boomy

Enthusiast

- Joined

- May 10, 2013

- Posts

- 10,118

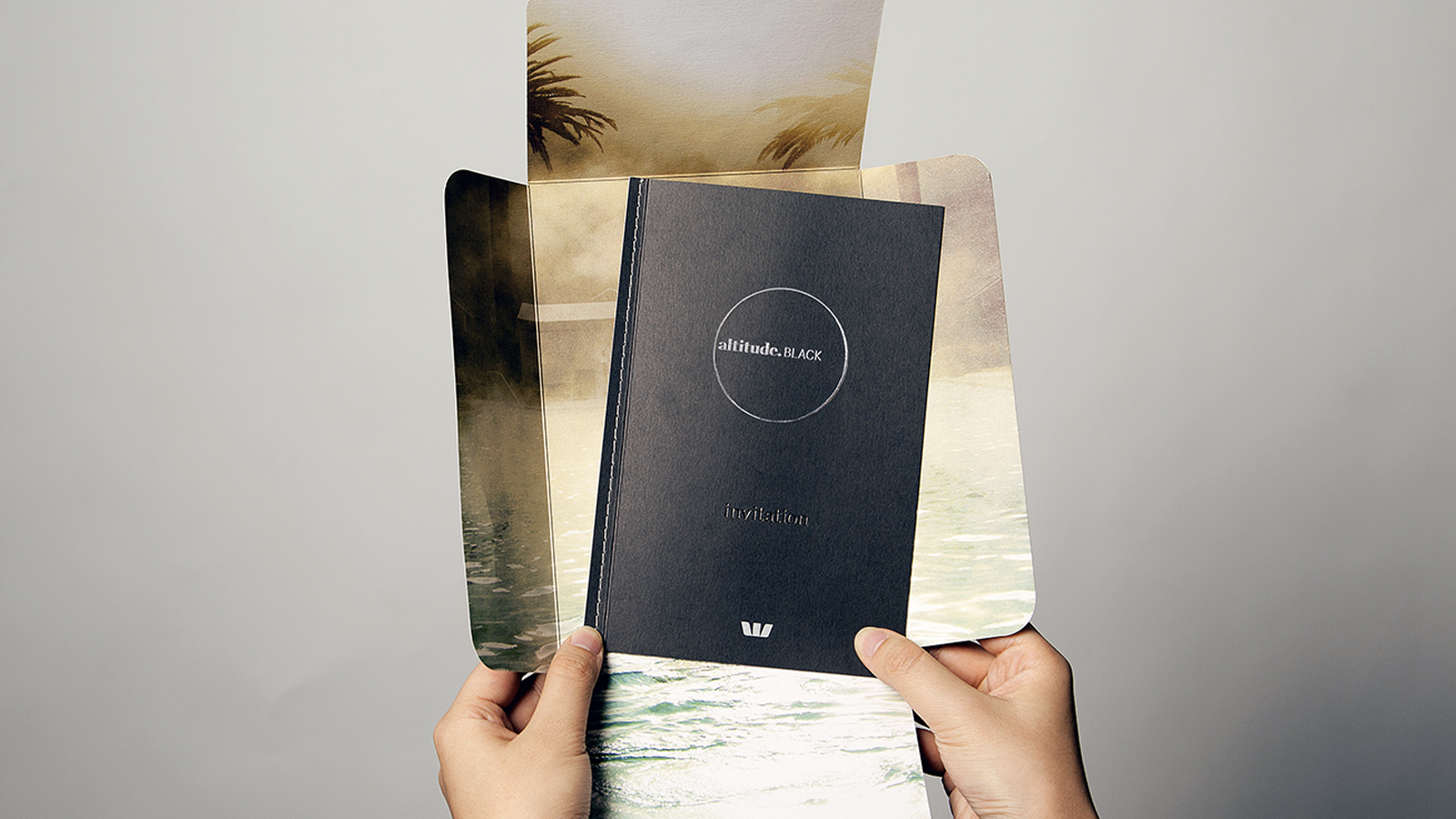

American Express and Westpac will no longer be offering the American Express® Westpac Altitude Card. As a valued Card Member, we're committed to providing you with a Card that continues to deliver the benefits you enjoy now.

On 24 February 2021, your Account will be automatically transferred to the new American Express® Elevate Credit Card.

On 24 February 2021, your Account will be automatically transferred to the new American Express® Elevate Credit Card.

The American Express Elevate Credit Card – same great earn rate and benefits |

Your new Card will have all the benefits of your current Altitude Platinum Card. You'll continue to earn Qantas Points at the same rate you do now, and points will be credited directly into your Qantas Frequent Flyer account each month. Naturally, you will continue to enjoy all the same reward options you do now with the Qantas Frequent Flyer program. |