RooFlyer

Veteran Member

- Joined

- Nov 12, 2012

- Posts

- 31,422

- Qantas

- Platinum

- Virgin

- Platinum

- Star Alliance

- Gold

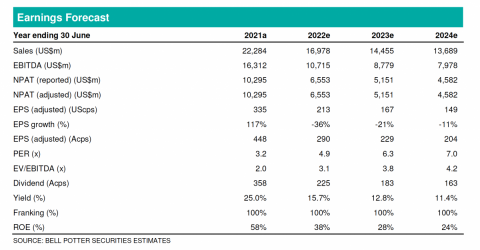

Dividend paid from past earnings with iron ore prices at record highs. Current price based on expectation of future earnings, based on collapse of iron ore prices ( and thoughts on prospects of China construction).FMG now at a 12 month low. Paying over 20% fuly franked dividend. Time to buy in for me.

What are the yield forecasts?