drron

Veteran Member

- Joined

- Jul 4, 2002

- Posts

- 37,581

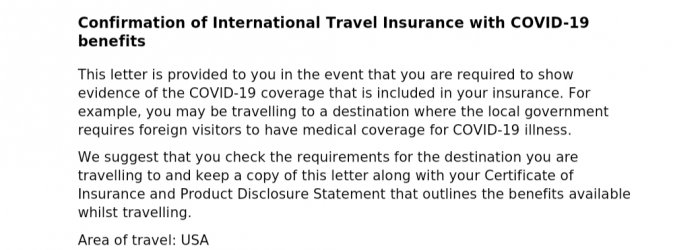

That's right. But at the moment it would be very unlikely that is needed. We would only test if symptoms.As posted in other thread I just checked Southern Cross and annual multi trip is <$300.

I am more interested in the rental vehicle excess but Covid cover is also good. So they will cover cost of hospitalisation due to Covid but not cost of return flight?