VPS

Enthusiast

- Joined

- Apr 2, 2011

- Posts

- 10,579

- Qantas

- LT Gold

- Virgin

- Gold

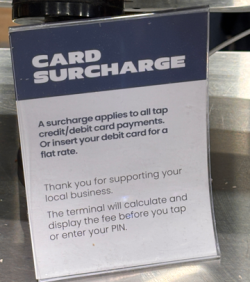

some of the local stalls in the Adelaide central market will usually say 5 or 10 cents which annoys me if it's a debit card.The amount or the %?

They must disclose that a surcharge will be added but, thinking about small transactions at cafes, butcher etc, I'm not often told the amount. Sometimes the amount is listed on the receipt but I'm not told that prior to receiving it. Often I get a tax receipt which has a lower amount (ie sans surcharge) than the transaction receipt (customer copy from the payment terminal) which includes the surcharge. This is a PITA when claiming expenses for work.

It's different online when everything is spelled out before I hit "pay now".

I want to see the percentage before I pay