Segmenting of different ANZ customers definitely happened with this whole AMEX exercise.

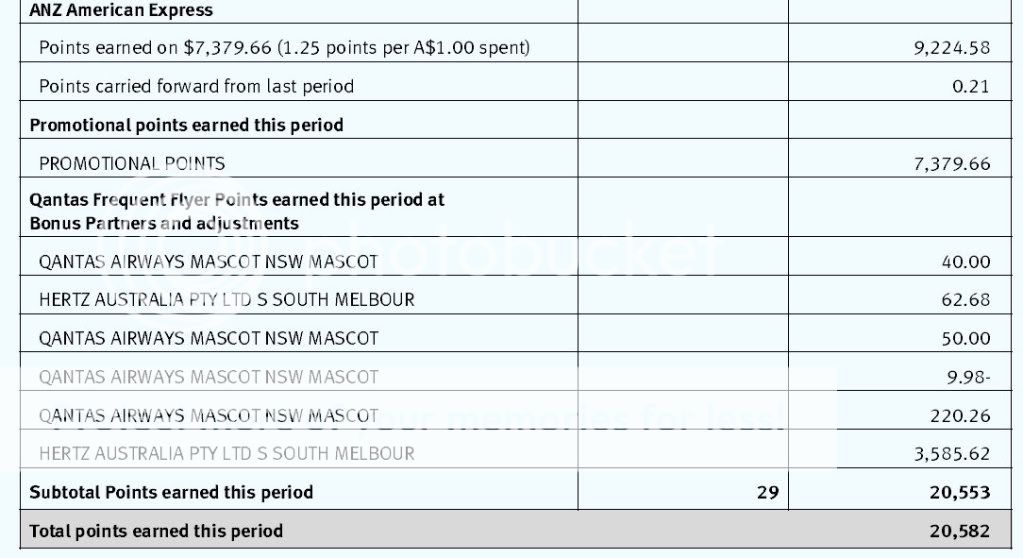

I was originally told late last year that my Platinum Visa point earning rate would reduce to .5 per dollar, but this has never happened. It has stayed the same at 1.1 up to $2500. The AMEX rate has settled at 1.5 after a few month bonus of double points.

I did complain a lot re the .5 points on the Visa and even went to my local manager.

I'm not a good customer, don't have a mortgage, only a very small savings account and pay my Visa / AMEX in full each month.

I'm quite sure ANZ lost many "good" customers over this whole matter!

I was originally told late last year that my Platinum Visa point earning rate would reduce to .5 per dollar, but this has never happened. It has stayed the same at 1.1 up to $2500. The AMEX rate has settled at 1.5 after a few month bonus of double points.

I did complain a lot re the .5 points on the Visa and even went to my local manager.

I'm not a good customer, don't have a mortgage, only a very small savings account and pay my Visa / AMEX in full each month.

I'm quite sure ANZ lost many "good" customers over this whole matter!