You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

ATO (tax office) payments by credit card

- Thread starter js

- Start date

One family member paid the ATO early then used a call to the redemption of Miles area of the credit card company to get the miles over to his airline frequent flyer account. As soon as the Miles arrived he booked another set of flights to Paris using the 95,000 each way for business class.

I hadn’t realized how low he was with his Miles account.

He was impressed with how little the cash fees are and I think he may be planning to do more than 2 trips to France each year.

I hadn’t realized how low he was with his Miles account.

He was impressed with how little the cash fees are and I think he may be planning to do more than 2 trips to France each year.

Scr77

Established Member

- Joined

- Feb 15, 2014

- Posts

- 1,823

Home - Easy Bill Pay

It allows you to pay ANY BPay or bank account using your credit card. You can even pay your credit card using the same credit card or to your personal account using a credit card.

Has a 0.8% surcharge for M/Card or visa (Amex not accepted).

I have used for several months and the payment is received promptly.

EasyBillPay can be considered a rewardsPay alternative to Amex with the added benefit of “pay to self transactions”. I was able to make “use” of it before the surcharge was enforced.

It allows you to pay ANY BPay or bank account using your credit card. You can even pay your credit card using the same credit card or to your personal account using a credit card.

Has a 0.8% surcharge for M/Card or visa (Amex not accepted).

I have used for several months and the payment is received promptly.

EasyBillPay can be considered a rewardsPay alternative to Amex with the added benefit of “pay to self transactions”. I was able to make “use” of it before the surcharge was enforced.

Scr77

Established Member

- Joined

- Feb 15, 2014

- Posts

- 1,823

EB Pay don't provide any phone contact details and are possibly offshore. What sort of data security do they provide?

I have no idea. I started with small amounts and slowly worked up. All charges were in AUD, posted accurately and promptly. I put hundreds of thousands through without an issue - except for the eventual enforcement of a credit card surcharge!

Scr77

Established Member

- Joined

- Feb 15, 2014

- Posts

- 1,823

I have no idea. I started with small amounts and slowly worked up. All charges were in AUD, posted accurately and promptly. I put hundreds of thousands through without an issue - except for the eventual enforcement of a credit card surcharge!

My early research had the company as publicly listed, but that may not be accurate.

That’s what it also says on their website:

“Easy Bill Pay is 100% owned by FSA Group Ltd, a financial services company established in 2000 and listed on the ASX.”

Nice find. Haven’t heard of FSA group until just now. Will investigate this. Looks like the MC/Visa cost is coming down. Looks like more entrants are being attracted to the sector. May see that surcharge for MC/Visa come down further.

“Easy Bill Pay is 100% owned by FSA Group Ltd, a financial services company established in 2000 and listed on the ASX.”

Nice find. Haven’t heard of FSA group until just now. Will investigate this. Looks like the MC/Visa cost is coming down. Looks like more entrants are being attracted to the sector. May see that surcharge for MC/Visa come down further.

bbqwer

Member

- Joined

- Jan 16, 2015

- Posts

- 455

You can even pay your credit card using the same credit card or to your personal account using a credit card.

Hang on - is that mean, I can use visa/MC pay my ownself to personal bank account, and still earns CC point ? With a fee 0.8% ?

let say $5000 x 0.8% = $40 fees , $1 for 1.5points , equals 3750 SQ points ( lets not mention which CC is this ) = 1 SQ point 0.0106 ??

Pointy Bird

Member

- Joined

- Mar 19, 2017

- Posts

- 159

let say $5000 x 0.8% = $40 fees , $1 for 1.5points , equals 3750 SQ points ( lets not mention which CC is this ) = 1 SQ point 0.0106 ??[/QUOTE]

It's like buying points - but as many as you like....

Is it worth buying points at 1.07 c per point??

You could use this to pay off a bank loan - if the loan was for business purposes, you may be able to claim the 0.8% fee as a tax deduction. True cost about 0.42%

Better not publicise this too much...

It's like buying points - but as many as you like....

Is it worth buying points at 1.07 c per point??

You could use this to pay off a bank loan - if the loan was for business purposes, you may be able to claim the 0.8% fee as a tax deduction. True cost about 0.42%

Better not publicise this too much...

bbqwer

Member

- Joined

- Jan 16, 2015

- Posts

- 455

Is it worth buying points at 1.07 c per point??

Definitely worth it. Look at ozb, velocity selling 1p for 1c selling like hotcakes. Even 1.2c gone real quick.

Not to mention using cc has 10% bday bonus

Scr77

Established Member

- Joined

- Feb 15, 2014

- Posts

- 1,823

Hang on - is that mean, I can use visa/MC pay my ownself to personal bank account, and still earns CC point ? With a fee 0.8% ?

let say $5000 x 0.8% = $40 fees , $1 for 1.5points , equals 3750 SQ points ( lets not mention which CC is this ) = 1 SQ point 0.0106 ??

Correct. Can pay ANY Aussie bank account or BPay bill with MC or Visa. Even the same credit card the funds came from.

Thought I'd give it a try this morning. Signed up quite easily. They say on the site that the first $1000 every calendar month is surcharge free then 0.8% applied to top ups funded from credit cards for the rest of the month.

Given it's the end of the month, have processed a $1000 tester from my credit card and directed it to my transaction account. Will see how long it takes to turn around before I do a more serious payment to a third party.

I've ever logged on the one time after creating my account (around 7am AEST 30/07/2018 - as I write this). It has a "welcome back" message with the following:

Is this hosted offshore? Looks like they're either 10 hours behind or something else is at play.

Also, when I checked my pending items on my credit card, the $1000 was already showing which is very fast. No surcharge added. Merchant showing is "EBP Sydney".

Given it's the end of the month, have processed a $1000 tester from my credit card and directed it to my transaction account. Will see how long it takes to turn around before I do a more serious payment to a third party.

I've ever logged on the one time after creating my account (around 7am AEST 30/07/2018 - as I write this). It has a "welcome back" message with the following:

Is this hosted offshore? Looks like they're either 10 hours behind or something else is at play.

Also, when I checked my pending items on my credit card, the $1000 was already showing which is very fast. No surcharge added. Merchant showing is "EBP Sydney".

Scr77

Established Member

- Joined

- Feb 15, 2014

- Posts

- 1,823

Thought I'd give it a try this morning. Signed up quite easily. They say on the site that the first $1000 every calendar month is surcharge free then 0.8% applied to top ups funded from credit cards for the rest of the month.

Given it's the end of the month, have processed a $1000 tester from my credit card and directed it to my transaction account. Will see how long it takes to turn around before I do a more serious payment to a third party.

I've ever logged on the one time after creating my account (around 7am AEST 30/07/2018 - as I write this). It has a "welcome back" message with the following:

View attachment 132749

Is this hosted offshore? Looks like they're either 10 hours behind or something else is at play.

Also, when I checked my pending items on my credit card, the $1000 was already showing which is very fast. No surcharge added. Merchant showing is "EBP Sydney".

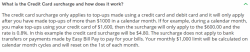

The month is your anniversary month not calendar month. The surcharge is included in the debited amount once you go over the $1,000. Ie if you do another $1,000 today, they would charge your card for $1,008. The surcharge is not a seperate transaction like the ATO.

I figured that calendar month was too good to be true since it's nearly month end now. I did find the following in the FAQs:

Assuming the initial payment arrives in good time, I'll be using this service more frequently. Looks like a good replacement for RewardPay and B2BPay. Found B2BPay quite slow - took over a week to make an ATO payment recently.

How long have ATO payments been taking from EasyBillPay?

Assuming the initial payment arrives in good time, I'll be using this service more frequently. Looks like a good replacement for RewardPay and B2BPay. Found B2BPay quite slow - took over a week to make an ATO payment recently.

How long have ATO payments been taking from EasyBillPay?

Scr77

Established Member

- Joined

- Feb 15, 2014

- Posts

- 1,823

I figured that calendar month was too good to be true since it's nearly month end now. I did find the following in the FAQs:

View attachment 132750

Assuming the initial payment arrives in good time, I'll be using this service more frequently. Looks like a good replacement for RewardPay and B2BPay. Found B2BPay quite slow - took over a week to make an ATO payment recently.

How long have ATO payments been taking from EasyBillPay?

I don’t have ato portal access to confirm how quickly payment is received. But for all others, it takes a day for funds to clear to card and then bpay is processed. To self bank account, it’s received in 2 days.

bbqwer

Member

- Joined

- Jan 16, 2015

- Posts

- 455

I am not sure if this works, seems like it allow you top up balance from cc, then you can withdraw funds into your bank acc. Without have to make/pay any bills.

I find the website pay bills quite confusing and complicated. Not as clear cut as rewardpay.

I find the website pay bills quite confusing and complicated. Not as clear cut as rewardpay.

Scr77

Established Member

- Joined

- Feb 15, 2014

- Posts

- 1,823

I am not sure if this works, seems like it allow you top up balance from cc, then you can withdraw funds into your bank acc. Without have to make/pay any bills.

Correct. You can pay ANY Australian bank account or BPay bill. I have done many times.

coriander

Established Member

- Joined

- Sep 13, 2014

- Posts

- 1,812

- Qantas

- Gold

- Virgin

- Red

By way of comparison, RewardPay/Amex Explorer/Ascent is 1.32c per point.Is it worth buying points at 1.07 c per point??

Become an AFF member!

Join Australian Frequent Flyer (AFF) for free and unlock insider tips, exclusive deals, and global meetups with 65,000+ frequent flyers.AFF members can also access our Frequent Flyer Training courses, and upgrade to Fast-track your way to expert traveller status and unlock even more exclusive discounts!

AFF forum abbreviations

Wondering about Y, J or any of the other abbreviations used on our forum?Check out our guide to common AFF acronyms & abbreviations.

Currently Active Users

Total: 2,010 (members: 10, guests: 2,000)