- Joined

- Mar 7, 2025

- Posts

- 61

- Qantas

- Qantas Club

- Virgin

- Gold

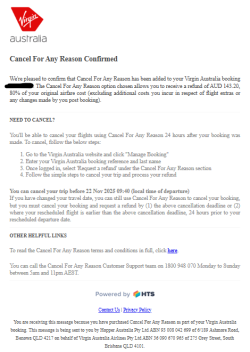

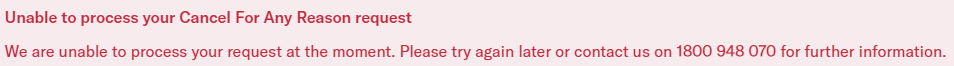

VA have introduced a new feature called Cancel For Any Reason (CFAR) for bookings usually not eligible for cancellation without a fee, and which is only available at initial checkout. You can choose to pay a sliding fee, lower than the usual $99 fee, to either refund 80% or 100% of the value of your ticket. But there are hoops.

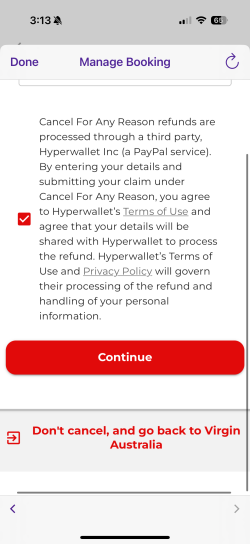

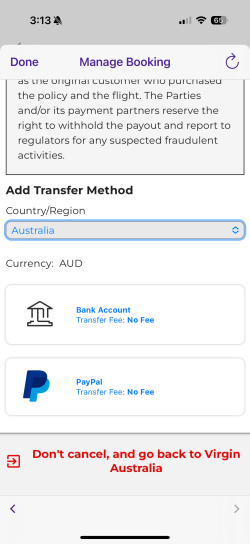

You must click through the correct gateway at the ‘manage booking’ page to access the service. if you purchase this product and then decide to use it, you’ll be redirected to sign up to a third-party service called Hyperwallet (apparently a PayPal company) who at their discretion will process the refund. The refund doesn’t come directly from VA or go into your Travel Bank.

Anyone have experience with this product?

You must click through the correct gateway at the ‘manage booking’ page to access the service. if you purchase this product and then decide to use it, you’ll be redirected to sign up to a third-party service called Hyperwallet (apparently a PayPal company) who at their discretion will process the refund. The refund doesn’t come directly from VA or go into your Travel Bank.

Anyone have experience with this product?