

- lazblue

- bablong

- leesionn

- jkbaus

- alexc

- tgh

- jase05

- GCC

- zig

- watzy

- AgentDCooper

- antycbr

- Auzzieflyer

- bPeteb

- Zero

- acestooge

- Harrison_133

- Subharpoon

- sudoer

- hydrabyss

- blackcat20

- lizfatz

- TomVexille

- Blackswan

- JCK98

- MEL_Traveller

- flyingfan

- Cottman

- Bundy Bear

- VPS

- element0

- Rugby

- grapes

- larry40

- somebol

- kkl

- PP075

- muppet

- maverick1

- Falcs

- Doug_Westcott

Total: 2,769 (members: 66, guests: 2,703)