The rates aren't amazing for it.

The best are the Citi, ING, Ubank and Mac Bank.

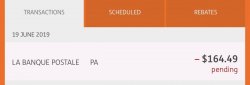

The one you quote are cheap, as they are using spot rates from the card scheme.

With HSBC, you can actually do forex in advance, so you pay 0% commission, and when you come back, you can hold onto the foreign currencies until your next trip / internet shopping