- Joined

- Feb 23, 2015

- Posts

- 6,905

- Qantas

- Platinum 1

- Virgin

- Platinum

- Star Alliance

- Gold

Elevate Premium card design looks like a poor man's Centurion  Just need to draw the gladiator head on..

Just need to draw the gladiator head on..

Following on from my posts in December, I successfully received my 150k MR for signing up to the Plat Charge but still have the Westpac Black open as I'm completing a spend '$1k every month for 4 months, get $100 statement credit' promo.

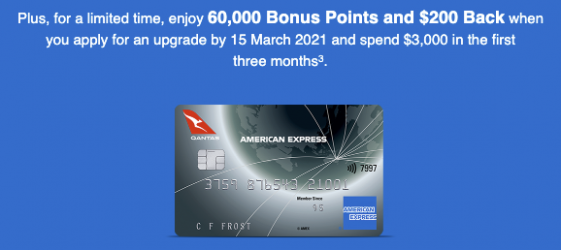

I have since received an offer to 'upgrade' to the Qantas Ultimate and receive 60k points + $200 credit, which I will probably take up in early March. Not too devastated about the Westpac card being discontinued anymore.

Following on from my posts in December, I successfully received my 150k MR for signing up to the Plat Charge but still have the Westpac Black open as I'm completing a spend '$1k every month for 4 months, get $100 statement credit' promo.

I have since received an offer to 'upgrade' to the Qantas Ultimate and receive 60k points + $200 credit, which I will probably take up in early March. Not too devastated about the Westpac card being discontinued anymore.