- Joined

- Nov 16, 2004

- Posts

- 49,357

- Qantas

- Platinum

- Virgin

- Platinum

- Oneworld

- Emerald

Interesting Question!Does anyone know how JobKeeper interact with CoINVEST (portable long service leave in VIC)?

If an employee goes on LSL and gets paid by CoINVEST and not by the employer, does that mean it fails the wage payment criteria of JobKeeper?

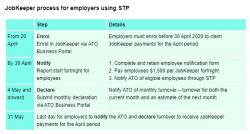

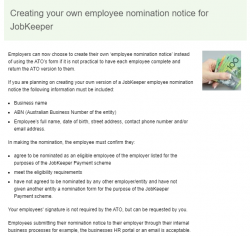

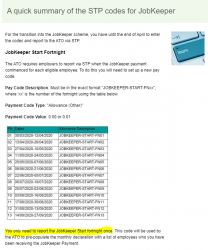

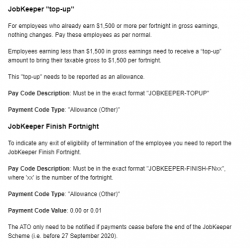

JobKeeper Payment | Australian Taxation Office

The JobKeeper Payment was a COVID support measure administered by the ATO.

I'd suggest anyone so affected would need to speak to a specialist in the subject - perhaps CoINVEST has some specific advice.