Denali

Senior Member

- Joined

- Sep 17, 2012

- Posts

- 5,857

Jobkeeper FYI

Link:

www.ato.gov.au

www.ato.gov.au

Link:

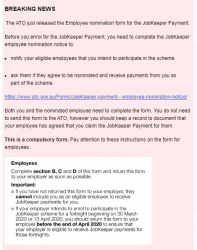

JobKeeper payment - employee nomination notice

Complete this form to notify eligible employees that you intend to claim the JobKeeper payment and ask them if they agree to be nominated by you.